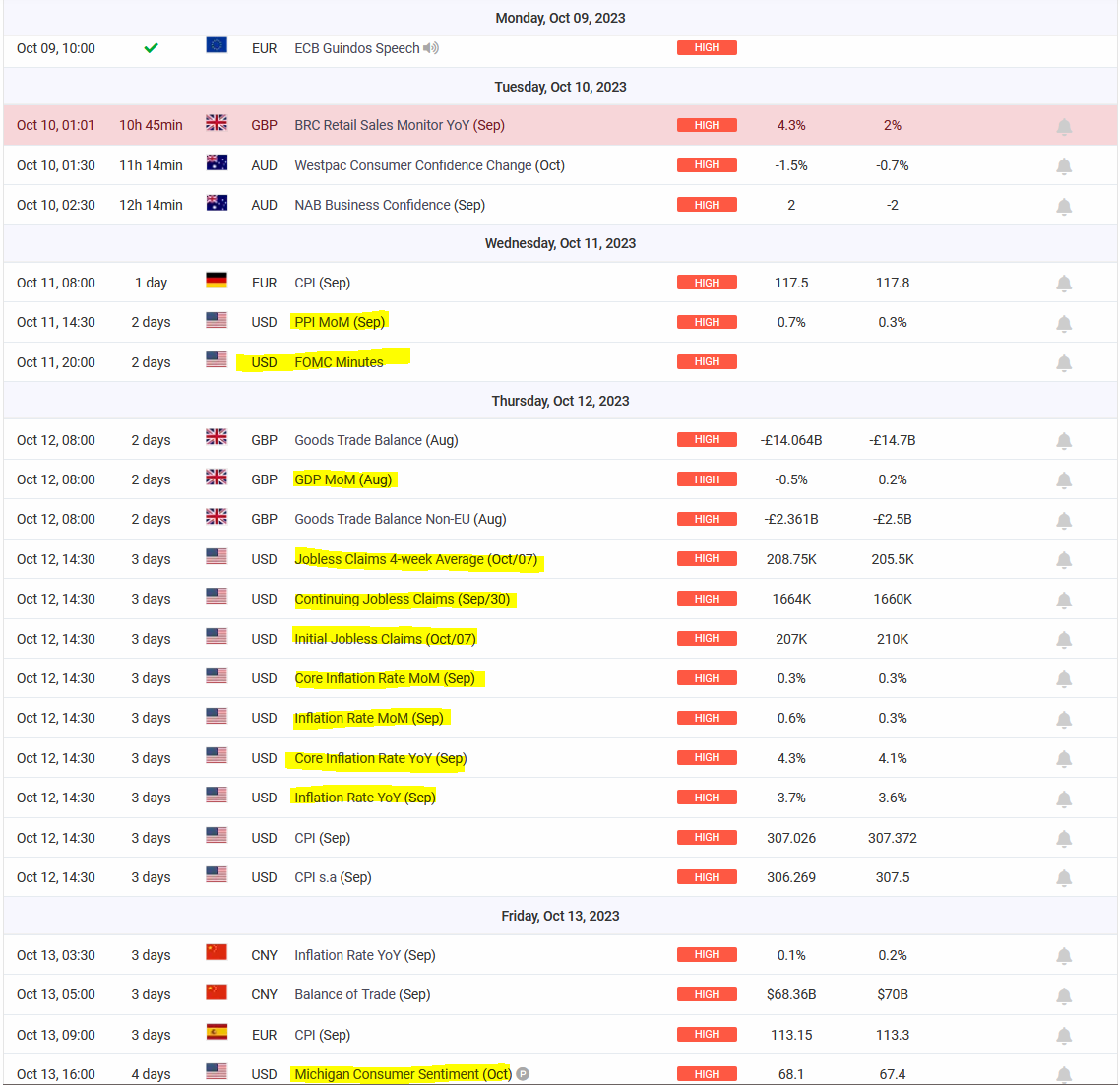

This week is not full of important economic events, but caution will certainly need to be taken on Wednesday at 19:00 – we will learn the minutes of the Fed meeting from 2 weeks ago. The next day of the week that could bring more volatility is Thursday, 12 October. There will be some data from the UK, GDP will be particularly worth looking at. It is expected to come in at 2% y/y. If the readings turn out to be worse, it could be a sign of weakness in the UK economy and weaken the pound.

