“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

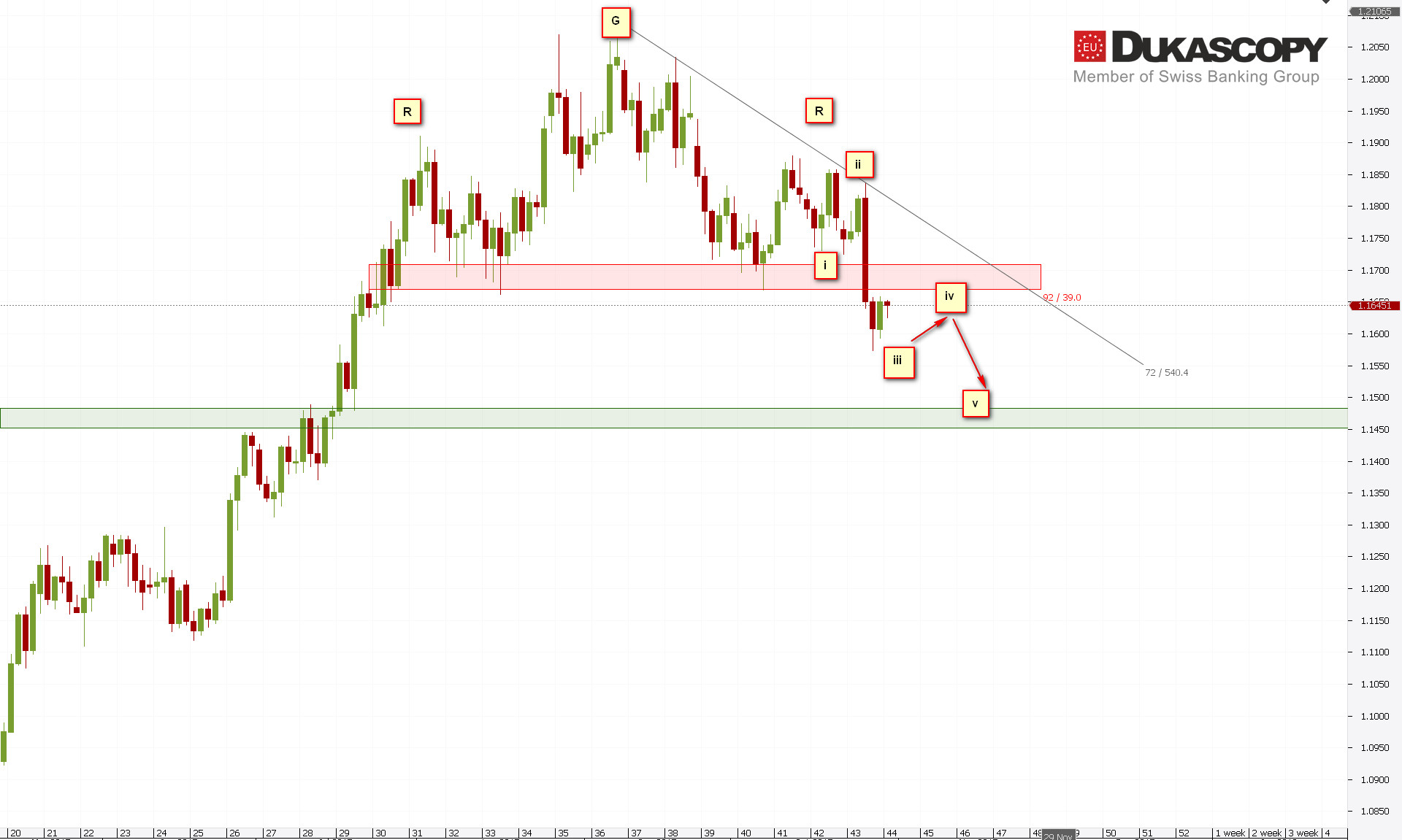

EUR/USD broke the neckline of the head and shoulders formation. The probability of its implementation is considerable. We are currently watching pull back to the defeated support zone, now the resistance. Its rejection should result in a deeper decline and a move towards another support zone. If we look at the wave chart, we see that the drop is slowly turning into a impulse. To complete it, there are two intermediate waves missing. Its completion will create two variants. In the first a straight correction and H&S formation will be negated. We will see a return to the gains or the end of wave A of a larger correction structure. In the second, a 1212 formation will occur, which should lead to full implementation of the formation and movement towards level 1.1300.

