More positions are opening and there is more signals. On indices we can see corrections of main trends what also weakens yen. It can mean that something is going on and it is too soon to say that this is big rebound. We just have to look for clear signals and play them by the system:

EURAUD

I wrote about this pair yesterday pointing out that there is a possibility of re-testing earlier support (now resistance) and further decreases. It really happened, we can see nice Outside Bar and we can open shorts. I always set limit order on 50% retracement of signal candle, so it isn’t opened yet.

If you are interested in Price Action Strategy description, you can read it here.

EURUSD

Buy signal on Eurodollar. Price decreased to support, tested it and clear Pin Bar showed up. What’s more, 50% retracement was tested so this position is already opened.

YOU CAN START USING PRICE ACTION AND INVEST ON FOREX MARKET USING FREE XM BROKER ACCOUNT.

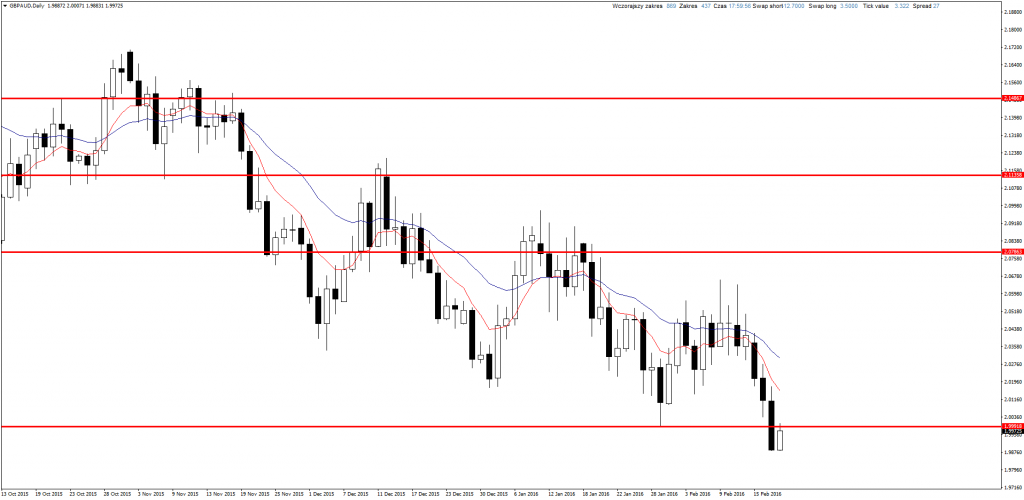

GBPAUD

Support was broken on this pair and currently it is tested from below. If there will be any sell signal on D1 or H4 chart we can open shorts consistent with the trend.

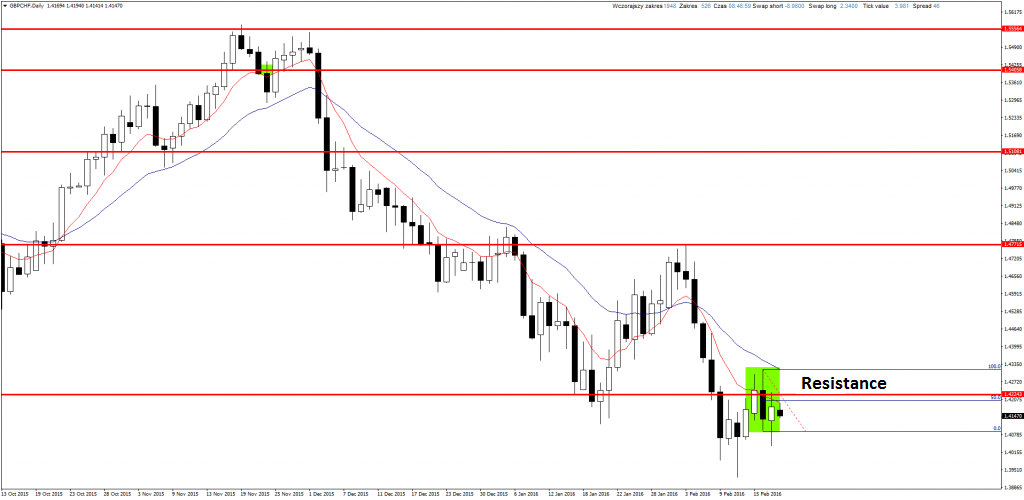

GBPCHF

Short position after Outside Bar was opened. Now we just have to watch the situation.

GBPJPY

The same signal was on this pair, but so far sell limit order was not activated. So far price didn’t decreased enough to cancel it, so I leave it.

USDCAD

Another test of support on Loonie. More expensive oil strengthen Canadian currency and there is possibility of breaking this level. If it happen further losses look sure and it will be worth to look for opportunities to open short position.