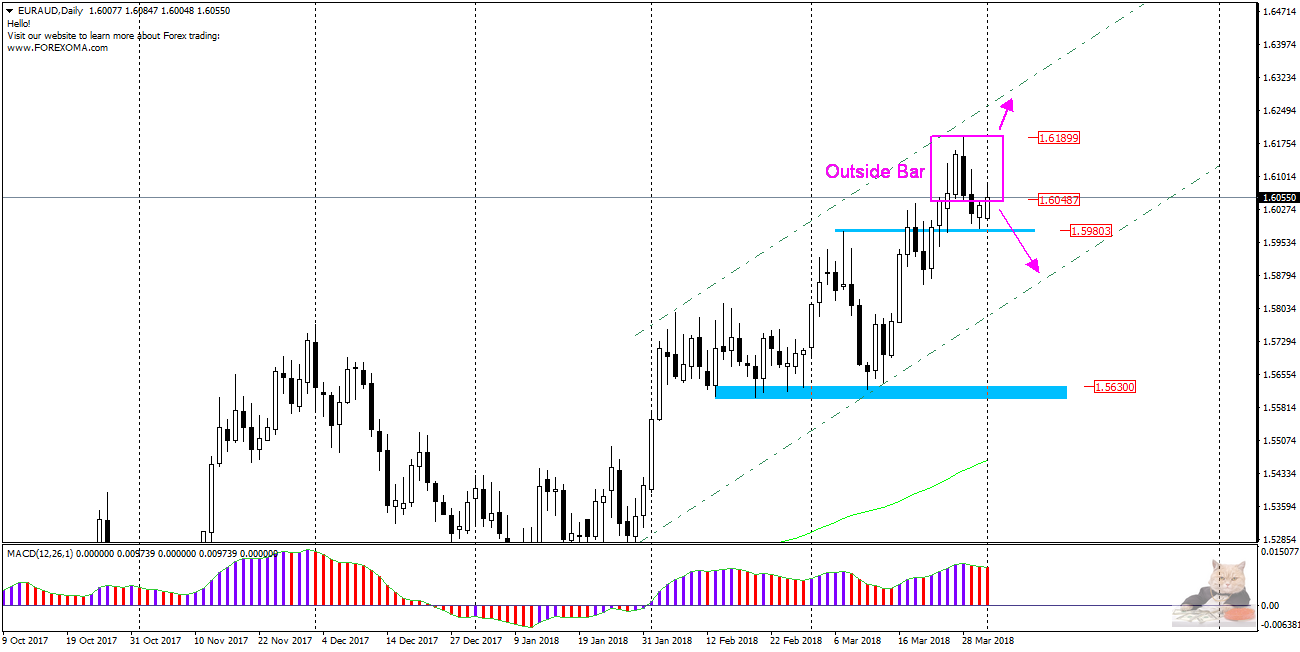

EURAUD – in the previous analysis (29/03) I described the formation of the Bear Market (Outside Bar), which as a typical bearish formation pointing to declines.

The predictions proved correct, the price left the formation thru the bottom and reached the level of the nearest local support of 1.5980 (the blue zone). According to the previous analysis, the price on the support turned back and returned to the outside bar, testing its lower limit along the way, where currently (at 00:10) it is located.

On chart H4 I drew the probable price behavior during the next sessions. If the bearish scenario is met, the price behavior in the 1.5980 support zone may determine the fate of this pair. Overcoming this level can open the way to the next support (1.5900) and then to the bottom limit of the growth channel in which the pair moves from the beginning of the year. Re-rejection of this level may signal a return to increases or to longer consolidation.

We should also take into account today’s macro data – at 6:30 the Australian Reserve Bank (RBA) will issue information regarding interest rates and a statement on monetary policy for the coming weeks.