EUR/USD broke the neckline of the head and shoulders formation. The probability of its implementation is considerable. We are currently watching pull back to the defeated support zone, now the resistance. Its rejection should result in a deeper decline and a move towards another support zone. If we look at the wave chart, we see that the drop is slowly turning into a impulse. To complete it, there are two intermediate waves missing. Its completion will create two variants. In the first a straight correction and H&S formation will be negated. We will see a return to the gains or the end of wave A of a larger correction structure. In the second, a 1212 formation will occur, which should lead to full implementation of the formation and movement towards level 1.1300.

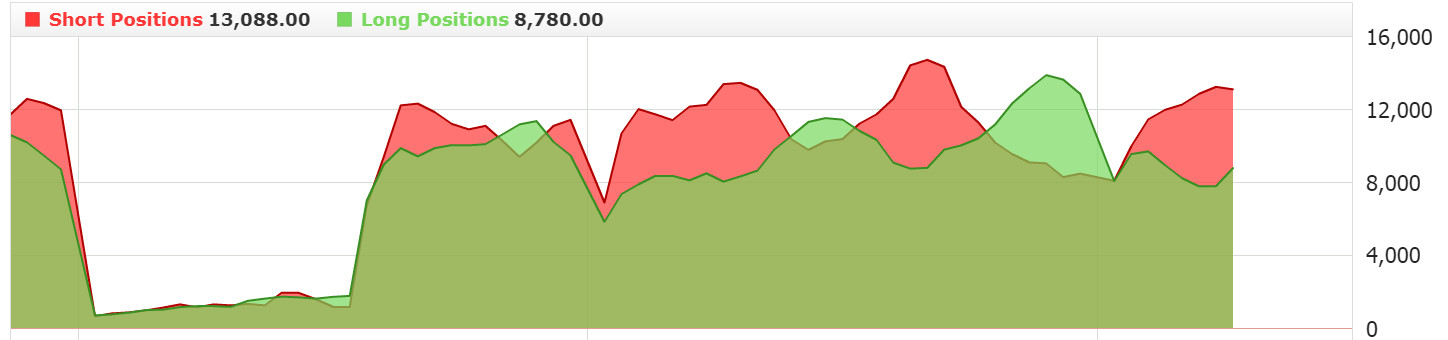

The level of sentiment speaks for the continuation of the decline. Watching return movement to neckline and rejection level can be an opportunity to find short.

The level of sentiment speaks for the continuation of the decline. Watching return movement to neckline and rejection level can be an opportunity to find short.

GBP/USD remains closed between two levels. The consolidation in which the pair has been for two weeks resembles a triangle. If that is the case, then we should see the trend line test and the the fate of the pair will depend on reaction on it. Breaking from the triangle thru the bottom and overcoming the trend line will result in a move towards the 1.2800 level. However, if it is not a triangle but just a simple correction of the recent increase, we will see another leg up in the wave 3C.

Sentiment suggests bearish bias, but the level on which the pair is currently doesn’t encourage to open the position. I’m waiting for a break from the triangle and only then I will find a position consistent with the momentum that will arise.

Sentiment suggests bearish bias, but the level on which the pair is currently doesn’t encourage to open the position. I’m waiting for a break from the triangle and only then I will find a position consistent with the momentum that will arise.

