EURAUD

Yesterday there was a strong correction on this pair. Price was just above the support and now I will watch H4 chart in looking for long positions, consistent with the trend.

GBPAUD

A lot of bad luck I had on this pair yesterday. Position was closed on 50% and the rest secured on Break Even. Take Profit was set on 2.10800, price reached to 2.10785 and moved down almost 400 pips. I just needed less than 2 pips to earn 300 pips of profit. Unfortunately because of that, yesterday my account gained just 0.5% instead of about 5%.

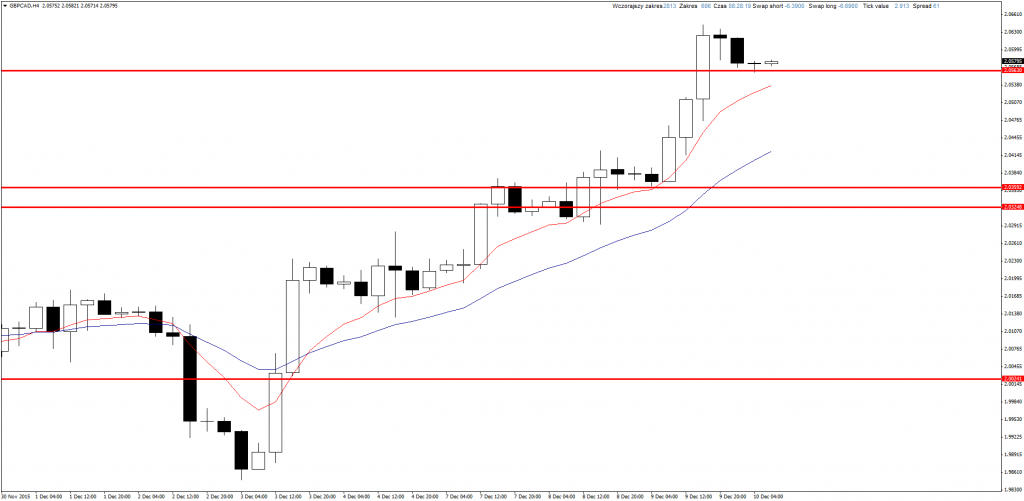

GBPCAD

Quite interesting situation on this pair. Yesterday price broke above resistance dynamically and then there was a bearish correction. Now we can watch H4 chart and wait for Price Action signals to take long position consistent with the trend. There is quite big range of potential gains – 400 pips.

If you are interested in Price Action Strategy description, you can read it here.

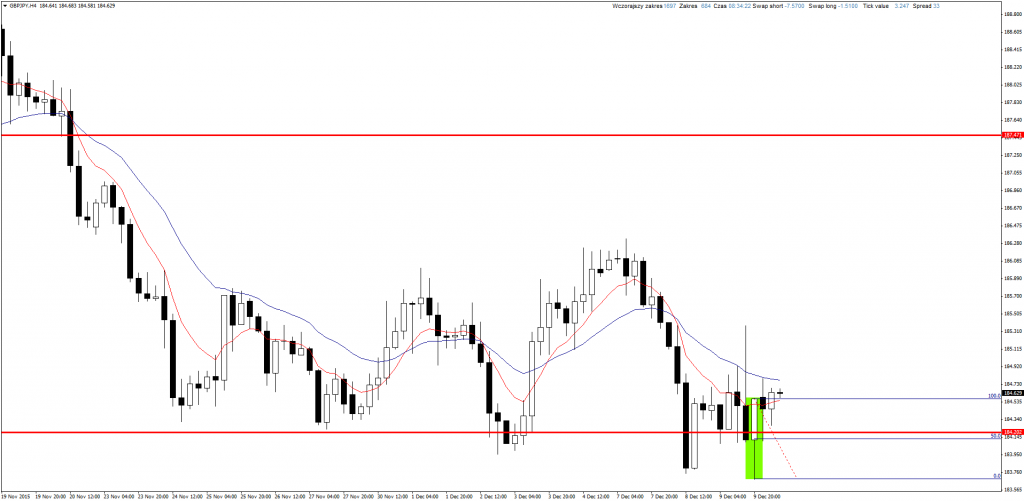

GBPJPY

Buy signal on this pair. Price tested support, there was long bullish Pin Bar and on 50% retracement I set buy limit order.

YOU CAN START USING PRICE ACTION AND INVEST ON FOREX MARKET USING FREE XM BROKER ACCOUNT.

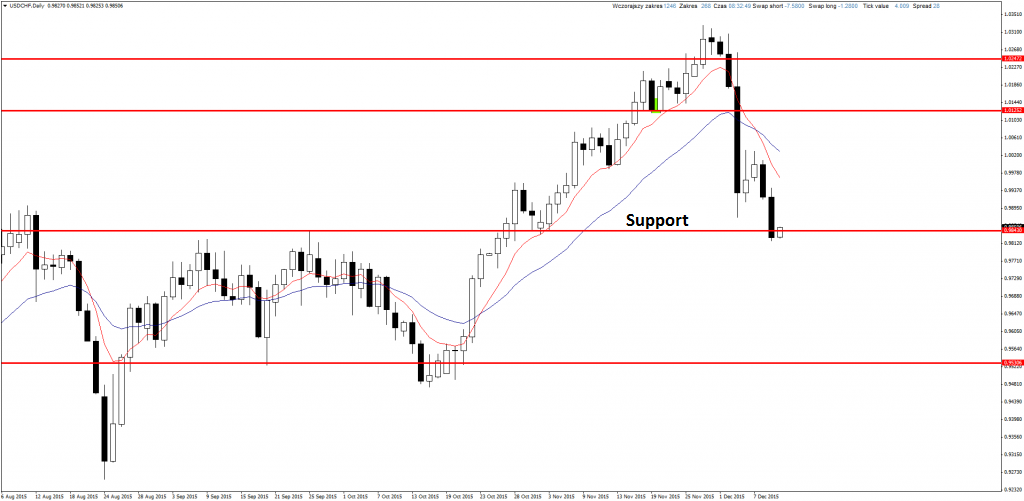

USDCHF

Price decreased to strong support and if gains want to be continued it is the last level to rebound. If there will be buy signal on the D1 chart, I will use it. If price will go lower, I will look for shorts on both H4 and D1 charts.

USDJPY

Finally break on USDJPY. Price moved quickly down reaching the closest support. I wouldn’t look for longs here, it’s better to wait for correction to the earlier lower band of consolidation (which should now become resistance) and there open shorts.