Let’s start with today’s PA setups. We have four currency pairs for March 11 and four potential trading signals:

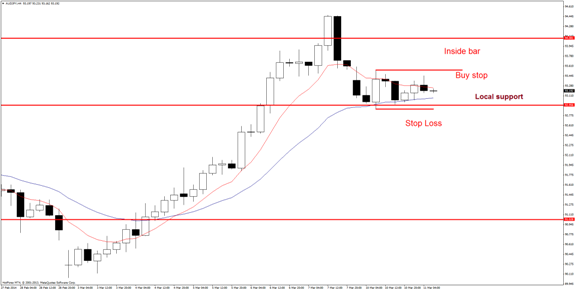

AUD/JPY:

Quite interesting situation on AUD/JPY. After an unsuccessful attack on the resistance, price fell to the first local support that can end the correction, because it covers more or less the 38,2% of Fibonacci retracement. On the 4-hour chart we can se that price quickly rebounded from the support and formed a long upward candle, which includes the six next ones. It creates a inside bar setup, which can be played by putting buy stop order above the mother-candle maximum, with SL below lub more aggressively below 50% of its abolition.

CAD/JPY:

Price rebounded yesterday from 8 and 21 EMA, which also indicate a upward trend. Small pin bar candle that formed yesterday may be used to open long positions. We can play it in three different ways:

-Buying after breaking the maximum, stop loss below the minimum,

– Buying after breaking the maximum, stop loss below 50% of candle abolition (better profit-to-risk ratio than in the first case – there was a greater likelihood of loss),

-Buy limit 50% of candle abolition, SL below the minimum. Better profit-to-risk ratio than in the first case and safer stop loss than in the second one. However, there is a risk that the correction will not occur and only the observation of developing trend will left.

GBP/CAD:

A pair consolidates below the key resistance. Long upper wicks may testify supply which starts in these areas. However, the trend is still upward and you have to remember about that when opening short positions. Long positions would be much more reliable, especially when the price permanently break 1.8570 level and test it from the top giving a buy signal.

GBP/USD:

The currency pair is approaching a key support. It is worth to observe GBP/USD because buy signal around 1.6600 level will be a good opportunity to look for longs – in accordance to current trend.