USDCHF 11.02.2019

USDCHF – with a strong strike the quotations of this pair started, 5 minutes after the opening of the market the pair reached the level of 1,100, i.e. 100p higher than Friday’s closing. This is the second such flash crash this year, the previous one was observed on the night of January 2/3 on japanese Yen, this one also happened at a time of very low liquidity, when Asian markets are basically not yet open, there are only working the markets in Australia and New Zealand, and in addition Tokyo has a holiday today. In a very short time, after just half an hour, the quotations returned to the level from Friday’s closing.

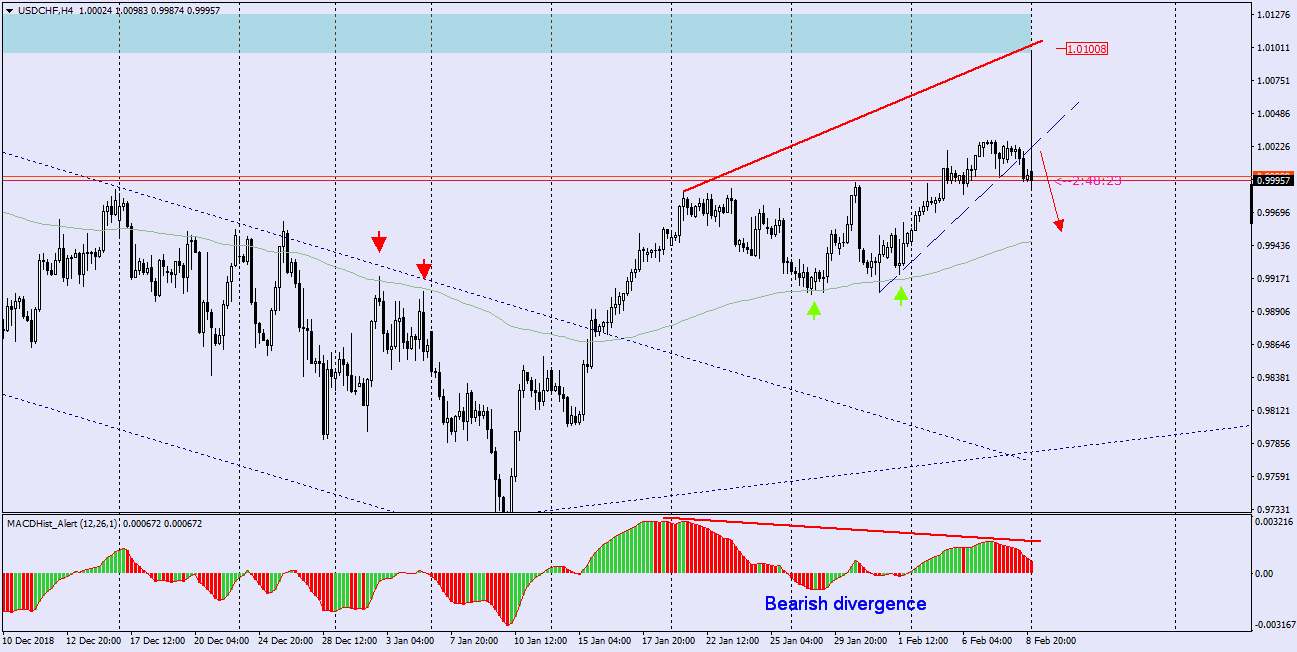

Since last week there was a big imbalance between sellers and buyers (93%/7%), we can say that it was a stop loss hunting. On the technical side, the H4 divergence indicates that we can expect drops, the nearest horizontal demand zone starts at 0.9930 some 80p lower than at present and it may be the first target for sellers. The average EMA144, which has recently been a dynamic resistance and has become strong support after defeat, maybe a certain obstacle to the price.

Join us in our new group for serious traders, get fresh analyses and educational stuff here: https://www.facebook.com/groups/328412937935363/