“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

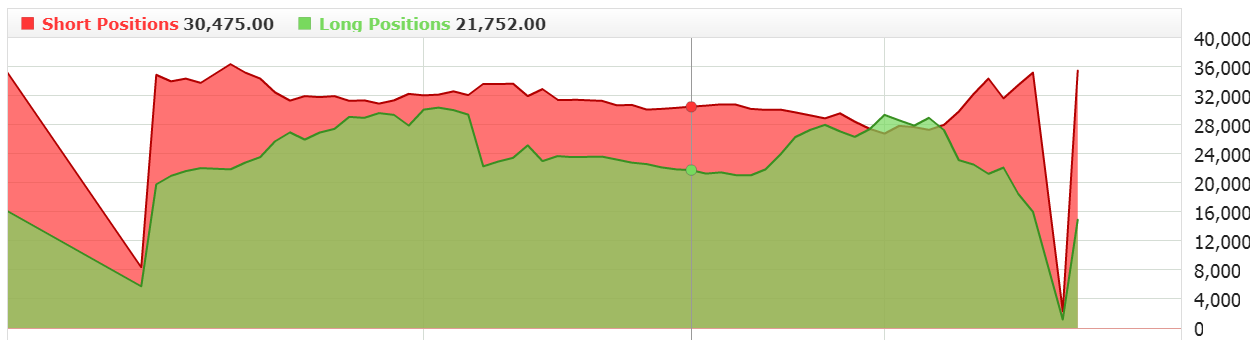

EUR/USD defended support zone last week. The increases have reached the resistance with which the pair is currently fighting. Its overcoming should end the simple correction and lead to continuation of increases towards the highs, or create a B wave in a compound correction. Rejecting the tested level should result in a re-test of the last low and a move towards key support.

The Ichimoku chart shows that the pair managed to defeat the Tenkan line and moved towards Kijun, which is currently being tested. Both the Tenkan and Kijun lines go flat, which may indicate consolidation. The Chikou line found support on price indicating line.

The Ichimoku chart shows that the pair managed to defeat the Tenkan line and moved towards Kijun, which is currently being tested. Both the Tenkan and Kijun lines go flat, which may indicate consolidation. The Chikou line found support on price indicating line.

There is no opportunity to enter a position, and the sentiment returns to normality after the weekend. That is why it remains on the side.

The partner of “Search, Analyse, Trade” series is a Dukascopy Europe broker who gives its customers access to ECN accounts in different currencies.

Trade on Forex, indices and commodities thanks to Swiss FX & CFD Marketplace. Open free trading account right now.

