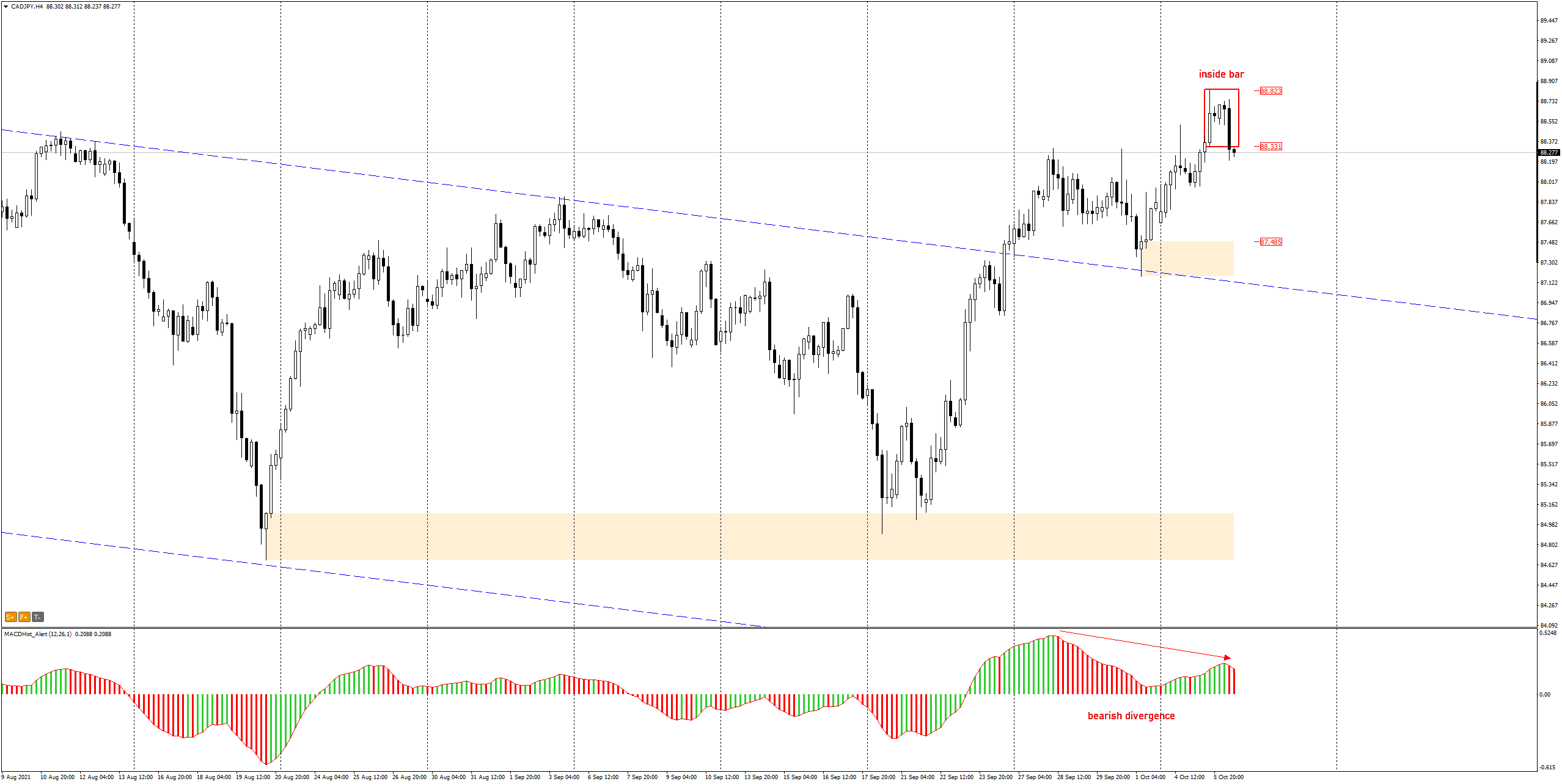

The quotations of the currency pair CADJPY in mid-September this year fell to the demand zone formed a month earlier.

- Inside bar on the highs

- Downward divergence on H4

After the unsuccessful attempt to overcome the zones, the demand directed the price north. On the way, the price overcame the resistance of the downward channel in which the price was moving since July this year. Yesterday, the price reached the level of 88.40 and at the end of the day began to fall.

Subsequent candles on the H4 chart were within the range of yesterday’s forming an inside bar formation. Currently (06.10 11:00) the price broke out of the formation downwards. On the MACD oscillator the maximum appeared and the histogram indicates declines (red). In addition, a downward divergence appeared. All conditions for the PA+MACD strategy to take a SELL position are fulfilled. The demand zone starting at the level of 87.50 can be a supply target. Overcoming the maximum inside bar will negate the downward scenario.

I recommend a description of the strategy used for this analysis:PA+MACD

ongoing actual analysis https://t.me/TradewithDargo

Today, Wednesday, 13:00 GMT+1 – live trading session here: https://www.xm.com/live-player/basic

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo