To begin with, a brief introduction on the reasons for the strengthening dollar. Yields on 10-year US Treasury bonds exceeded 4.63% once again today, the highest level since 2007. The reason is fears that interest rates will remain high for a long time, as mentioned by Kashkari ( a Fed member) in his speech yesterday.

Investors have also been keeping a close eye on the recent rise in oil prices and its potential impact on inflation, while fears of a government shutdown in the US are growing. Last week, the US national debt surpassed $33 trillion and the deadline for the 2024 budget deal passes on 1 October.

Investors will be closely watching Thursday’s comments from Fed Chairman Powell (around 10pm) and other policymakers for more clarity on the Fed’s plans for the rest of the year. The list of important data will include PCE inflation, which is the Fed’s preferred measure of inflation, its value will be known on Friday at 14:30.

As I believe that tonight’s Powell speech and Friday’s PCE data could move the dollar strongly, I prefer to focus on the crosses, i.e. the ‘no dollar’ pairs. Looking through the charts of pairs with the British pound, I noticed two interesting set-ups.

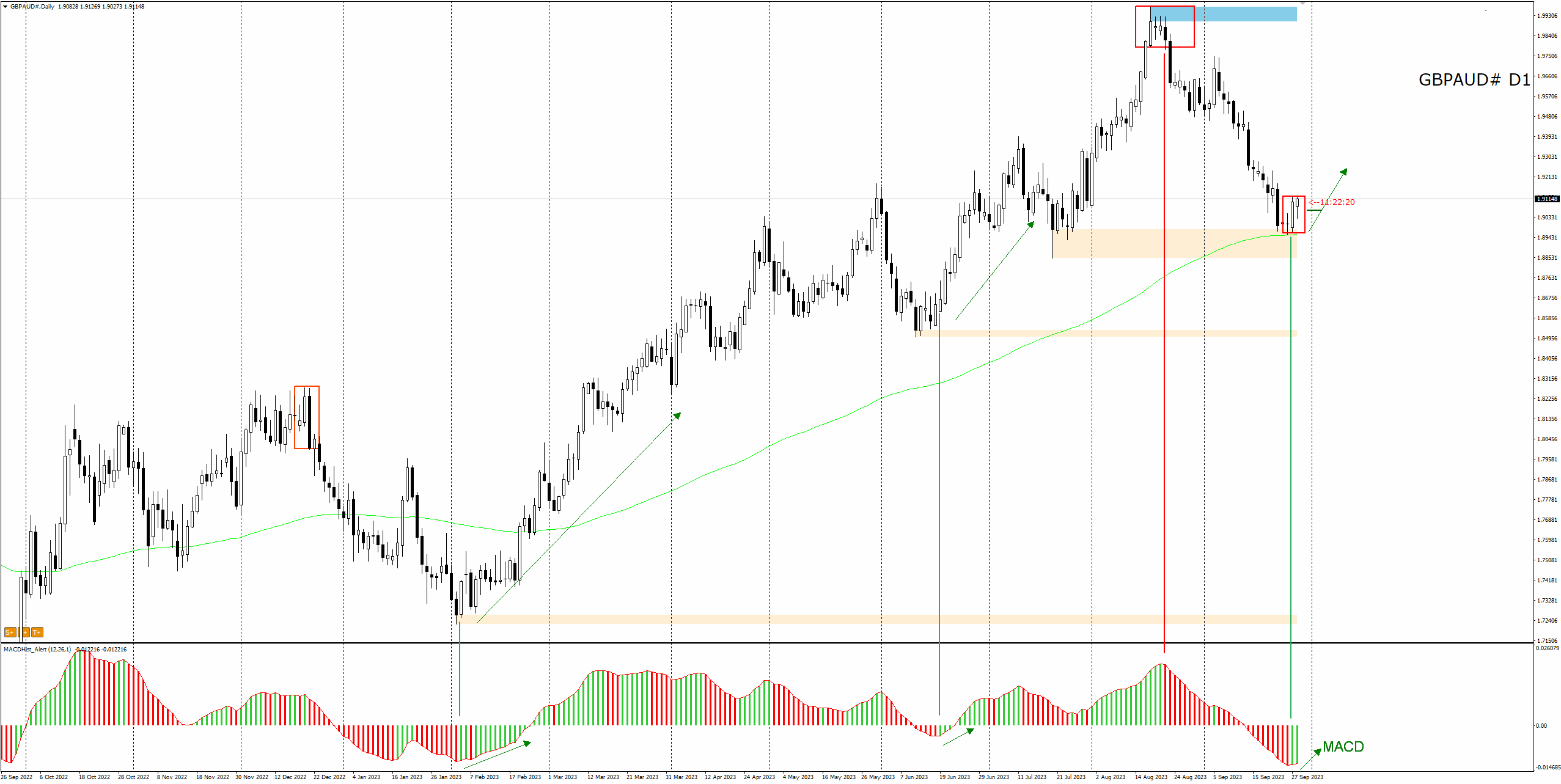

GBPAUD

The price of the GBPAUD pair reached the demand zone. The MACD entered an upward phase after a prolonged period of declines. A bullish engulfing formation has appeared on the chart. If you look at the historical chart, you will notice that usually when the MACD started to rise, upward swings appeared. We may just now have the beginning of another upward swing.