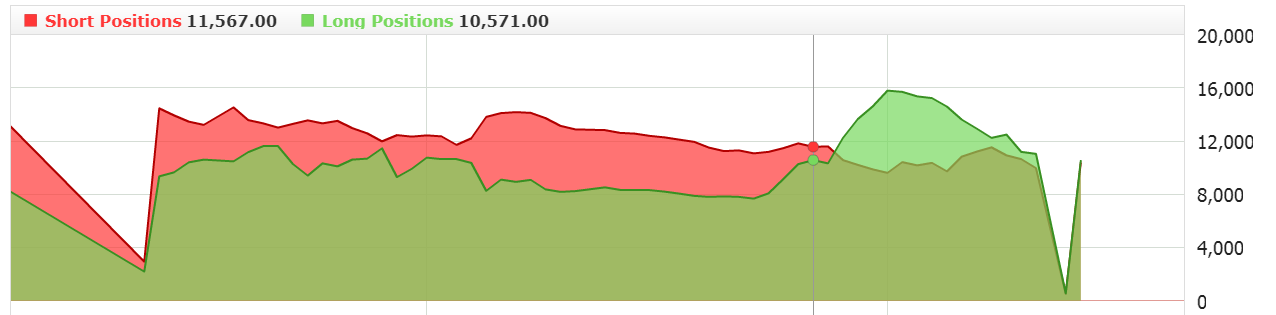

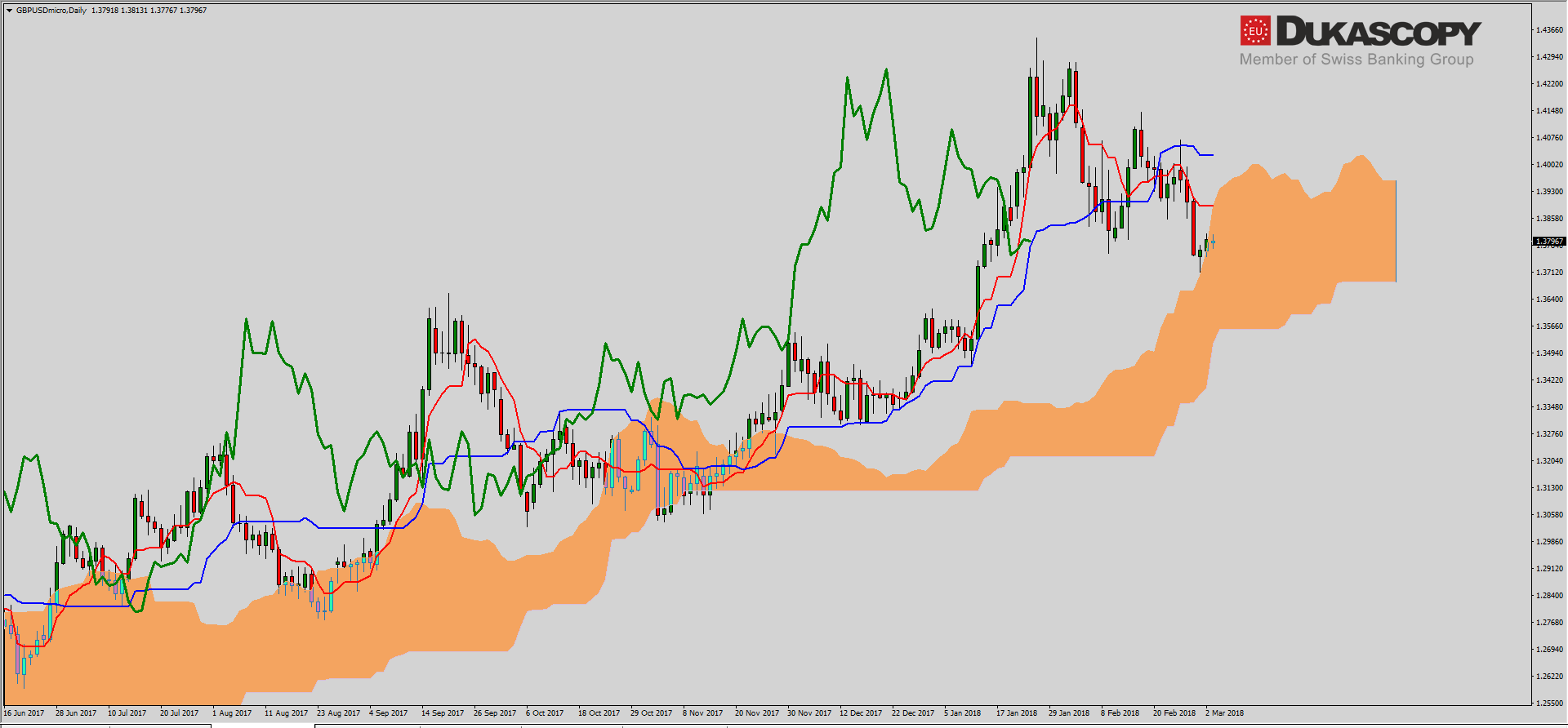

GBP/USD pair has not changed completely since last week. Everything I wrote about the pair is still valid. The potential c wave is not yet finished, so I expect after completing the correction just observed and rejecting the trend line, a move towards the support zone. There should clarify whether we are dealing with wave C or wave 3.

On the Ichimoku graph pair is still struggling with the line of Senkou Span A. The KIjun and Tenkan lines are laid flat, which indicates consolidation. The Chikou line has beaten the price line and has now found support in the Kijun line. The cloud is expanding and the price will soon come within its scope, which may mean the extension of consolidation in time.

On the Ichimoku graph pair is still struggling with the line of Senkou Span A. The KIjun and Tenkan lines are laid flat, which indicates consolidation. The Chikou line has beaten the price line and has now found support in the Kijun line. The cloud is expanding and the price will soon come within its scope, which may mean the extension of consolidation in time.

