Last Friday, we learned about data from the US labour market. The US economy added a net 263,000 jobs in November, well above market forecasts of 200,000 proving that the labour market remains in good shape.

Earlier, on 30 November, Fed Chairman Powell said that it may be appropriate to slow the pace of interest rate hikes, as recent data points to a slowdown in the US economy. These two events following each other caused quite a few changes on the charts of many financial instruments. After Powell’s dovish speech, the dollar lost heavily against most currencies. Stock indices and gold shot upwards.

The increases continued for the next two days until the payrolls. The good labour market data caused the dollar to strengthen temporarily, but after only a few hours the market the dollar started to lose again and returned to the trends started on 30 November.

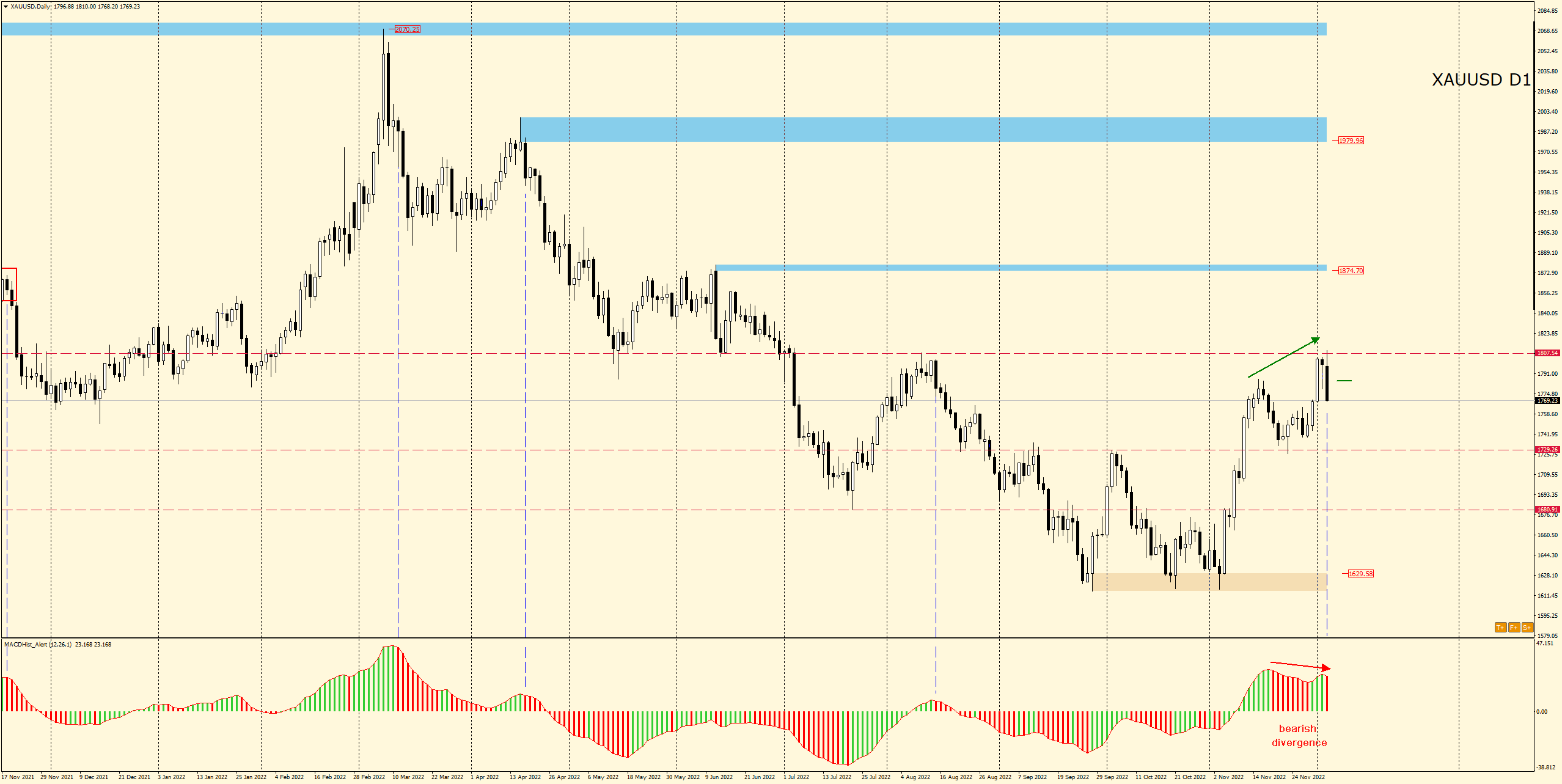

Technical analysis of gold – bullish engulfing

Today there were the first signs of a recovery of the losses the dollar suffered at the end of last week. In the morning, gold prices reached 1810 oz/$ where $3 lower at 1807 is the support and resistance level and we have seen slow but systematic declines since the London session.

