Yesterday brought a lot of confusion in the market. Dollar was weakening, euro was getting stronger. What is more Canadian dollar and Australian dollar continued previous declines. Let’s start with our today predictions and price action setups:

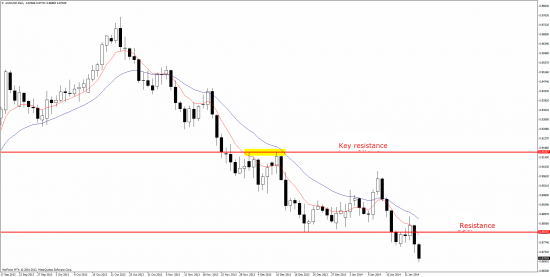

AUD/USD

After false puncture of resistance line on Wednesday, AUD/USD reached the new minimum. Currently we should be waiting for the growth corrections and trady only short positions.

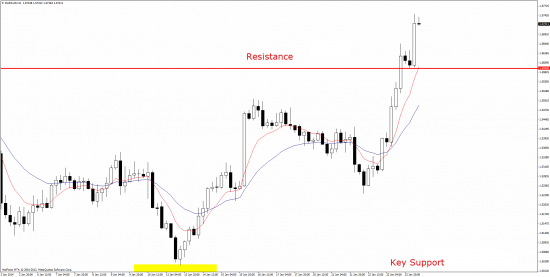

EUR/AUD

We see here really nice trend in euro to Australian dollar. Almost perfect resistance puncture, re-test from the top and re-growth. We are waiting here for the bearish correction and we advise trading only in accordance with the current strong momentum growth.

EUR/USD

Someone could say: FINALLY! Eurodollar bounced from the last days ongoin stagnation. In earlier posts we mentioned long lower wicks on that pair – which indicates demand. It turned out to be tru and the pair shot up stopping at the resistance line. Breaking it should result in a test of the next key level at 1.3833. Downward correcdtion will be a good opportunity to open long positions.

GBP/USD

GBP/USD pair jumped over the maximum from the this year beginning. Re-test of this level from the top and buy signal from the price action will let us to join and follow the trend.

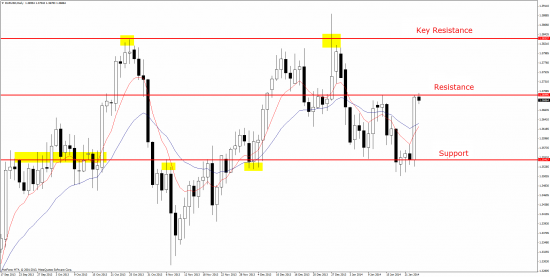

NZD/CAD

Yesterday we observed a false puncture of resistance line – as it clearly looks. Although we are in upward trend the whole situation looks really bearish. If we will see sell signals around resistance line on H4 chart then we can wait for greater correction.

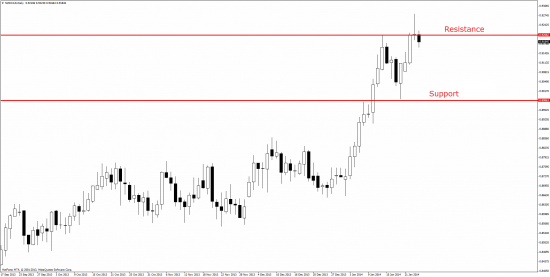

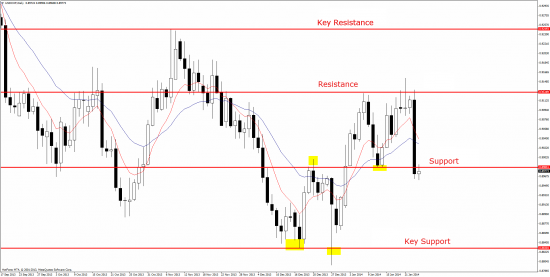

USD/CHF

Yesterday morning I was writing about that pair indicating a sell signal on the resistance line. You could easily open shorts, which have a chance to earn nice sums. Currently, support line has been pierced and re-test from the bottom with the occurrence of a sell signal will be a great opportunity to open shorts.