Session Summary 13.11.2017

The first day of the new week for the German index DAX ended with a drop -0.40%. These may have been significantly higher, however, in the end of the session DAX regained most of the loss. As a result, the daily bar chart showed a bullish bar that tested the maximum of June this year. Are we at the end of bearish correction?

Of the companies that make up the German benchmark, only 9 recorded profits. Among them, only Adidas achieved a positive result of more than one percent (+ 1.60%). Merck (+ 0.80%) and Vonovia (+ 0.73%) were the next. At the second pole thyessenkrupp of -2.66%, EON of -1.56% and MRG of -1.33%.

Even before the opening of the cash market, DAX responded positively to the morning German GDP figures. On Tuesday, we are still awaiting publication of forecasts of gross domestic product for the entire euro zone and ZEW indexes for Germany (11am), which will also translate into volatility of the stock index.

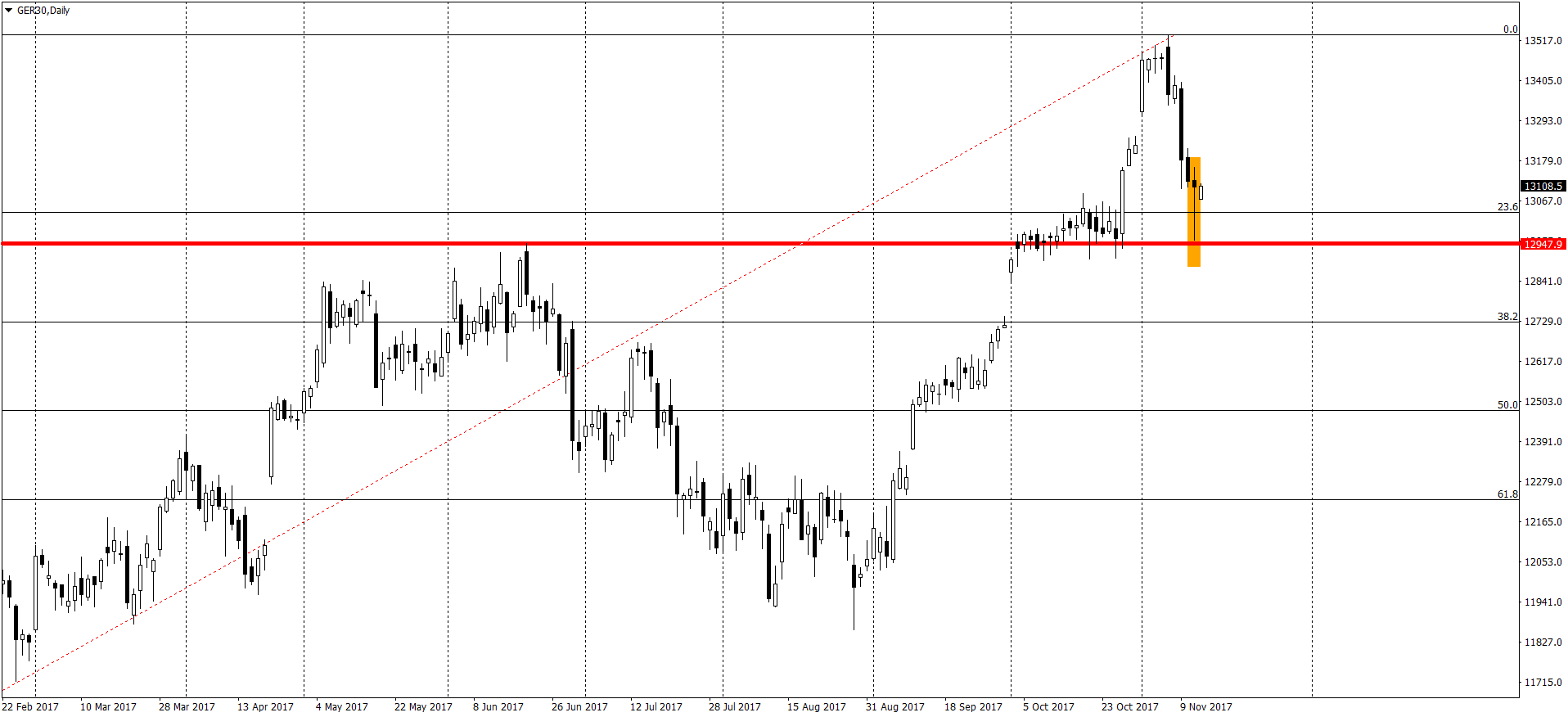

In the long term, the aforementioned demanding pin bar with long bottom wick tests the zone under 12,950.00 (mid-year peak) and 23.6% of the Fibonacci correction ( bullish trend started in January ). The price is also above the 13,000.00 cap, which should give the bulls a psychological advantage. Only falling down bellow the current support area will let us think about further correction and further depreciation.

In the long term, the aforementioned demanding pin bar with long bottom wick tests the zone under 12,950.00 (mid-year peak) and 23.6% of the Fibonacci correction ( bullish trend started in January ). The price is also above the 13,000.00 cap, which should give the bulls a psychological advantage. Only falling down bellow the current support area will let us think about further correction and further depreciation.