We expect the BoJ to maintain its current monetary policy following meetings today and tomorrow. Our economist pointed out the lack of a need for a policy change as inflation remains a long way from the 2% target and the long-term rate has fallen to 0%.

We expect the BoJ to maintain its current monetary policy following meetings today and tomorrow. Our economist pointed out the lack of a need for a policy change as inflation remains a long way from the 2% target and the long-term rate has fallen to 0%.

We think the pace of JGB purchases will slow at some point, but expect the BoJ to leave unchanged the statement that the pace will remain ¥80trn per year. Although forex is not in the BoJ’s jurisdiction, with the USD/JPY not fully free of the recent downward correction, we think the BoJ will be careful to avoid language that would prompt speculation on it rolling back monetary easing.

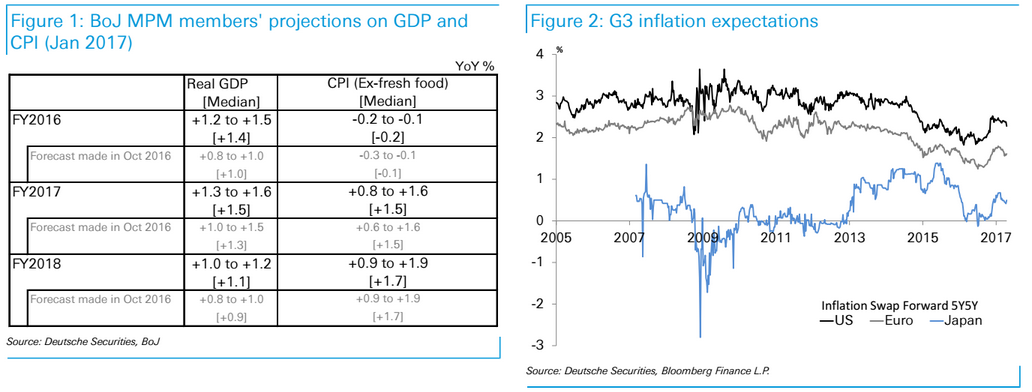

The BoJ will also release its outlook report at the same time. Our economist expects it to lower its FY2017 core inflation forecast from 1.5% to 1.3%, but also thinks it could slightly upgrade its economic outlook.

We do not think the current monetary policy meeting will especially impact the yen market. That said, we do think that the BoJ will choose its words carefully to avoid harming the recent USD/JPY recovery that has only just brought the rate back to the 110 level after a correction in April.

We do not expect BoJ policy to drive a rise in the USD/JPY, but expect it to continue offering support. With the Trump administration realizing some of its policies and the US economy growing stronger, we see the Fed raising rates twice more this year and the USD/JPY firming up in the 110-115 range and trying to rise even higher.