Gold, like the Swiss Franc (CHF) or Japanese Yen (JPY), is one of the safe heaven instruments that are willingly bought when the financial markets are uncertain and the appetite for risky investments is decreasing. Currently, due to the US-China customs war, the moods are not the best, so is it possible that after a period of declines, the price will return to growths?

GOLD 29.05.2019

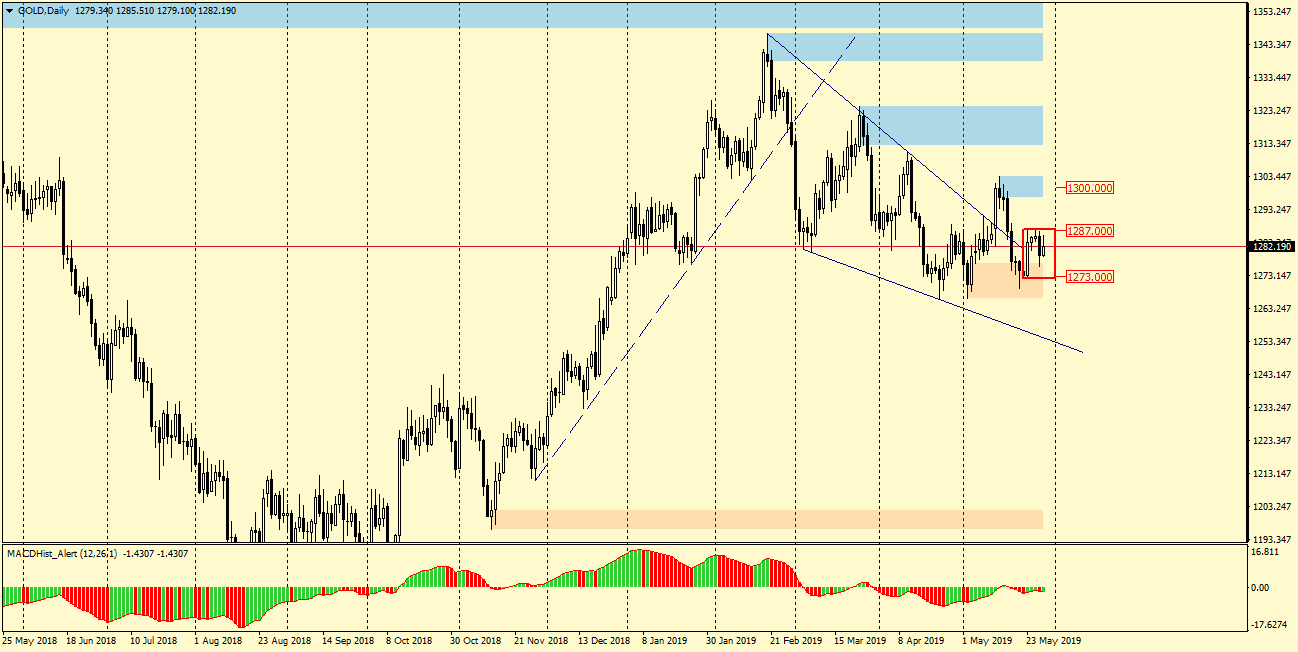

GOLD from August 2018 moved in an upward trend to reach a maximum of 1346.40 USD/oz. in February this year. Since then, the price has started to fall, making a number of corrective moves along the way, which have resulted that the quotations on chart have taken the form of a Price Action formation.The price has been moving in the range of Thursday last week’s quotations for several days now, creating the Inside Bar pattern.

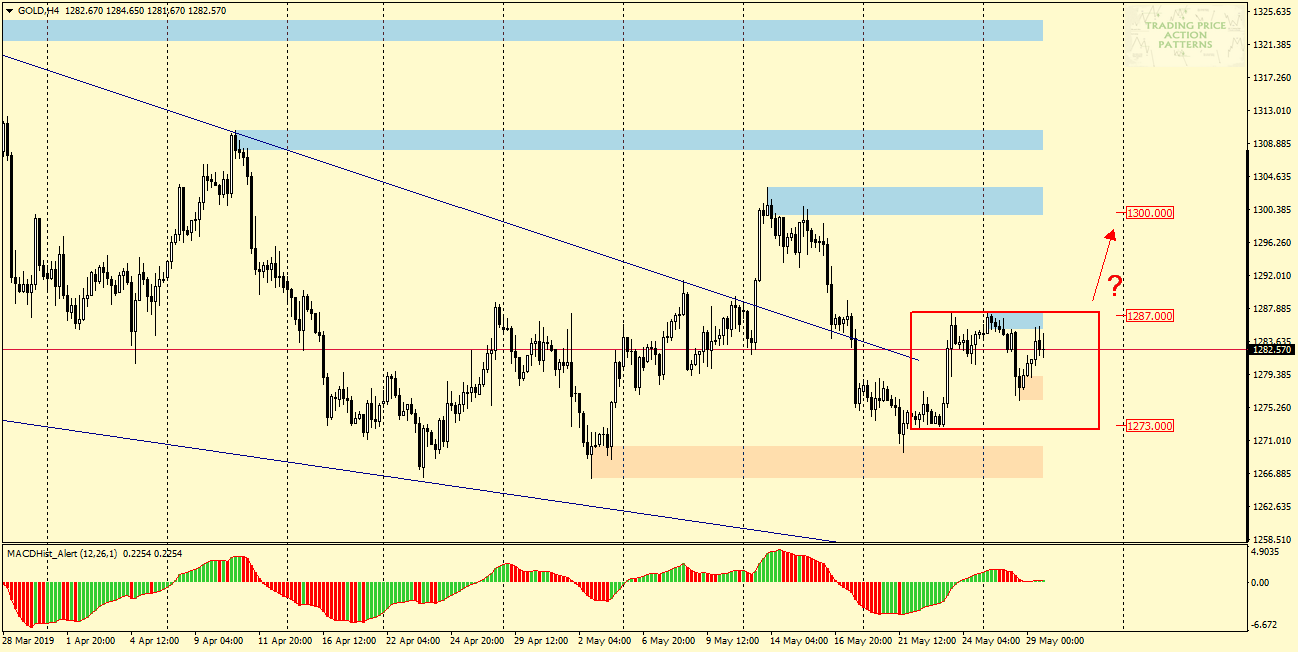

On chart H4 we can see quite clearly that the first strike from the wedge was not continued and the price returned to the pattern. A week ago there was a second attempt and so far the price is above the resistance of the wedge, which was successfully tested tonight – resulting in a rebound from this resistance, which has now served as a price support.

It seems that the decisive factor in the future direction of the price of Gold will be the direction in which the IB will be broken. So far, everything indicates that it will go up.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities