Experts from large investment banks Bank of America Merrill Lynch (BofAML) and Citibank assess the current situation on the main currency pairs and indicate the further direction for AUD/USD, USD/CAD and NZD/USD trading.

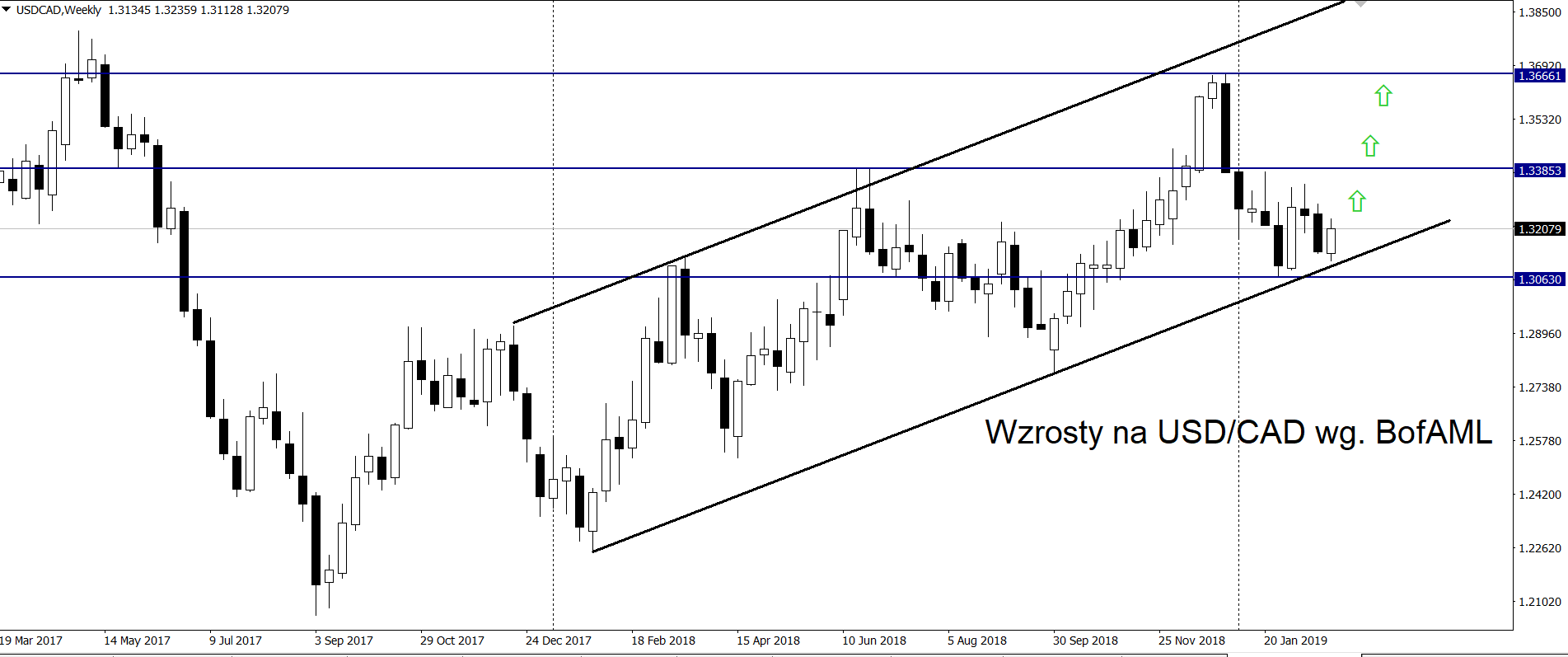

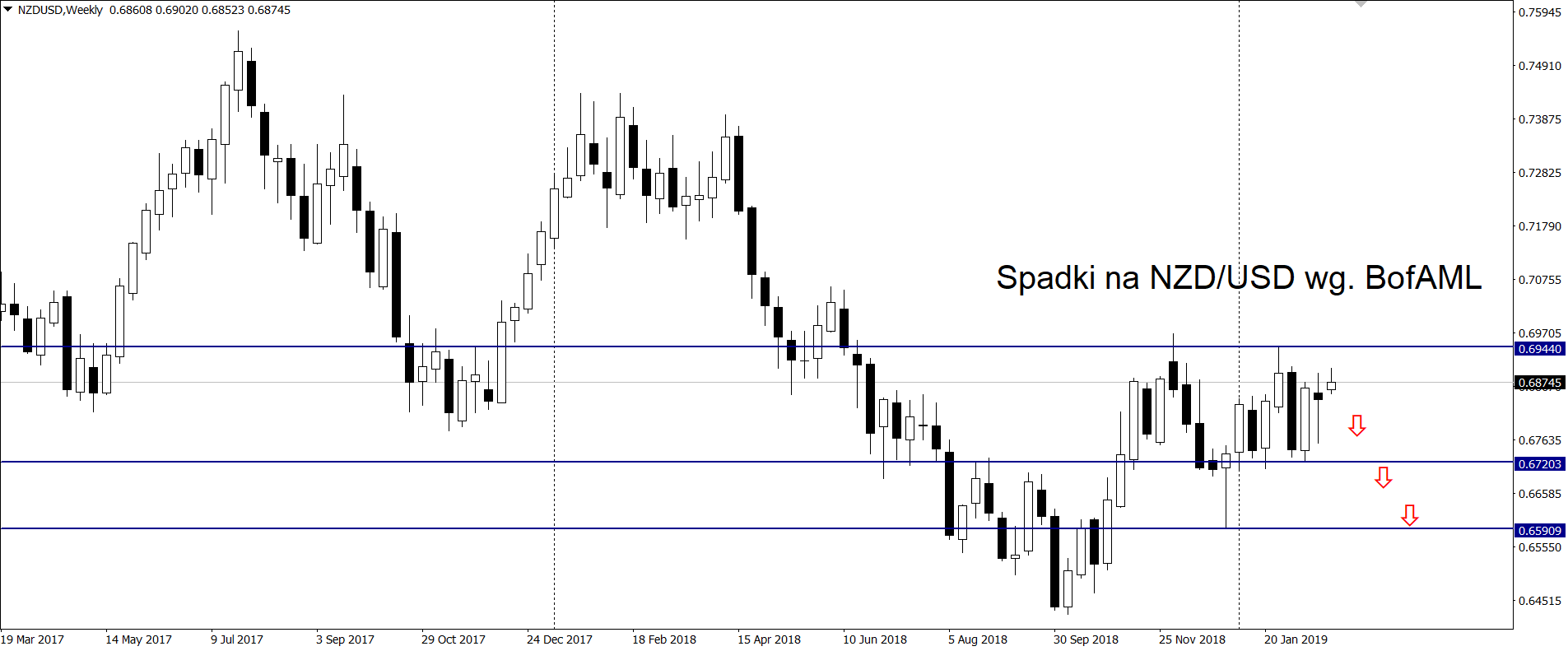

BofAML: Bullish on USD/CAD, bearish on NZD/USD

Analysts from Bank of America Merrill Lynch are increasingly focused on NZD/USD drops while maintaining a pro-growth attitude for USD/CAD. They point out that their assessment is based on medium-term valuation and expectations regarding the further monetary policy of central banks.

– “Growths on the USD/CAD pair are additionally supported by flows, price position and price impetus, a potentially powerful set of signals rarely combined together,” the report reads.

