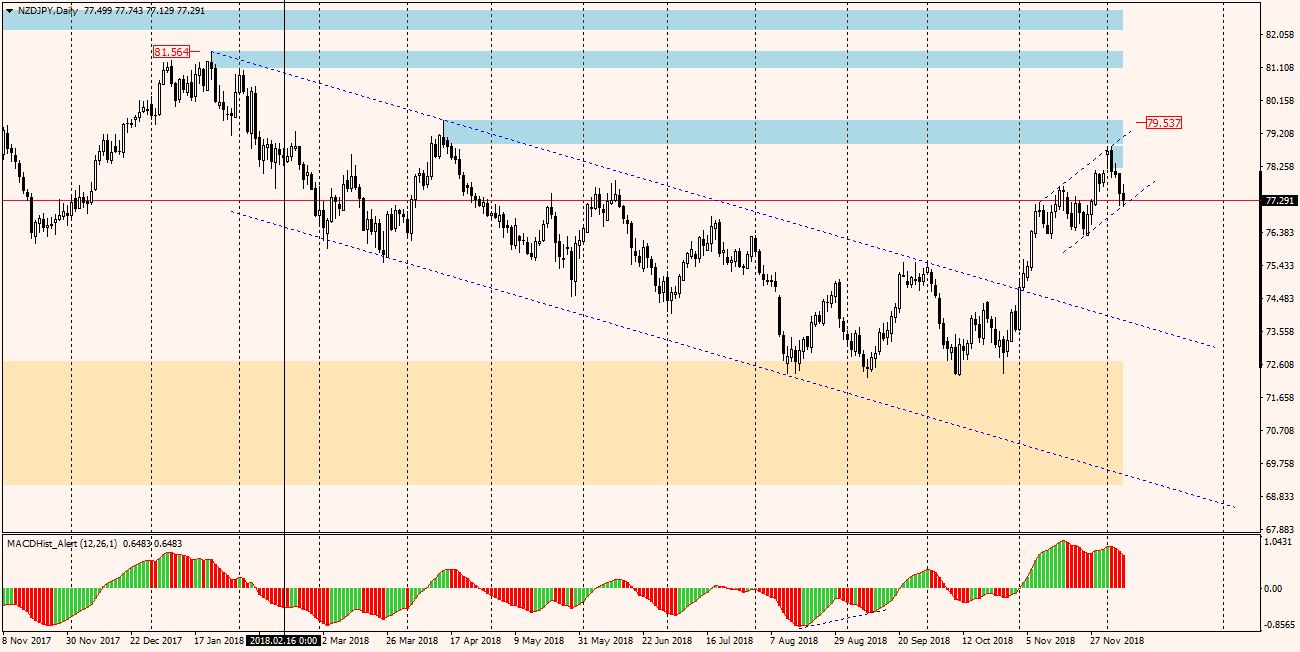

NZDJPY

NZDJPY – I wrote about this pair last Wednesday, and only two days later the price reached the level of growth channel support predicted in the analysis. It is worth observing the price behavior around this support, because its overcoming may give a signal to the continuation of drops. This scenario is supported by divergence on MACD oscillator, lasting already for 3 days.

On the basis of the analysis of the H1 chart, in the case of bearish scenario, the objective for quotations will be the nearest demand zone starting at the level of 76.75 and after a possible correction to the defeated channel support, continuation of falls until the next support 76.40. The stop loss should be above the average EMA144, which is currently 77.75, overcoming the average may negate the bearish scenario.

Join us in our new group for serious traders, get fresh analyses and educational stuff here: https://www.facebook.com/groups/328412937935363/