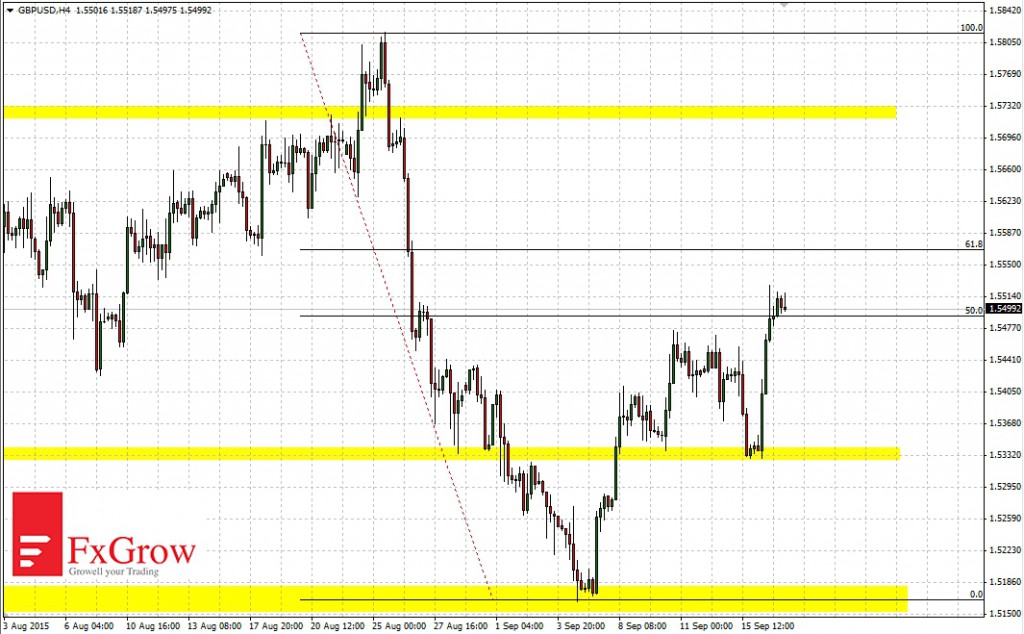

Since September 7 rebound on GBPUSD is in progress. Today the price is trying to get over 50% Fibonacci retracement of last downward move. If it succeeds the next targets of upward move will be 1.5570 and 1.5720. Alternatively a possible weakness of the bulls bring price to level 1.5330. Today, the markets are waiting for a very important macroeconomic event. This will be the Fed’s decision on interest rates. Approaching the time of the decision will increase volatility in the markets.

Wider view W1

GBPUSD is moving in a downward trend, and the current rally took the form of flag formation. If price will go above the maximum level of June 1.5930, it will increase the likelihood that the current rally is not just a corrective rebound. Alternatively exceeding the bottom from June 1.5160 gives the signal that the rebound is completed and minimum from 2015 may have been deepened.