On the other hand, declines in NZD/USD are, according to experts, supported by seasonality.

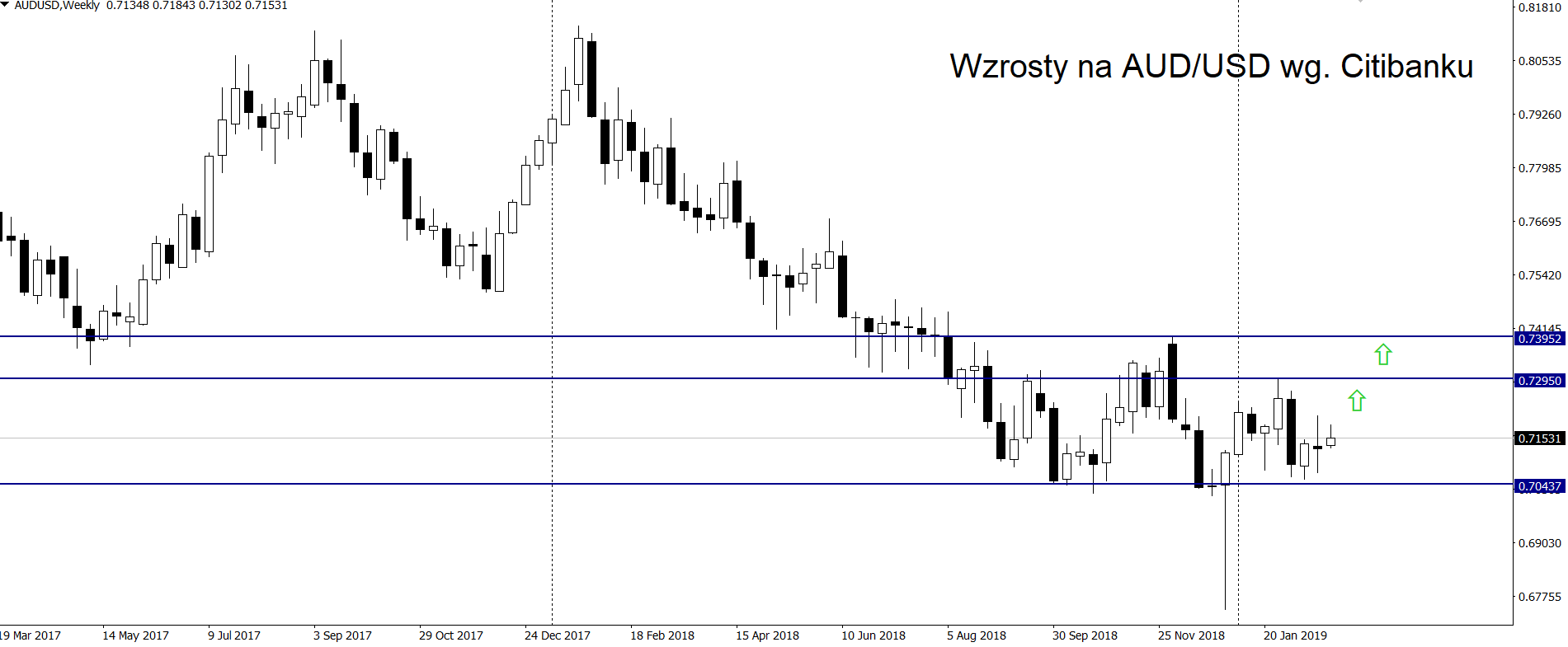

Citibank: Long on AUD/USD

Citibank’s analytical team maintains its long positions on AUD/USD, mainly due to the recent de-escalation of trade tensions between the USA and China. Recent movements in the Australian dollar index also point to the strength of AUD.

– “The chance that the Chinese economy will catch a breath has risen, which in turn will bring Australia additional momentum and we expect a better reading of the data soon. This is undoubtedly an opportunity for the appreciation of the Australian dollar, which weakened as the market discounted interest rate cuts” -the report shows.

Join us in our new group for serious traders, get fresh analyses and educational stuff here: https://www.facebook.com/groups/328412937935363/