Today’s daily candle has formed a bearish engulfing which could foreshadow another day of declines. An additional factor supporting declines is the appearance of a downward divergence on the MACD oscillator.

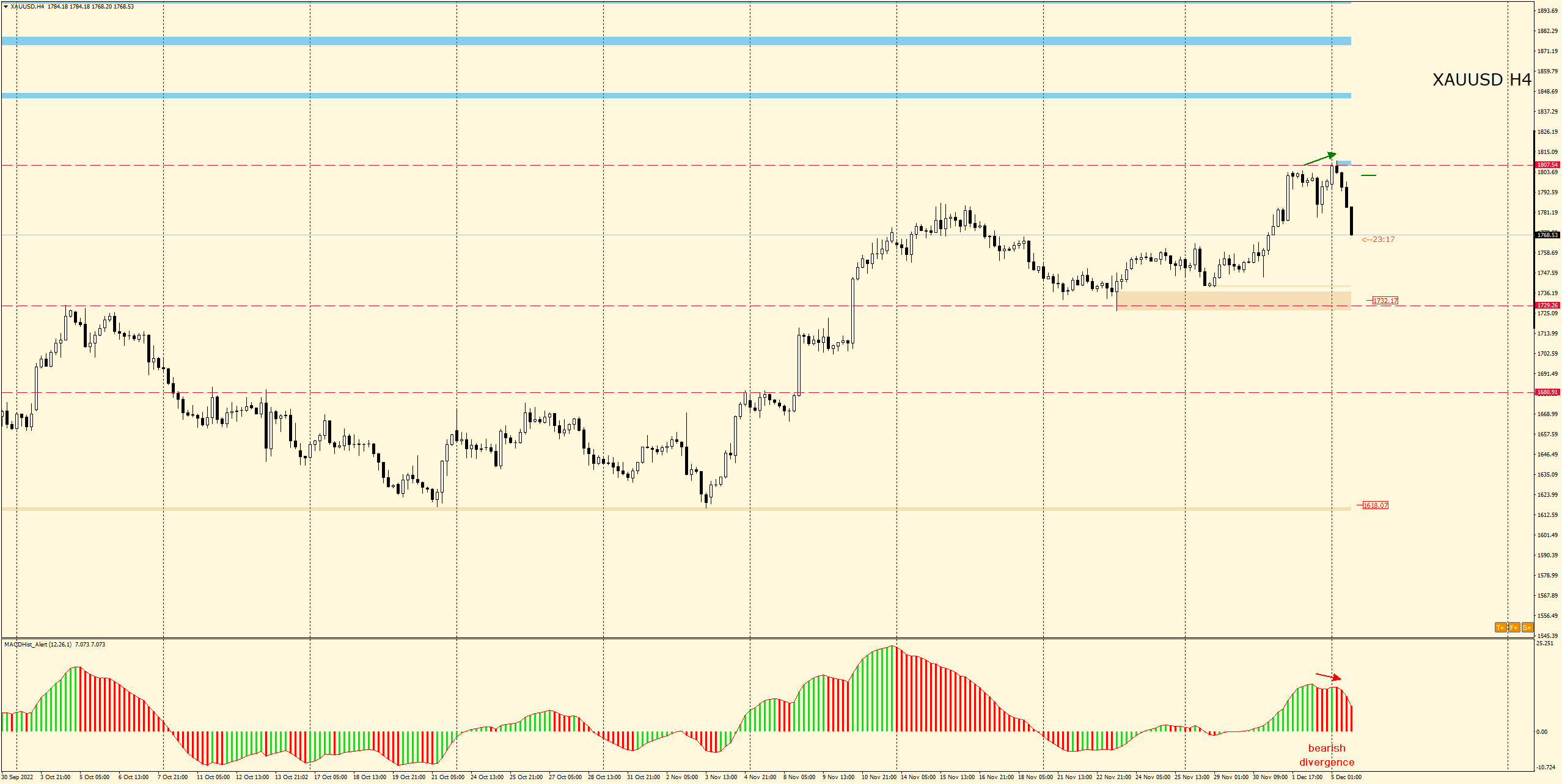

H4 chart confirms D1 scenario

On the H4 chart, the last 4 candles are bearish and here also a bearish divergence on the MACD has appeared.

Should the declines continue, the target could be the S/R = 1730 level, which is also where the demand zone formed on 23 November is located. Possible declines do not necessarily mean a permanent change to a downward trend. Two important macroeconomic events await us next week.

On Tuesday, 13th December, we will learn about inflation in the USA and the next day we will learn about the FED’s decision – the level of interest rates. If the expectations are fulfilled and inflation falls for another month in a row and the FED decides to raise no more than 50 bps, then gold could return to growth.

By the way, I invite you to a live session where I will also discuss the interesting situation on other instruments including EURUSD and USDJPY.

LIVE EDUCATION SESSIONS

This DECEMBER I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo