Selling EUR/USD is obvious for those who stays on market daily. But some of traders may don’t know (is there anyone like that?) why EUR/USD is keep falling. Citi had created a short commentary why you really should keep shorts on EUR/USD.

Selling EUR/USD is obvious for those who stays on market daily. But some of traders may don’t know (is there anyone like that?) why EUR/USD is keep falling. Citi had created a short commentary why you really should keep shorts on EUR/USD.

Market forecasts

Forecasts of future monetary policy of Fed and EBC runs this downtrend on EUR/USD. Traders are almost sure, that Americans are actually going to hike this time, and so far this scenario is in play, so far EUR/USD is going to drown.

Differences between policies

Fed is going to hike, we’re almost sure about that. But also, market is ready for another round of QE in Europe. This divergence will make this trend even more solid.

Economy factors

Inflation level in Europe is still pretty far from EBC’s target, also last data from eurozone doesn’t look like help at all. But in America, we’ve seen solid gains in jobs report, and CPI is pretty satysfying. These factors makes differences between policies even clearer.

Macroeconomics

China slowdown is definitely threat to Europe rather than US. Biggest economy in eurozone – Germany, may have problem with its economic activity when China’s consumers won’t show demand. Also weaker yuan is probably get USD to outperform next few months.

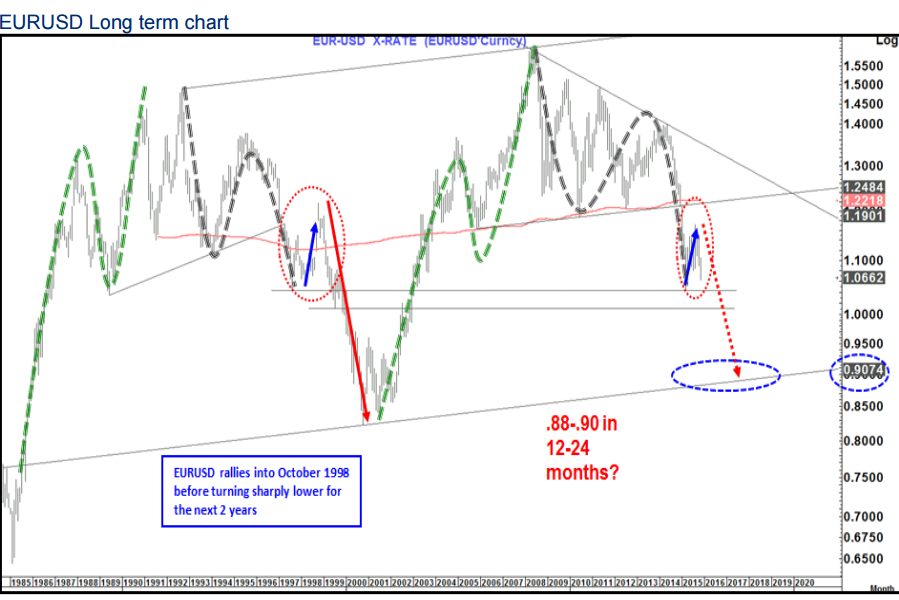

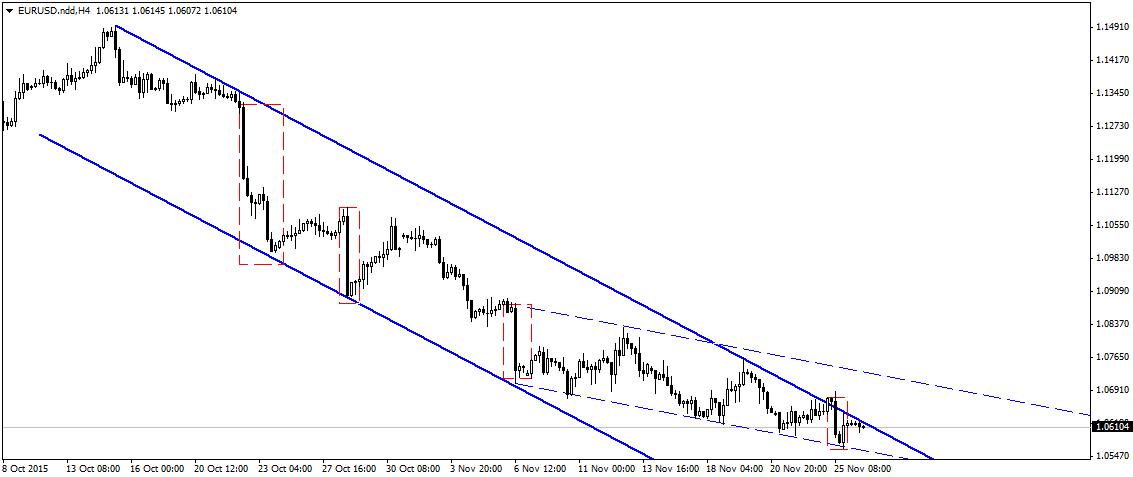

Technical

Analysts from Citi convince that current price action is simmilar to that seen in late ’90. Period of 1998-1999 was also period of growing policy divergence between Fed and eurozone. That’s why getting through March lows will be important event.