Exactly at 9:30 GMT we got to know the most recent data from the UK primarily concerning industrial production in November last year. Investors focused on the negative information arising from the report of the trade balance – deficit deepened in international trade and negatively affects the valuation of GBP.

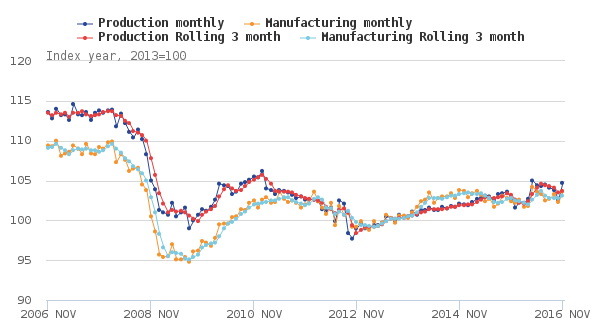

Starting with more pleasant parts of today’s publication, we will discuss November change in the level of industrial production in UK. These data proved to be surprisingly positive and indicator on a monthly basis rose to 2.1% against a forecast of 0.8%. Also, the annual rate of change should be read positively – November’s change of 2% continues the upward trend in industrial production (despite the mishaps that took place in October). According to the ONS, the increase in production in November 2015 is mainly due to better situation in mining and quarrying.

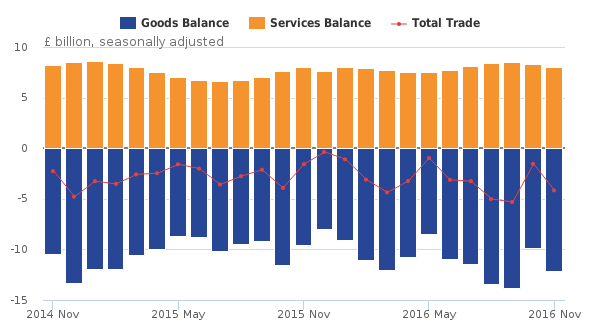

Definitely worse presents British trade balance. In November, the trade deficit in the UK widened more than forecast assumed it. Ratio is found this time at -12.16 billion GBP, the market consensus assumed increase in the deficit to just 11.2 billion GBP.

Worse is also balance with countries outside the European Union. Instead of the expected three billions pounds, the trade deficit of United Kingdom amounted to 3.58 billion GBP.

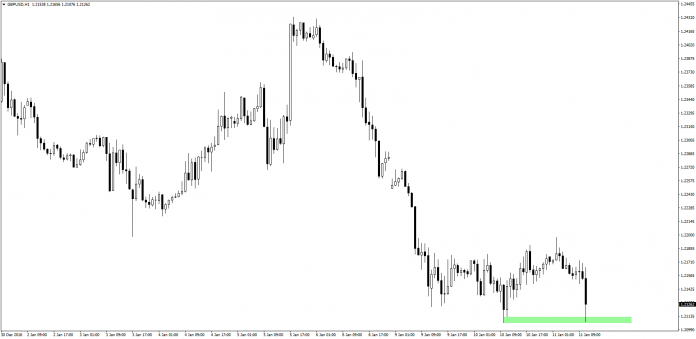

The market reaction to the latest data is clearly bearish, the pound lost to most of the major currencies:

GBP/USD

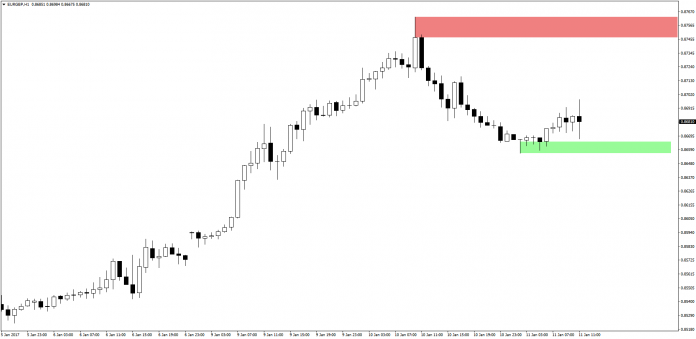

EUR/GBP