Yesterday on the markets passed fairly quietly, which was caused by a blank calendar. Also today, there are not too many key data – only those connected with pound sterling at 10:30 (CET). Let’s start today’s Price Action setups review:

AUD/USD:

Downward correction on Australian dollar. Aussie still got huge amount of place before it encounters the key support. At the moment, the best option is to wait, because the currency pair is in medium-term uptrend and it is worth to play only long positions.

EUR/USD:

Very narrow consolidation continues on Eurodollar. Local resistance created at 1.37300 and it seems that in its surroundings we should consider short positioning after clear purchase signals from Price Action – on the H1 or H4 chart.

GBP/AUD:

Price reached the resistance which stopped increases two times in the past. The current impulse is quite strong and only really clear PA signal may be used to open short positions. Even though, from a broader perspective the trend is downward, from mid-April we can talk about rebound which is still seen.

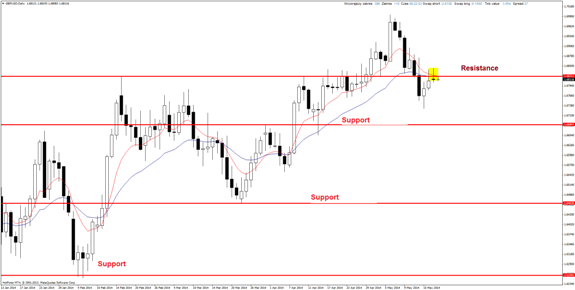

GBP/USD:

Cable tested resistance yesterday (previously support) and pin-bar candle formed on the daily chart. It is quite small, so to confirm the trend you can set a sell stop below it with SL just above 50% of the candle’s abolition (risky option) or above the candle’s maximum (safe option). Also, you can trade it in a third way, by setting sell limit around 50% of candle’s abolition. Of course in this case, there is always a danger that the price will fall and we will be left without any position.