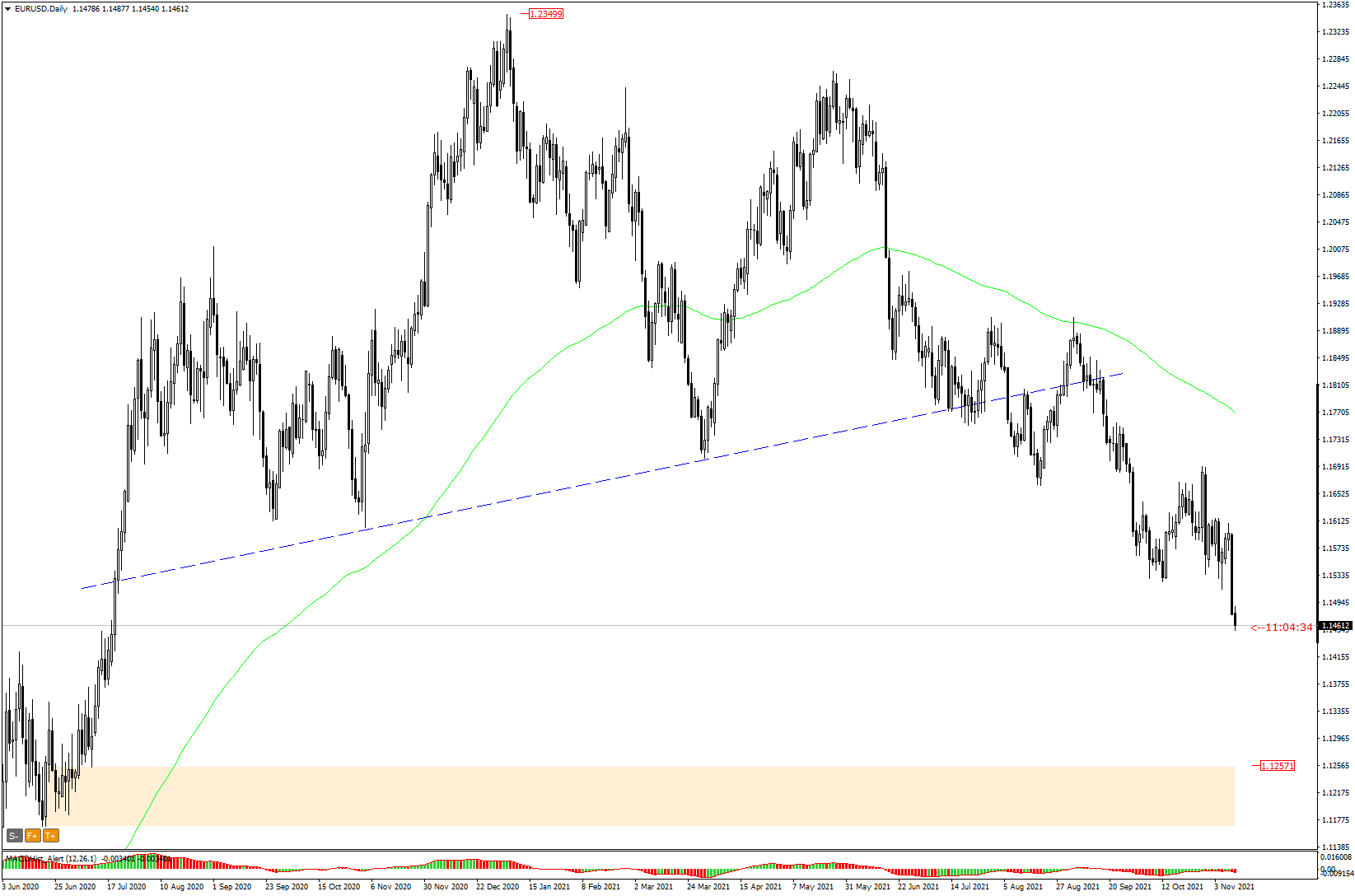

US inflation is likely to skyrocket in the coming months. Here are five reasons why Nordea economists believe the rise in inflation will also continue in 2022. Inflationary pressures are building up, so economists expect the Fed to raise rates several times in 2022 and 2023, respectively, and the ECB once in 2023. As a result, the dollar is likely to outperform its rivals, with the EUR/USD pair falling in the region of 1.08.

- US inflation likely to skyrocket in coming months

- The Fed will raise rates three times in 2022 and 2023 respectively, and the ECB only once in 2023

- The EUR/USD currency pair will fall to 1.08 at the end of 2022.

Five reasons why inflation will continue to rise in the US – Nordea

Broad wage growth leads to higher median prices

– Broad wage growth typically moves to higher median CPI with a lag of 6-9 months, which is likely to lead to higher median prices in 2022. This is exactly the type of inflation the Fed fears most.

Used car prices are rising again

– Used car prices have started to rise again and we may see further price increases in line with our model.

Rental prices are picking up

– Our model predicts rent prices to rise at an annualised rate of just under 6%

Energy feedback loop to food prices

– There is a negative feedback loop in food prices as higher energy prices lead to higher fertiliser prices and ultimately higher crop and food prices in general. The energy crisis is far from over as Russia is still not supplying gas through the Mallnow station on the German-Polish border.

Restrictions prolong supply problems

– Restriction orders continue to distort Nonfarm reports in the US as well. This is causing wage inflation, while restrictions in Europe and the US will keep consumption of goods higher compared to services, a key reason for supply chain problems.

Dollar (USD) exchange rate overshadowed by hawkish Fed – Nordea

As inflationary pressures build, Nordea economists expect the Fed to raise rates three times in 2022 and 2023 respectively, and the ECB only once in 2023. As such, the dollar is likely to outperform its competitors.

– Our new forecast of six 25bp rate hikes by the Fed and one 25bp rate hike by the ECB by the end of 2023 obviously has implications for the entire bond curve. Given our views on the ECB and the Fed, we stick to our long-held view that relative policy divergence should lead to a stronger dollar against the euro. Our target is a EUR/USD exchange rate of 1.08 at the end of 2022. – wrote the report.

Moreover, the dollar often tends to perform well when growth slows, as USD liquidity through global trade flows is reduced from a momentum perspective – the Fed’s monetary tightening is also moving in the same direction.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo