Welcome to weekly market overwiev, where we look for Price Action patterns and/or use Elliott Wave Theory.

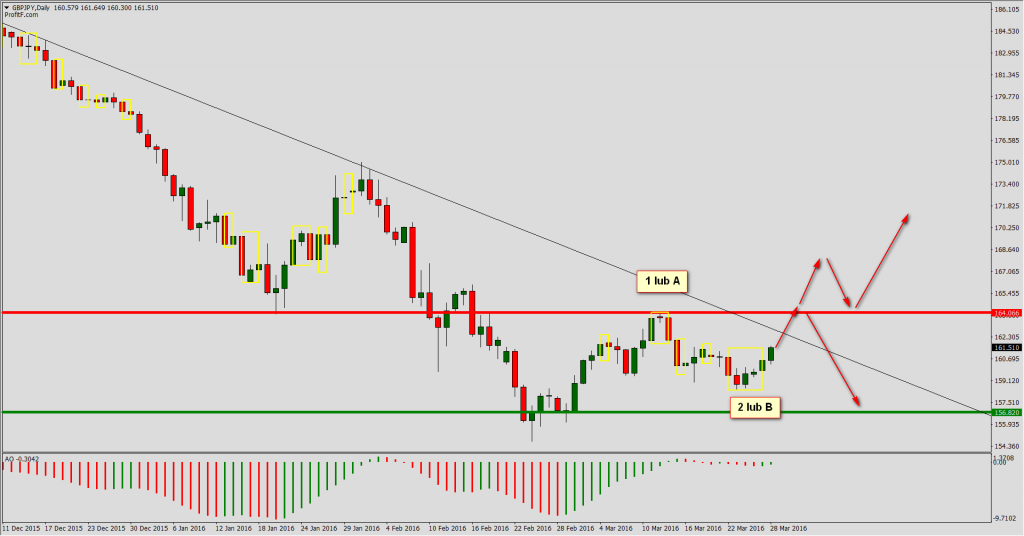

GBP/JPY

Pair is for longer time in bearish trend. I assumes that what we can see right now is a part of wave C of correction. We will know for sure in 164 area, where resistance area and high of wave 1A are located. Only breaking this level will change sentiment to 123 and will let us look for longs.

AUD/JPY

In case of this pair decreases lasting since November 2014 is finished bearish impulse. I have mixed feelings about taking this depreciation as an impulse because it is in channel.

This channel is very characteristic. This is why I will look for shorts in upper band area.

INVEST ON FOREX WITH FREE FXGROW ACCOUNT

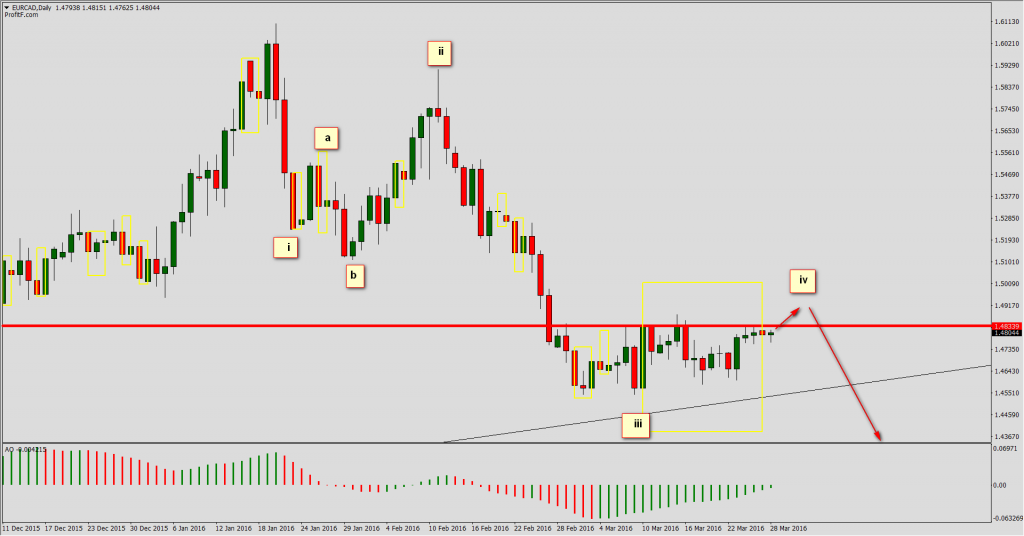

EUR/CAD

Pair is in correction for few weeks now. I assume this is fourth wave of this movement and we will see another drop in the fifth wave.

Good spot for looking shorts will be attack on March 10th high.

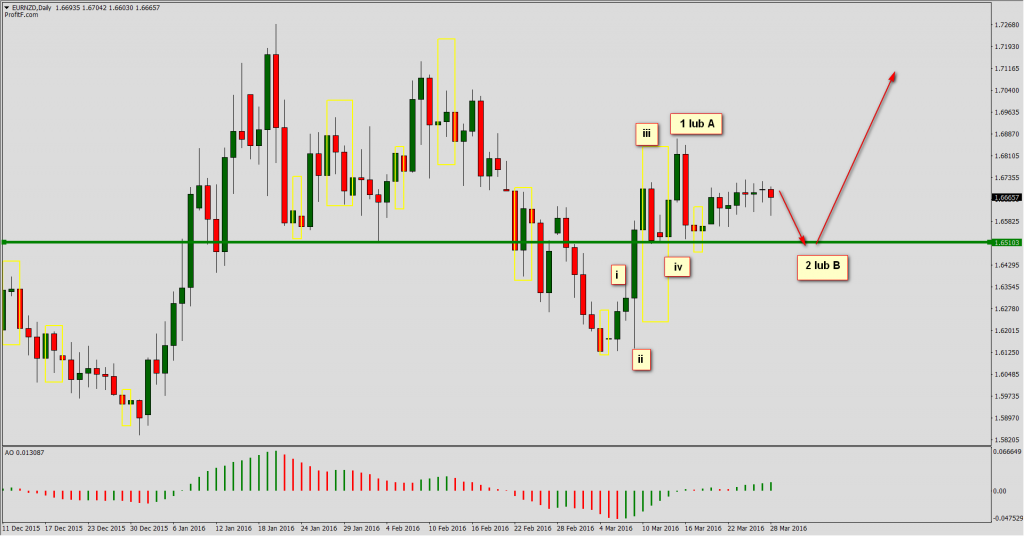

EUR/NZD

Last increase can be considered as 1A impulse. If it is true, current side movement should be its correction. Decrease to area of wave IV will be an opportunity to open longs.

EUR/AUD

Pair is consolidating for some time below resistance and it can be fourth wave 3c after which we will see another decrease below low set by wave 1A.