Also on Thursday, we will hear a lot of data from the US – the labour market will be represented by new jobless claims data, among others. The state of the labour market is closely watched by the Fed when making decisions affecting monetary policy. The next Fed meeting will take place on 1 November. But even more important in my opinion will be the inflation readings. This indicator is of fundamental importance for the Fed. Inflation is expected to fall from 3.7 to 3.6% y/y.

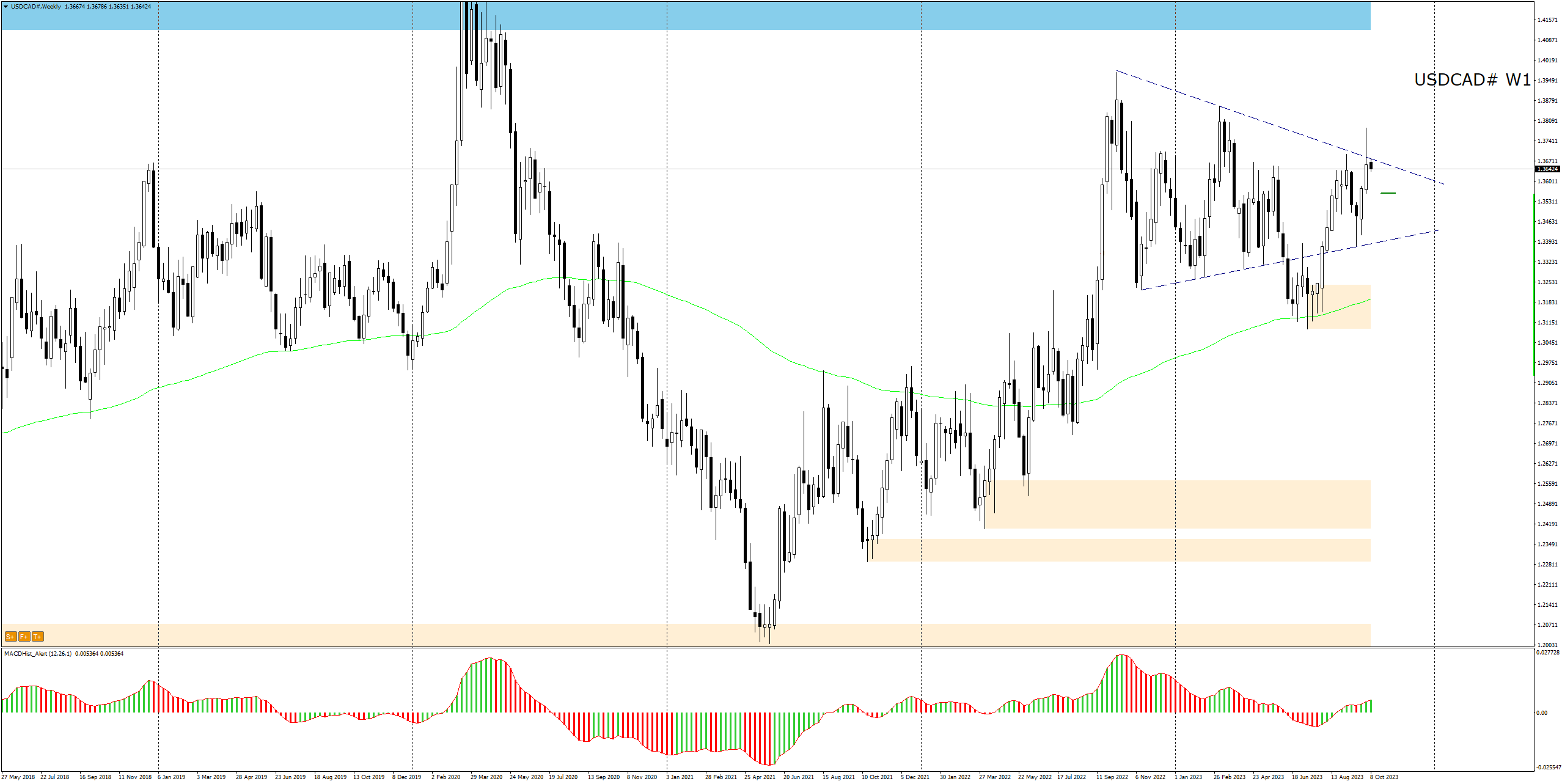

USDCAD – Symmetrical triangle on the weekly chart

On the weekly chart, the price has drawn an equilateral triangle. This is a form of consolidation with a declining range. Last week, the price broke out of the formation at the top, but Friday’s session closed below the triangle’s resistance, suggesting that this may have been a false breakout.

