Summary of the session 10/10/2018

Wednesday’s session was fatal for stock markets, the German DAX lost 2.2%, with equally strong indexes overseas. This is the largest scale of declines since June 25, 2013, when DAX lost nearly 2.5% and during subsequent sessions deepened the minima and then made more than 600 points upward movement. The highest volume on this series of contracts over 150k involves almost all players; LOP grows over 5k.

Start trading with leading CFDs on over 10,000 global markets. Trade in currency pairs, indices and commodities.Entering global financial markets has never been easier.

Among the components of the DAX index, the best result was recorded by Deutsche Telekom, which gained 2.70%, while Merck increased by 0.90%. The worst result was a new component in DAX – Wirecard, dropping as much as 14.19% and SAP lost 4.90%. The total number of losing companies outnumbered the number of gains listed on the stock exchange from 592 to 123.

DAX Intraday

DAX reached yesterday’s most-advanced destination in both daily and weekly S3. The increase in volatility raises the problem of widely spaced pivot lines at today’s session. Nevertheless, the sellers did not stop before erasing the first S1 support point slightly above 11,500 points at the start of trading. This otherwise round level can stop the falls for some time. Directional point for today over 200 points higher, next S2 support only at 11,370.

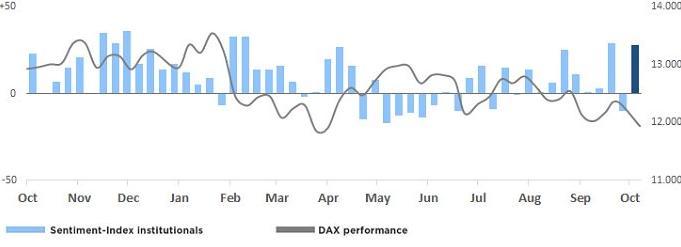

According to a weekly survey conducted by Xetra, among institutional investors, the percentage of bulls increased by 19% and bears dropped by 19%. This translates into 55% of optimists, 27% of pessimists and 18% of investors outside the market. Thus, it can be seen that with the drop of as many as 420 points during the week, institutional investors are beginning to look more optimistically at the market, sentiment increased by 38 points, in contrast to the so-called “Street”.

According to a weekly survey conducted by Xetra, among institutional investors, the percentage of bulls increased by 19% and bears dropped by 19%. This translates into 55% of optimists, 27% of pessimists and 18% of investors outside the market. Thus, it can be seen that with the drop of as many as 420 points during the week, institutional investors are beginning to look more optimistically at the market, sentiment increased by 38 points, in contrast to the so-called “Street”.