Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

I wanted to write that the situation on the charts didn’t change and there are no many signals. I wanted to mention situation on ERUGBP where short order was not yet activated. However, Bank of England decision caused opening of position and after a dozen minutes it was earning twice three times the size of SL. More details below.

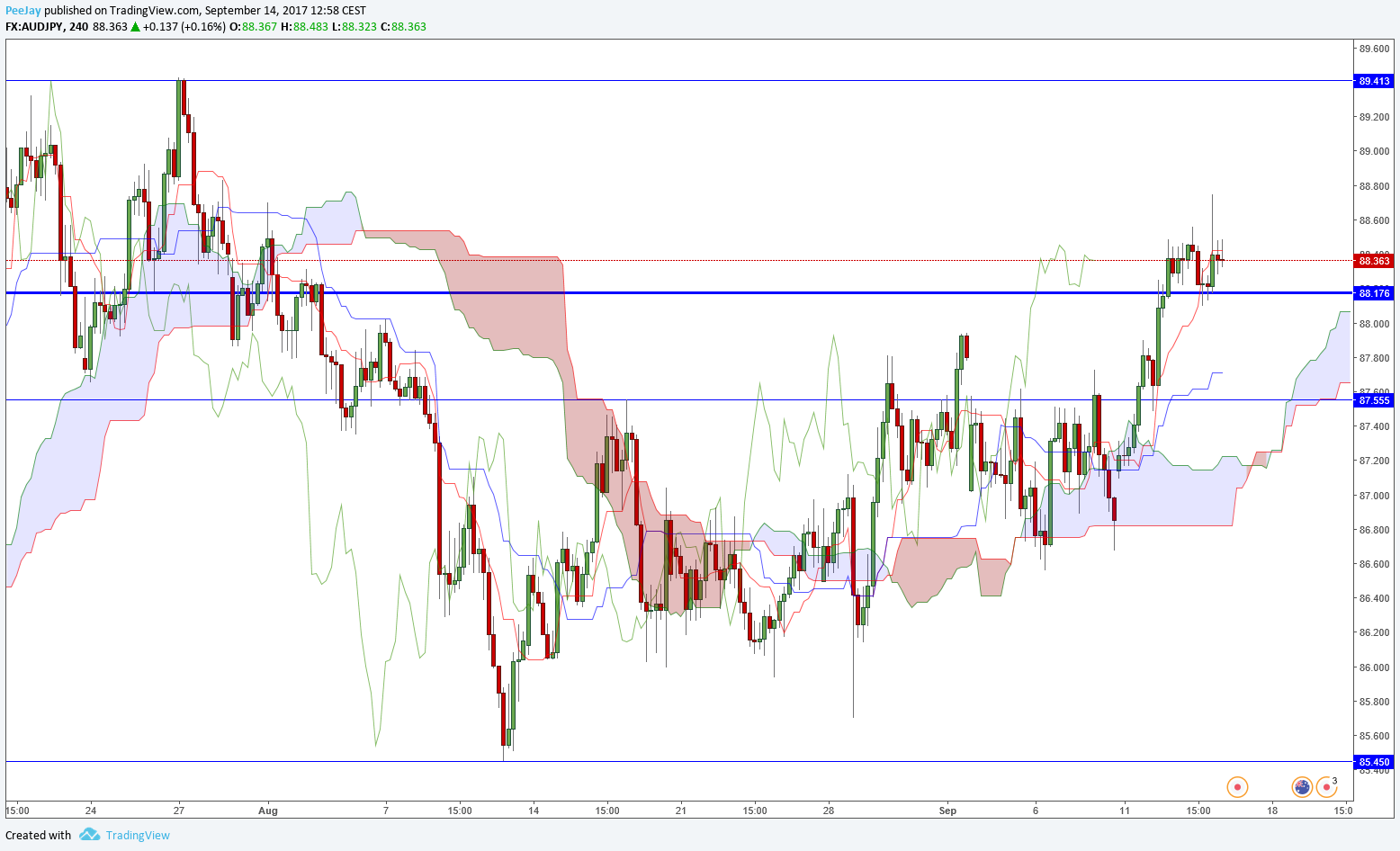

AUDJPY

Lately there was a break of daily resistance in the 88.20 area. Sentiment is bullish, Tenkan line is way above Kijun and the cloud supports gains. You can open long position with the target on another resistance in 89.40 area. I already have opened position on Australian dollar, so I will stay away.

