Dynamic Friday didn’t change much on Forex market. We can say more about daily candle on US indices. First there was a decrease and then S&P500 even topped previous highs. Index is still below key resistance and there can be nervous situation in near time.

AUDNZD

Inside Bar is still building. There are three scenarios:

- Break below and close below mother candle (green range on the screen). Then we can set sell limit order on 50% retracement of signal candle, with Stop Loss above it.

- Break below and come back to mother candle range. Then we can open longs with market price and SL below signal candle.

- Break above and close above mother candle range. It will be long signal and I will set buy limit order on 50% retracement of signal candle and SL below it.

EURJPY

Pair broke above resistance and on Friday bearish correction started. Maybe it is an opportunity to open longs on H4 chart. Position will be consistent with the sentiment, so today I will look for signal to open long position.

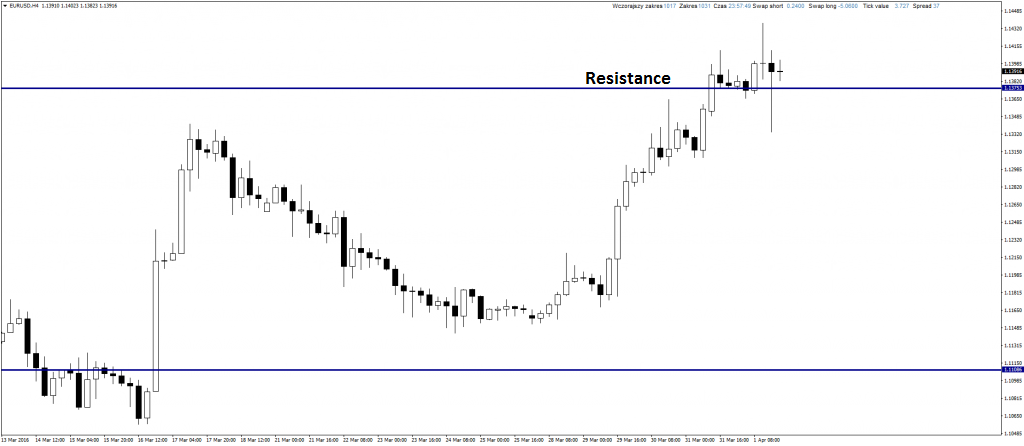

EURUSD

Signal to open long position showed up in the end of the week. Clear Pin Bar rejecting earlier resistance (now a support) let us open longs. Of course we have to check whether Stop Loss will be at least 2x smaller than Take Profit.

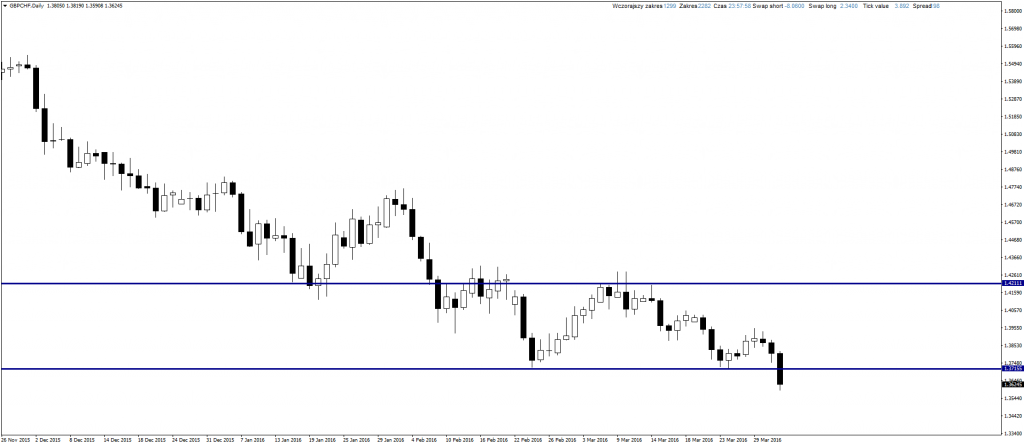

GBPCHF

This pair broke strong support on Friday and it seems like further decreases are certain. Perfect scenario will be joining the trend when there will be bullish correction testing mentioned level from below and some PA sell signal on H4 chart.