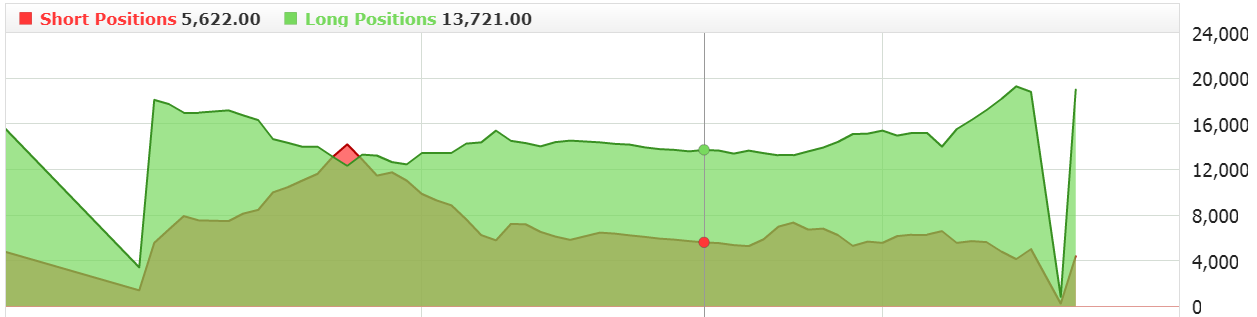

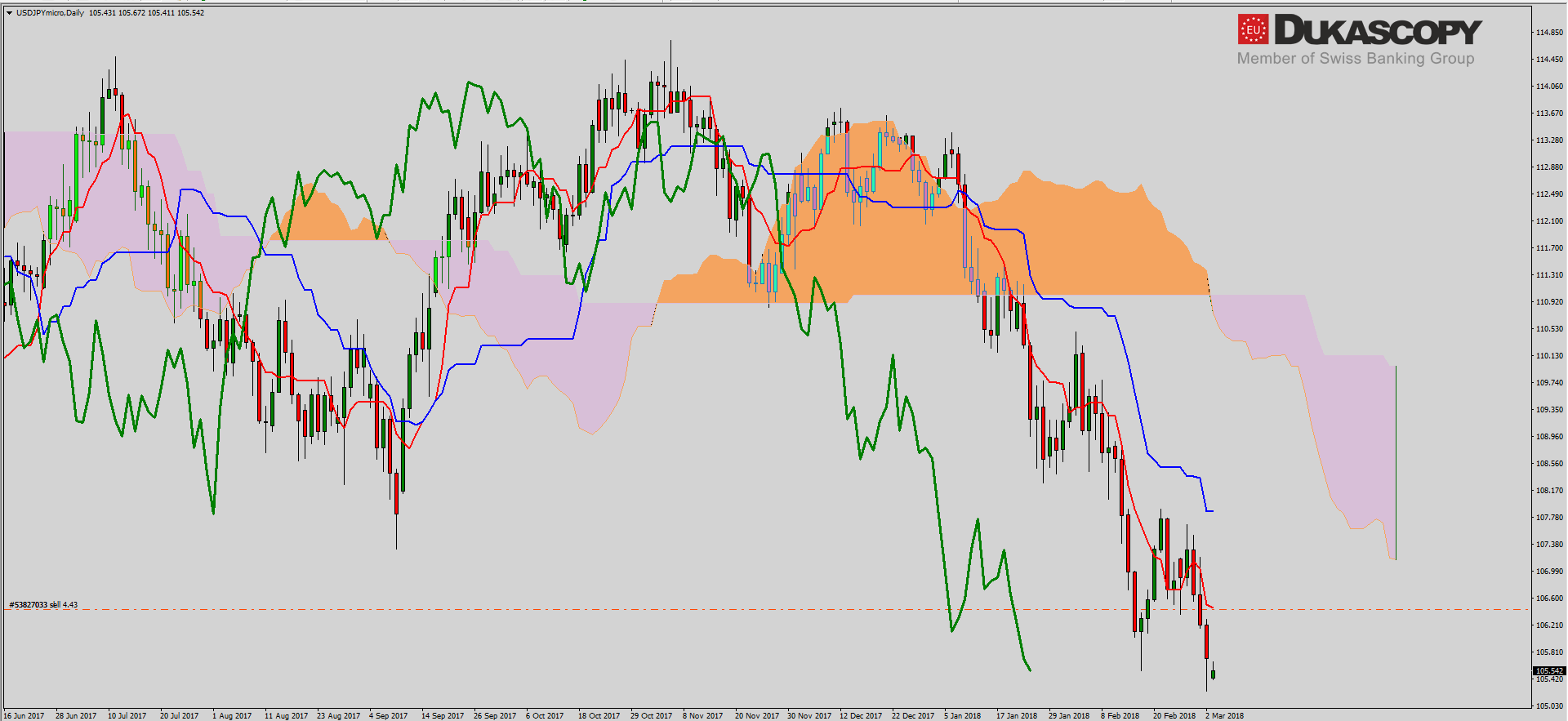

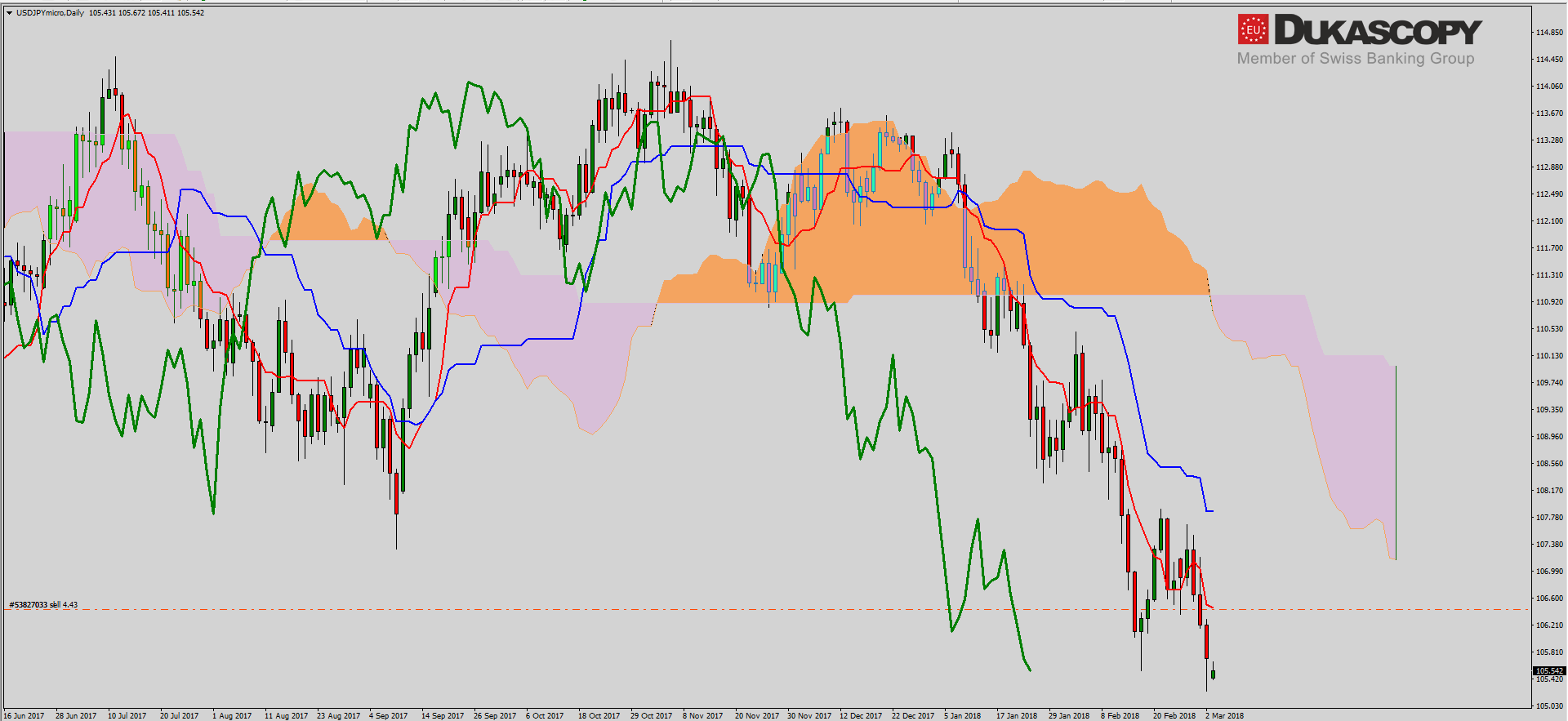

USD/JPY after rejection and re-test of the key resistance zone, again tests important support. Its defeating will open the way for further declines even towards the low from September 2016.

On the Ichimoku chart, we can see that all lines are arranged in a typical bearish way. After defeating the Tenakan line, the pair could move toward the distant Tenkan line. However, this did not happen and after a test from the bottom, the pair continued declines. One thing that interferes with the bearish arrangement of the line is the cloud, which is expanding more and more and this can mean the transition to greater consolidation.

On the Ichimoku chart, we can see that all lines are arranged in a typical bearish way. After defeating the Tenakan line, the pair could move toward the distant Tenkan line. However, this did not happen and after a test from the bottom, the pair continued declines. One thing that interferes with the bearish arrangement of the line is the cloud, which is expanding more and more and this can mean the transition to greater consolidation.