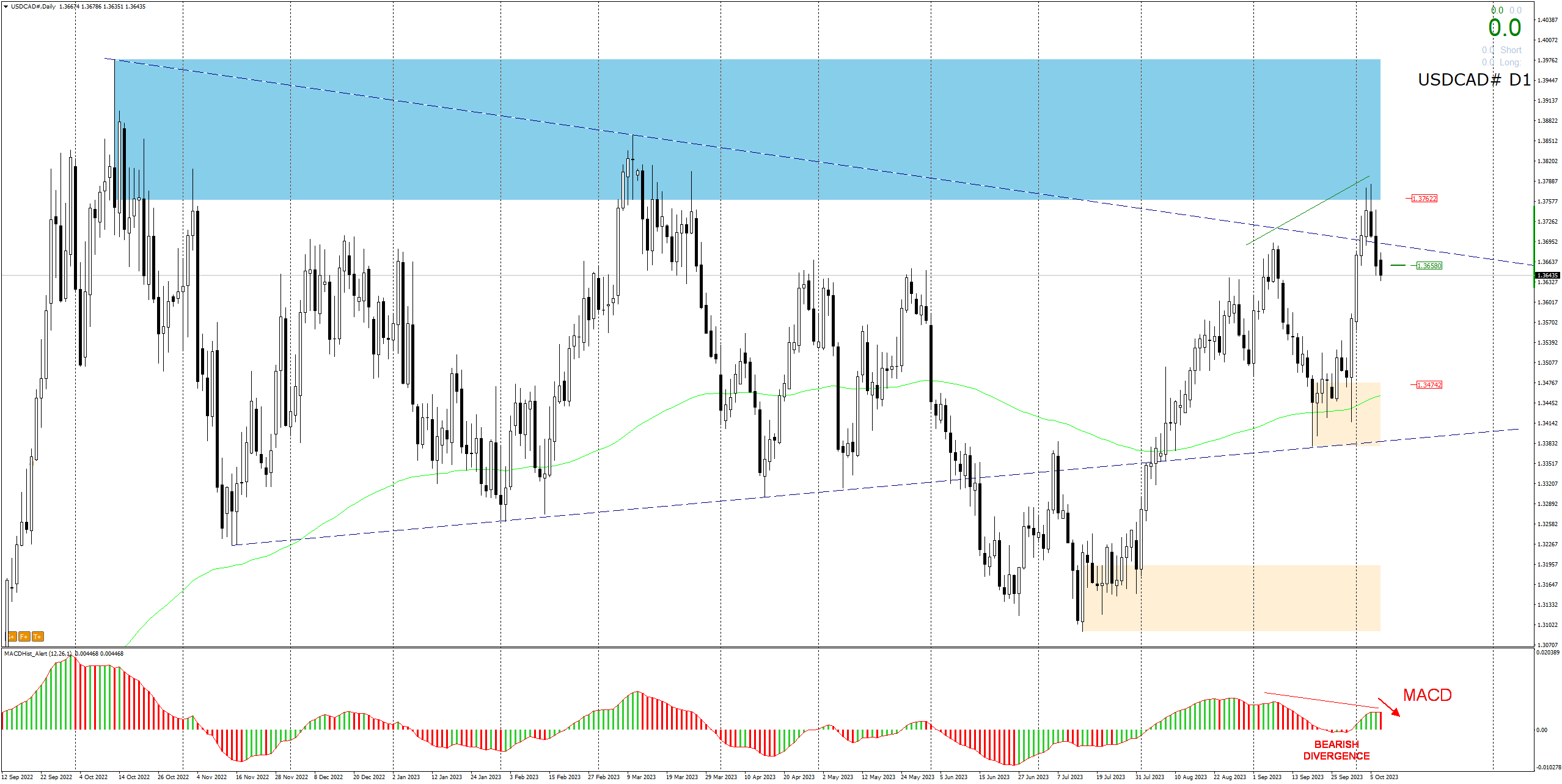

USDCAD daily chart. The falling MACD indicates the start of a downward divergence. If the price stays below 1.3658 until the end of the session, this could be a signal for further declines, with Friday’s (6.10) breakout proving to be a false breakout. The supply target could turn out to be the demand zone at 1.3475.

LIVE EDUCATION SESSIONS

This WEEK (09-13 October 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo