![]() The option for today is an analysis cycle for binary options in cooperation with BDSwiss broker. Every day we present the best PUT or CALL options for a selected financial instrument along with its current technical analysis.

The option for today is an analysis cycle for binary options in cooperation with BDSwiss broker. Every day we present the best PUT or CALL options for a selected financial instrument along with its current technical analysis.

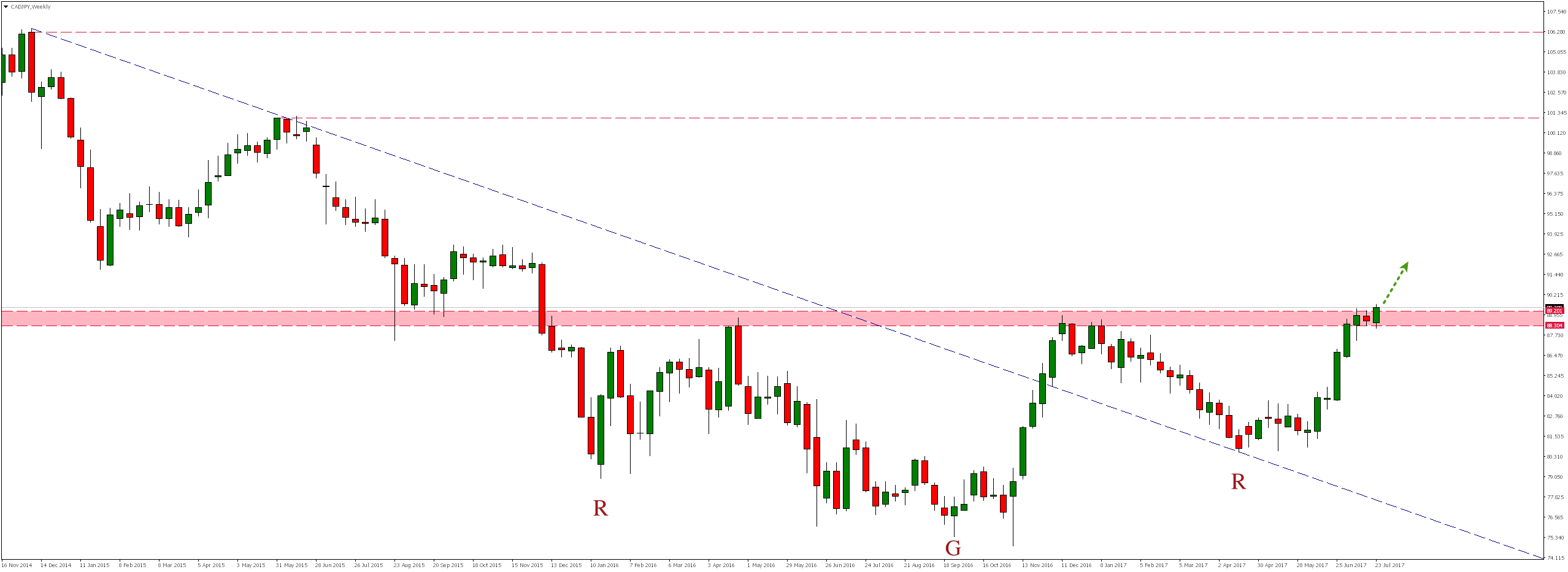

CADJPY for two weeks moved in a consolidation between levels 88.30 – 89.20. As a result of Monday’s gains stemming from earlier rejection of the lower limit of this consolidation market has reached and breached its upper limit.

In near future, we would expect re-test of 89.20, and if there would be a demand response we could expect continuation of growth.

Looking at weekly chart, we find that this consolidation was a zone of extremely important area of resistance. It is also worth noting that as a result of lasting since November last year growth pair overcome downtrend line and precisely tested it from the top (as a resistance). From that moment we observe growth again.

As a result of the recent downward movement, the right arm of bullish inverted head and shoulders formation was formed, and now the neck of the formation is a strong resistance level. It turns out that re-testing and permanent rejection of this zone could open the way to further growth even in a slightly wider time horizon than just intraday or intraweek.

BDSwiss, offers 70% return on options. If you win, the greater will be the percentage of your earnings from invested stake. If you lose, regardless of the size of the defeat, you will never lose more than you bet. You can also choose other expiration hours for options, both shorter and longer.