Let’s take a look at another Price Action Daily Setups. This time only 4 pairs, but all of them can end with a position opening:

AUDNZD

Pair is almost for a month in bullish trend, it managed to break resistance and for now we can only look for longs opportunities. It can show up during today’s session because there will be a test from above of earlier resistance (now a support). I will watch H4 chart and if there will be any Price Action buy signal I will open position.

If you are interested in Price Action Strategy description, you can read it here.

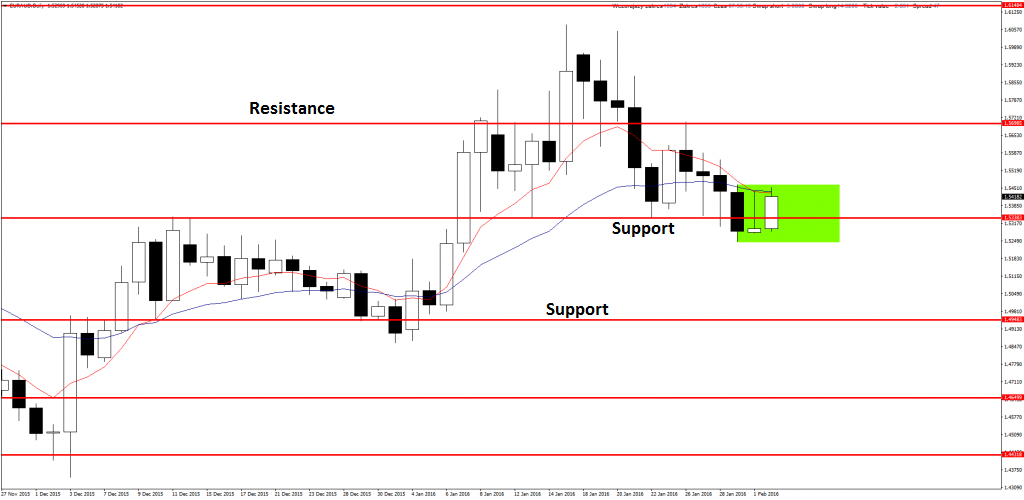

EURAUD

On this pair we can see Inside Bar. There are 3 possibilities to play it:

- Break below and close below mother candle (green range on the chart). Then we can set sell limit order on 50% retracement of signal candle and SL above it.

- Break below and rebound to mother candle range and close in it. Then we can open longs with market price and SL below signal candle.

- Break above and close above mother candle. It will be a long signal and I will set buy limit order on 50% retracement and SL below the signal candle.

GBPCHF

I wrote about this pair and sell signal on it. Unfortunately it ended with SL and yesterday’s candle could be used as buy signal. Despite small RR (local resistance at 200 pips and SL 100 pips) I seriously consider this position because it is consistent with the momentum. TP on another resistance (around 400 pips) and BE at zero with 50% close just below local resistance.

YOU CAN START USING PRICE ACTION AND INVEST ON FOREX MARKET USING FREE XM BROKER ACCOUNT.

GBPJPY

This pair is getting close to resistance at very strong bearish trend. If there will be any sell signal we should consider opening shorts.