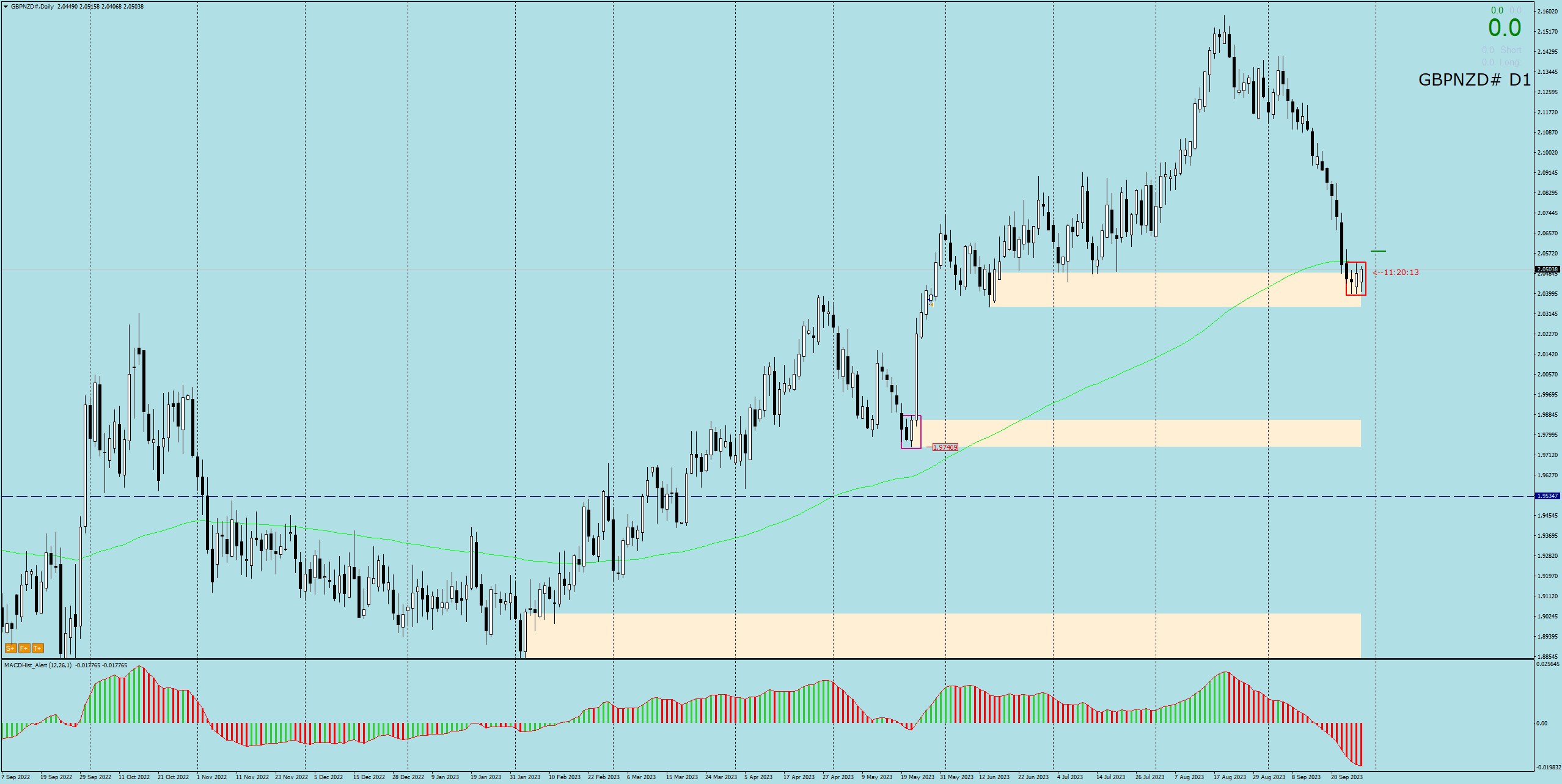

GBPNZD

The British pound-New Zealand dollar pair GBPNZD also promises a correction of the recent strong declines. A possible breakout of the bullish engulfing pattern is possible and if the MACD enters an upward phase, this could signal the beginning of an upward swing.

LIVE EDUCATION SESSIONS

This WEEK (25-30 September 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo