Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

EURCHF

On the H4 chart we can see how great bullish trend line works. Today in the morning there was another rebound from this line. If there will be any bearish correction, and the price will stop near upper band of Kumo, we can think about opening long position on this pair.

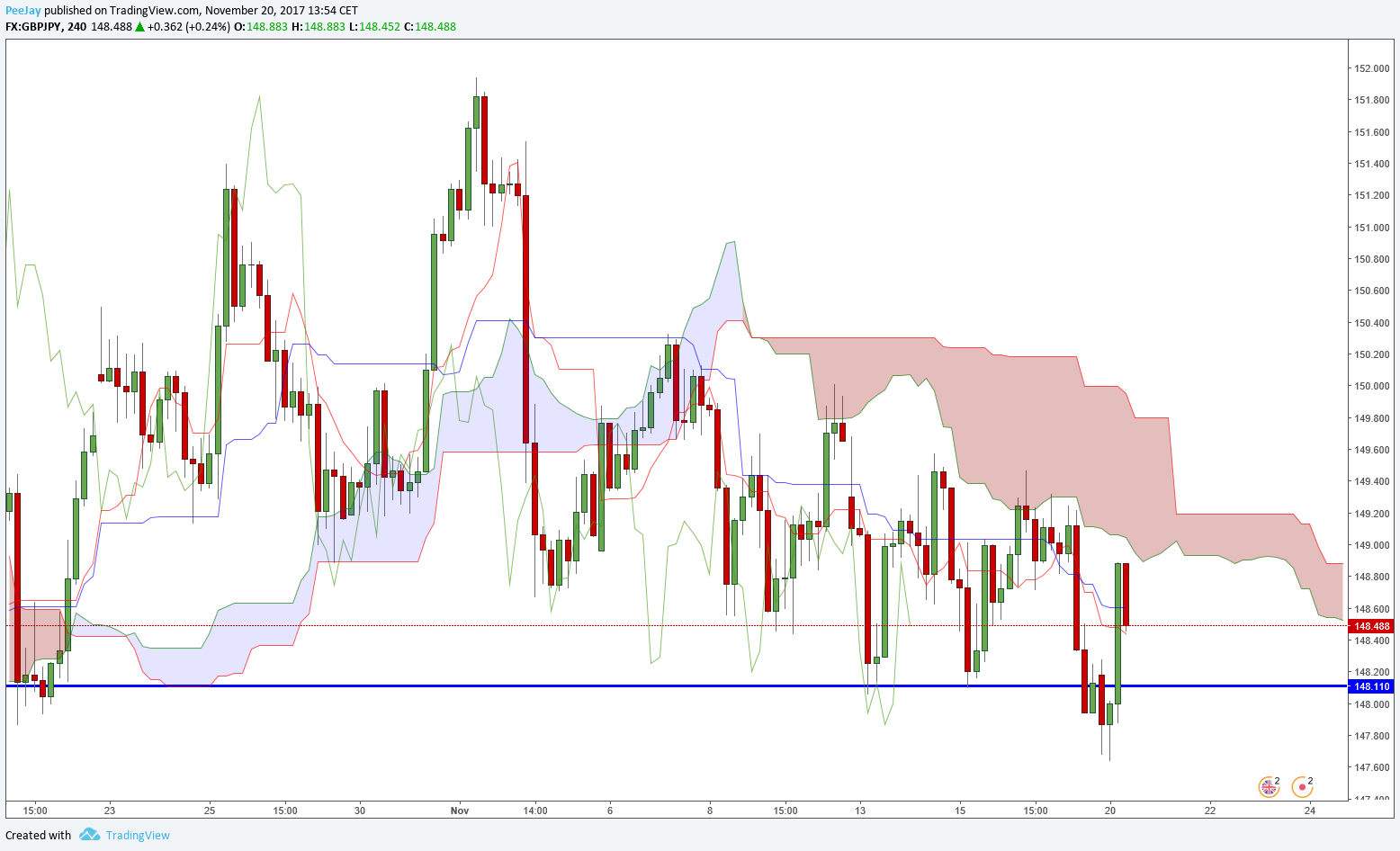

GBPJPY

Perfect example of cloud working as a resistance in a bearish trend. GBPJPY is gradually decreasing, however we can see strong price swings. During last few days Senkou Span A stopped gains three times. Unfortunately, we cannot open shorts before the break of important support from the daily chart. Only after permanent break of this level we can think about opening position.

