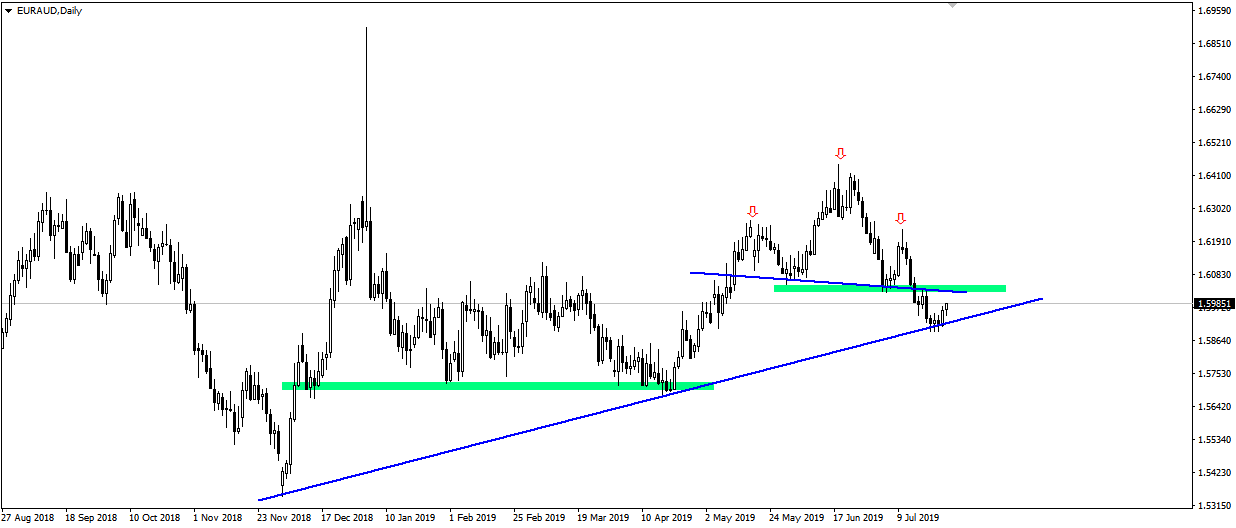

The situation on the EUR/AUD pair on the daily chart is interesting. During Wednesday’s session there was a rebound from the well respected trend line starting in December 2018. The price has been falling continuously since mid-June and now it seems that there is a chance for a correction. The chart also shows a large inverted head and shoulders. If the correction were to take place, the price could go back to the recently broken neck line. It seems that with a small correction, the downward trend may continue and the trend line may break.

Why this assumption? It is worth remembering that a meeting of the European Central Bank will be held today. Yesterday, data on PMI for industry and services, both for the euro area and for the German economy, were very poor. The data were surprisingly weak, it seems that it increases the chances of interest rate cuts or at least the announcement of such a step in the future, which may translate into weakness of the European currency, and thus into decreases and breaking the trend line in the chart.