Without further ado, let’s begin the daily market review using Ichimoku technique:

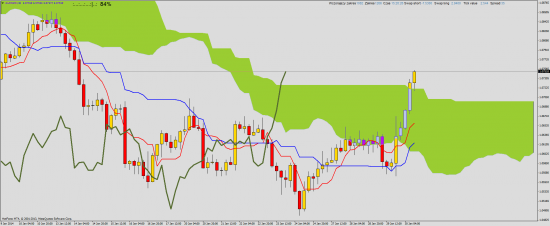

AUD/NZD:

Price released itself from the cloud (kumo), breaking through the key resistance level. It is worth to wait here for correction and re-test from the top of Kumo and resistance (which should now become a support line). Let’s look for correct position on D1 chart.

AUD/NZD D1:

Price broke Kijun line which portends deeper correction and access to at least the lower cloud limit – this will be our first target after opening position.

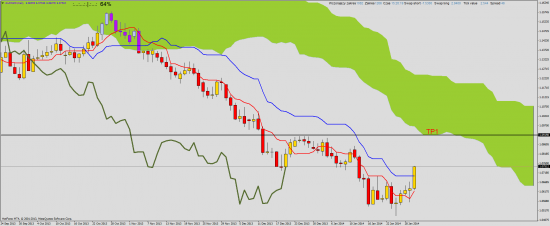

EUR/CAD:

Currency pair which was recently in a dynamic uptrend, currently is undergoing a revision. If the price will bounce from Kijun then with the occurrence of growth signal we can open long – provided, that Chinkou Span will be above the price.

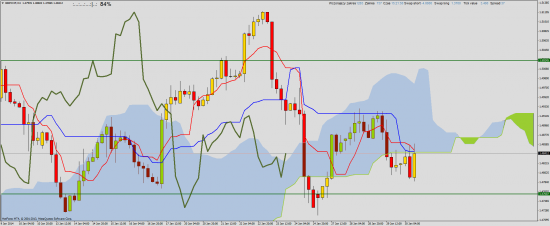

EUR/USD

We were not posting any Eurodollar signals for a long time. Finally, a clearer sell signal appeared, but the clouds arrangement – which is strongly increasing – may be a little bit worrying. We won’t advise looking for opportunities on this pair. Better switch to another one, where the situation is clearer.

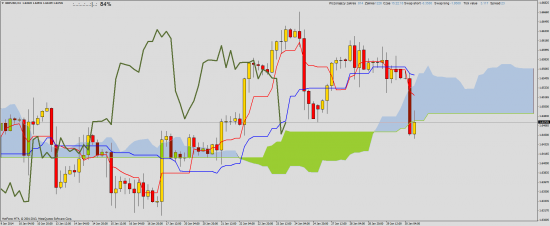

GBP/CHF:

Yesterday, we wrote about breaking out of the Kumo. It is worth to wait for a re-test here. Just like now – if the price goes back and comes out again at the bottom, it will be a signal to open a short position with a stop loss above the present maximum. This gives a much better profit-to-risk ratio than a position opened after the first release from Kumo.

GBB/USD

Clear sell signal on Cable. Once again we should wait for a successful re-test of the Kumo bottom and just then think about short positions. The price may go up – even in a cloud – and consolidate there. Another breakout will be a signal with a lower SL.

If you want to learn more about Ichimoku technique we invite you to watch one of Marcin Wenus webinars about Japanese way of trading: https://www.youtube.com/watch?v=QOLgKH15LGw