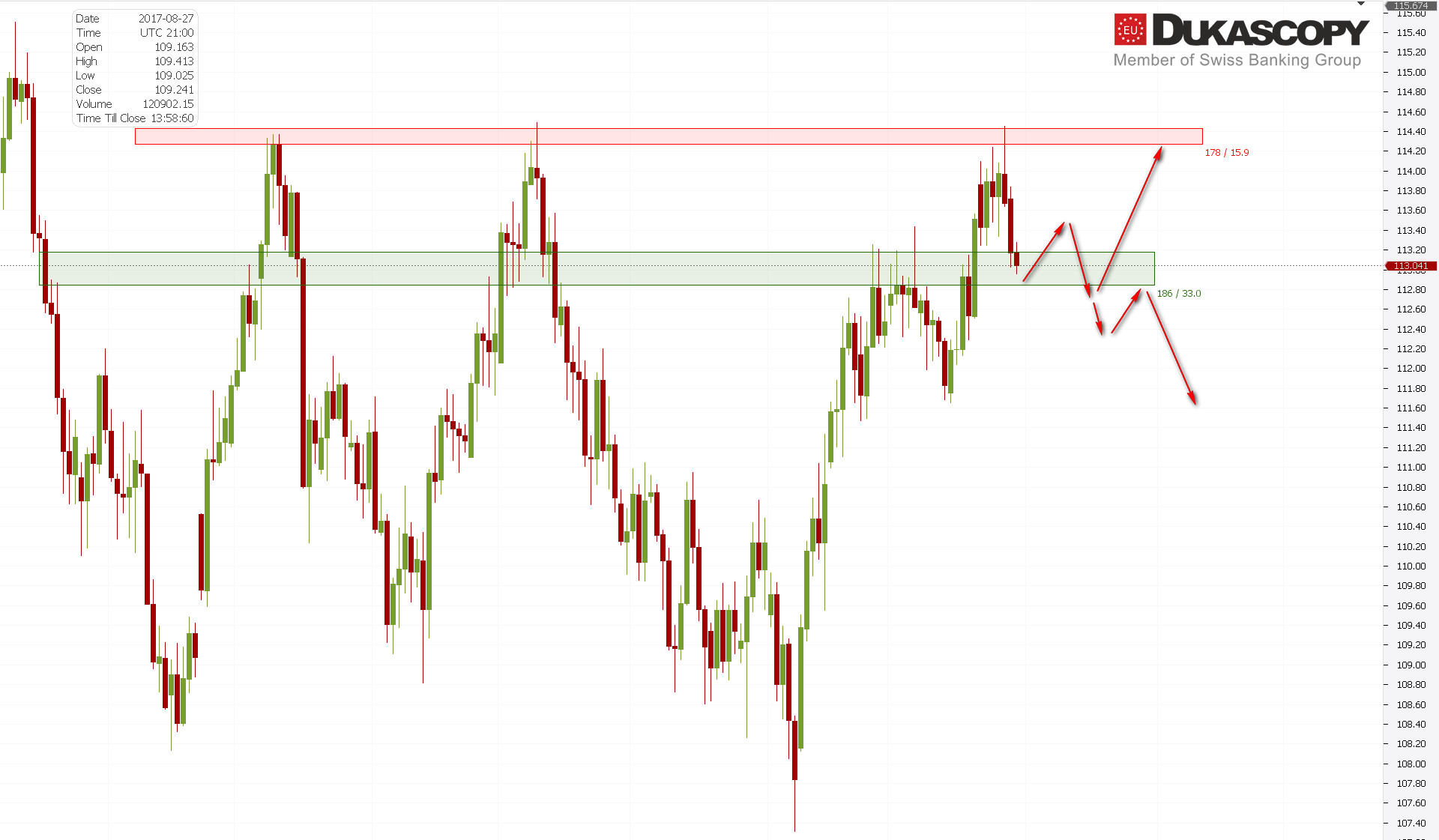

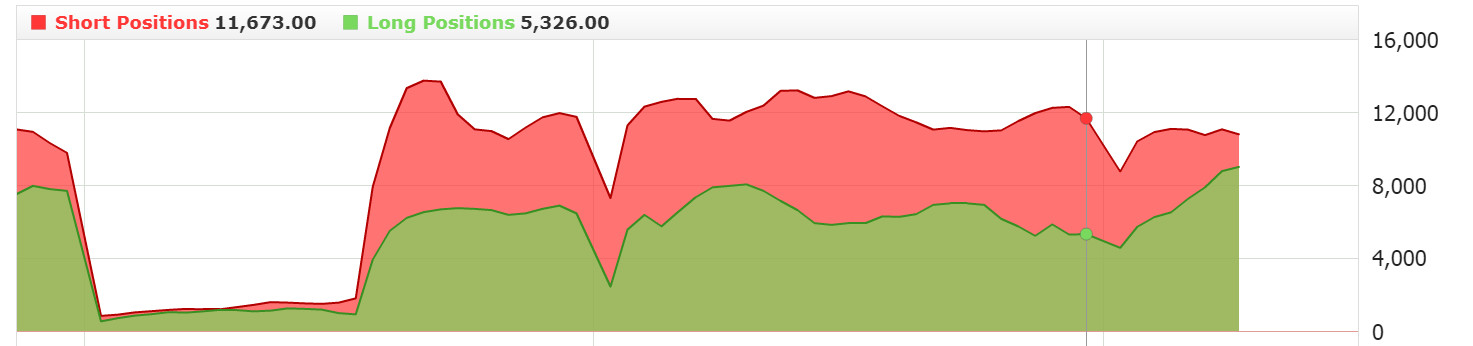

USD/JPY has rejected an important resistance zone. A Pin Bar was created, which led to deepening the declines. The pair is currently fighting with support zone. The last wave of the uptrend is the fifth, so the decline we see may be both the beginning of a major downward movement and its correction. After that, we should see a return to growth. By defeating the test zone with a stronger impulse, pair negates such a scenario and it should lead to a movement towards the level of 111,700.

The sentiment speaks for defending support and continuing the upward movement. A strong rejection of the level can be an opportunity to play long.