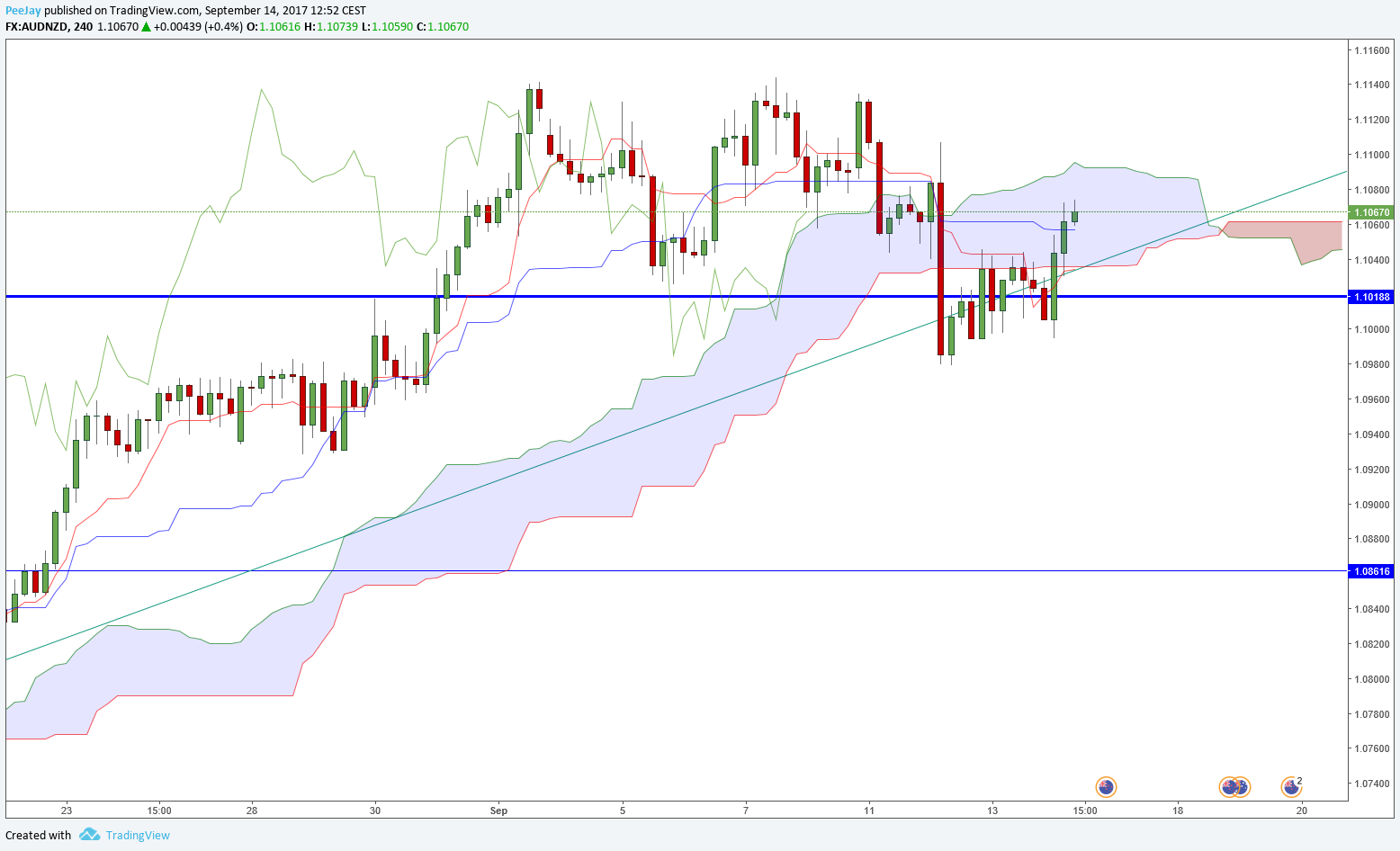

AUDNZD

This is my position opened for two weeks now. Price came back above support from daily chart and the bullish trend line, it started bringing profit again. If the appreciation should be continued, the price need to break above local resistance at 1.1140.

