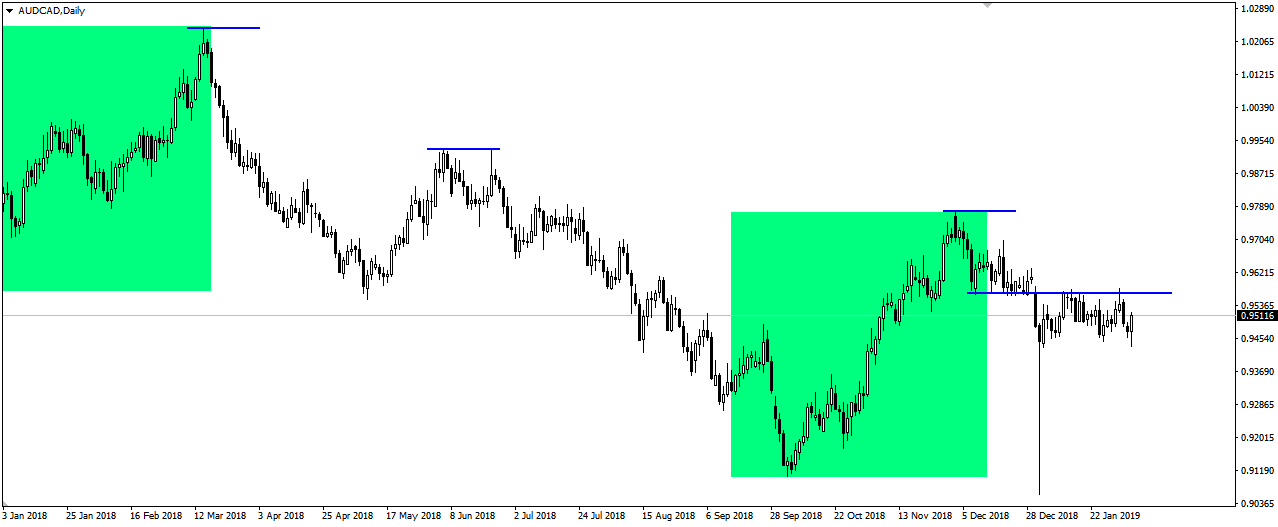

AUD/CAD pair quotations indicate a downward trend since the beginning of 2017. An interesting phenomenon is a fact that despite their dynamics, the appearing corrections have a rather similar range. This was the case in October and November, when the upward trend reached almost the same range as at the beginning of last year. The pattern of lower and lower peaks confirms the downward trend. Currently, there is a rebound from the local resistance around 0.9570 and it seems that the price may fall to lower levels.

I trade on this instrument at broker XM, which has in its offer more than 300 other assets >>

From a fundamental point of view, we have recently seen very weak data from the Australian real estate market, as well as further poor readings from China. What supports the Canadian currency is the oil price, which has clearly recovered some of the falls of the previous year. Despite the fact that the increase in the price of this raw material is not dynamic, there is still no stronger supply reaction. Perhaps positive markets assess the prospects for a sustained rebound, e.g. the reduction in oil production in OPEC countries. Saudi Arabia and several of its allies decided to cut production in December. Economic problems, e.g. in Venezuela, also cause the production of crude oil to decline automatically. After the end, at least temporarily, of the shutdown of administration in the USA, the publication of CFTC reports, which show the behaviour of institutional investors on the raw materials market, was also resumed. The last report showed an increase in long positions on oil quotations. All these factors may indirectly support Canada’s currency, which will allow for continued declines in AUD/CAD.