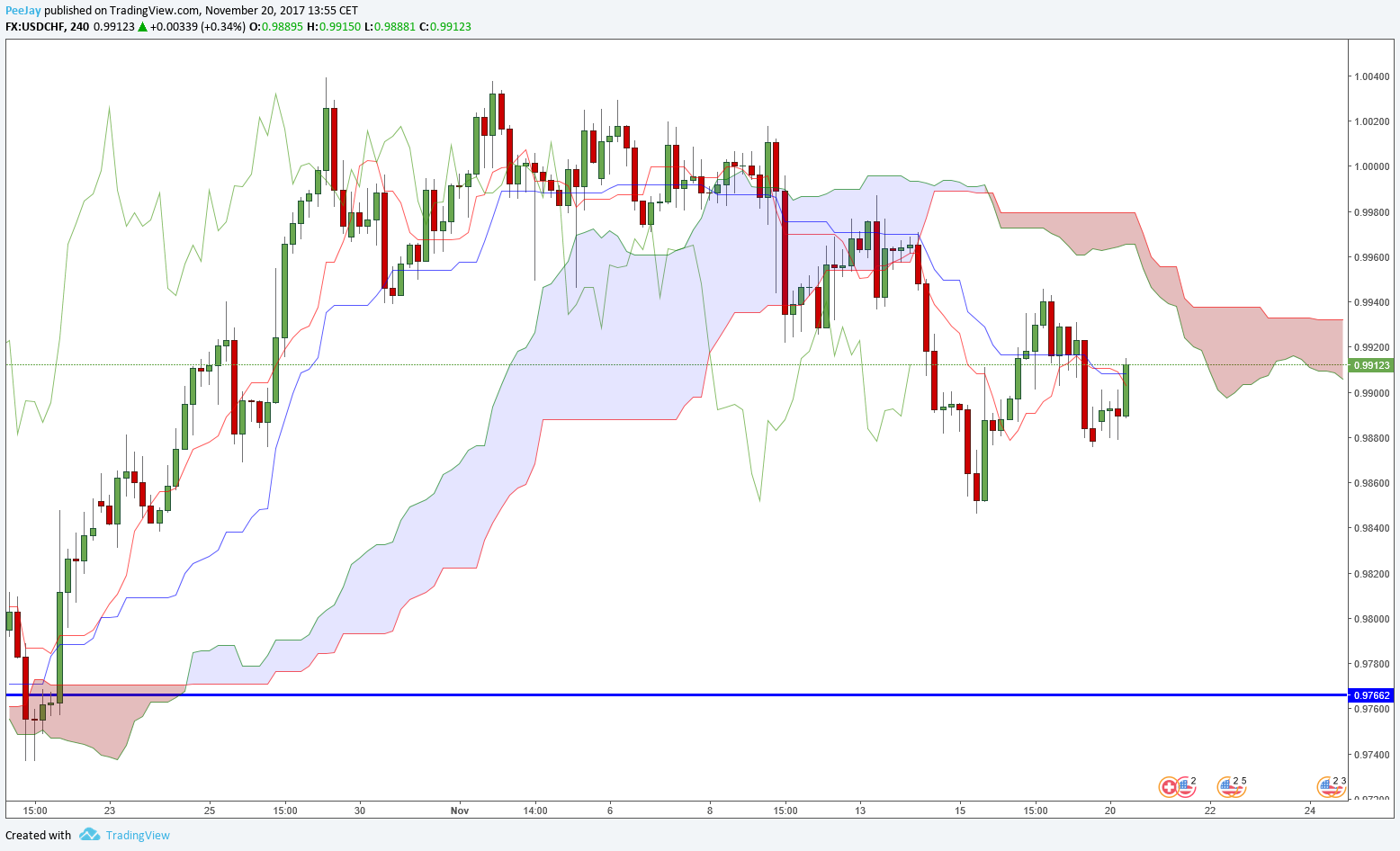

USDCHF

Sell signal showed up on this pair. Tenkan line crossed Kijun-sen from above. Possibility to open short was confirmed by Chikou Span. Stop Loss can be small, just above last high. Take Profit is about 150 pips lower. I opened the positions with 24opiton broker, which offers really low spreads and great trading conditions.