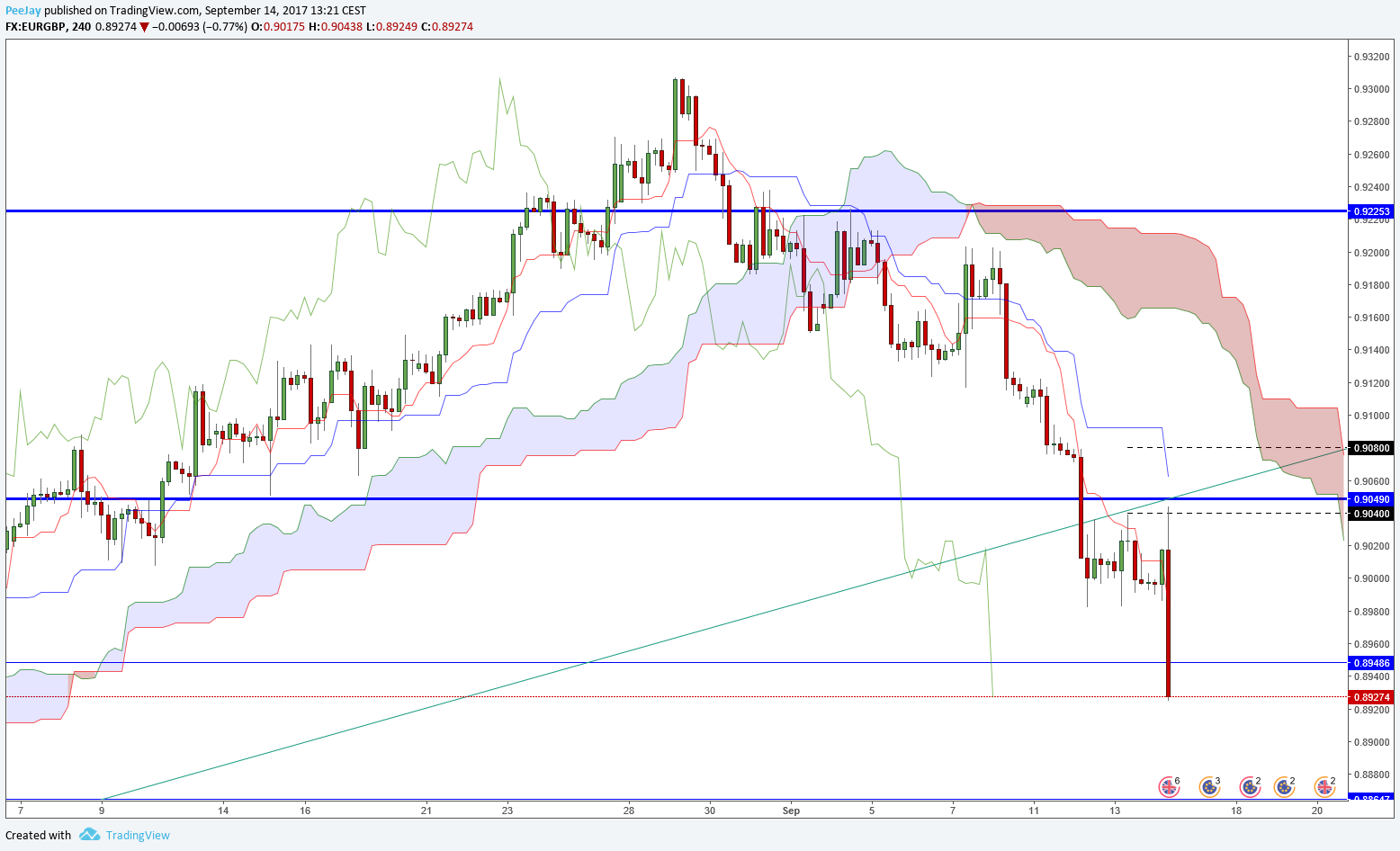

EURGBP

Yesterday I wrote about sell signal on this pair. I decided to open sell limit order, which after Bank of England decision was activated (dotted lines show the place where I entered and the Stop Loss). Below you can see the third screenshot of this chart, previous ones were outdated in a flash. Currently the price brings profit of 3x SL.

I moved SL to BE, so if the sentiment will change, in worst case I’ll end up break even. The volatility on this pair can be huge in hours ahead. There is still a long way to the Take Profit, I set it in the area of daily support on 0.8800. I opened this position with 24option broker, which offers exceptionally small spreads.