“A Glimpse at PLN” is series of analysis created in cooperation with the InterTrader broker. You can track all these analysis every Tuesday and Thursday on Comparic. The aim is to present the current market situation on the currency pairs connected with the PLN.

EURPLN

On H4 chart we can see that market since last Wednesday moves in a consolidation, which its upper limit is the level of momentum 50% Fibonacci correction of previous increases and could provide the right shoulder of the potential formation of Head & Shoulders

Breaking bottom of this formation could lead to declines and potential target would be around level of 4.3360.

GBPPLN

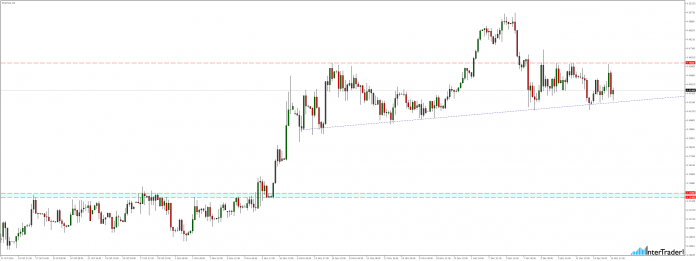

For nearly five weeks market moves in a growth channel and despite attempts to break up bears denied the chance to dynamic growth and again we returned to the channel. As a result of yesterday growth market once more reached upper limit of the formation and again rejected it. If decline will continue in the near future we expect to test the lower limit of the channel.

USDPLN

According to our Tuesday’s projection as a result of yesterday’s decision of the FOMC to raise interest rates from 0.50% to 0.75% there was strong appreciation of US dollar, with the result that not only market reached intended target around 4.2530 level but also beat it. Currently price is re-testing it from the top (as support), and only if it is rejected, we expect continuation of growth.

Since we are now at the highest levels since March 2002 its hard to determine where we can expect emergence of supply because from a technical point of view, growth could even reach level of 4.65 area.

The analysis was performed on platform of broker InterTrader, which spreads at the time of creation of this analysis for each instrument in turn were 5.2, 13.3, 3.9 pips.