The currency pair (USD/JPY) of the U.S. dollar and the yen has been moving in an upward trend since early 2021. During this period, the yen has lost nearly 40% to the dollar. Analyzing this pair in early July, I looked for the reason for the yen’s weakening, and I will now quote some excerpts from that article.

This seems like a distant past, and it is so recent, just at the beginning of 2021 most developed economies were struggling with too low inflation. After a period of trials and mistakes, most central banks adopted a strategy to deal with this problem, which was to dampen the upward pressure on bond yields exerted by improving GDP growth. The assumption was that this would encourage a positive feedback loop between falling real incomes and rising spending.

Typically, an improvement in economic growth causes bond yields to rise. This is because the market expects the central bank to tighten monetary policy in response. In addition, an improved economic outlook causes investors to move from safe government bonds to riskier assets.

Is a weakening yen good or bad for growth?

To begin with, a little explanation of what YCC is. Yield Curve Control – stands for keeping government bond yields at a constant, usually low, level through appropriate monetary policy by the central bank.

The depreciation of the yen plays a key role in thinking about how long the Bank of Japan will be able to maintain the YCC. In theory, a weaker yen is an important monetary policy element through which the YCC can stimulate higher Japanese economic growth. As the Bank of Japan holds the Japanese bond yield curve steady, rising yields outside Japan cause the yen to depreciate, which stimulates Japan’s net exports and puts direct upward pressure on Japanese inflation through higher import prices.

Every stick has two ends

Weakening the yen too far could unexpectedly be counterproductive. On the positive side, it could help to perpetuate upward cost pressures, to the point where companies would have no choice but to raise the prices of their products. This would mean an increase in inflation expectations, which is probably exactly what the YCC is aiming for.

On the other hand, consumer confidence in the face of falling real incomes could fall, further reducing their willingness to spend. Moreover, businesses forced to cut production from lack of demand and faced with reduced profits and greater exchange rate uncertainty could react by reducing investment spending which is a straightforward path leading to recession.

All this means that the Bank of Japan increasingly appears to be put between a hammer and an anvil. Continuing to hold the YCC at 0.2-0.25% in the face of rising bond yields around the world could hurt the economy by rapidly depreciating the yen. However, an upward revision of the YCC also risks a sharp appreciation of the Japanese currency and a significant deterioration in export competitiveness.

The BoJ maintains bond yields by buying up debt securities on an intervention basis. In June alone, the BoJ bought them up for a record $81 billion. Thanks to this operation, yields on government bonds fell below the key level of 0.25 percent. By comparison, the European Central Bank, until May, under the APP program, bought $27 billion worth of debt on average per month.

Not whether, just… when?

At its April meeting, the Bank of Japan signalled its continued support for a continuation of the YCC, but this should not necessarily reassure investors. Experience and history with artificially maintaining fixed exchange rates shows that even despite assurances, the central bank can unexpectedly change its mind.How much longer?

At subsequent meetings, the Bank of Japan has signalled its continued support for a continuation of the YCC, but this should not necessarily reassure investors. Experience and history with artificially maintaining fixed exchange rates shows that even despite assurances, the central bank can unexpectedly change its mind. In the past week, the USDJPY rate reached 145 yen per US dollar. The last time such a rate was seen was in 1998.

There was news of a previously unscheduled meeting between representatives of the government and the Minister of Finance and members of the BoJ during which issues of excessive volatility in the yen exchange rate were raised.

No official announcement was made, but one of the participants in the meeting said that the BoJ could use extraordinary measures to stabilize the exchange rate and strengthen the yen at any time. The statement caused a slight strengthening of the yen, but analysts believe that the exchange rate may continue to move in the direction of 147 yen per USD, unless there is some real change in the BoJ’s monetary policy after verbal interventions.

A technical look at USDJPY

An inside bar formation appeared on the daily chart. The daily candle of September 7 established the maximum of the year, and the following day’s quotations were within its range. Today we could see a test of the formation from below. The price has currently returned to the formation and is 10p above its minimum. A downward signal appeared on the MACD, which may suggest a continuation of the correction of the recent strong increases.

On the H1 chart, we can mark the upward channel ( downward flag), from which the price broke out from the bottom today. A good place to take a Sell position may be the supply zone ( blue) starting at 143.20, which has already turned the price south once today.

LIVE EDUCATION SESSIONS

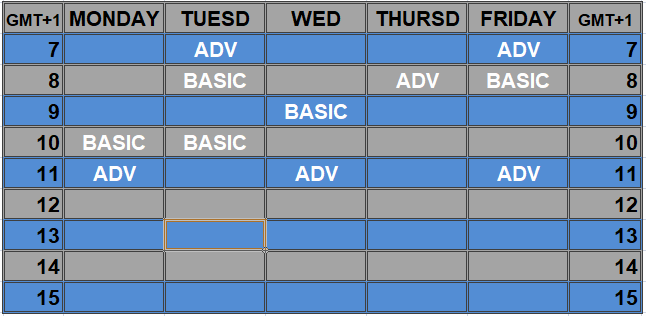

This month I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo