Recent days have seen a renewed concentration of positive news. Fed Chair Janet Yellen’s recent hawkish comments made market participants refocus on the strength of the US economy and the potential for another hike in December 2017 and three in 2018.

Recent days have seen a renewed concentration of positive news. Fed Chair Janet Yellen’s recent hawkish comments made market participants refocus on the strength of the US economy and the potential for another hike in December 2017 and three in 2018.

The Trump administration and Republican Party also announced tax-cut proposals centering on a 20% corporate tax rate. These caused the dollar to rebound versus major currencies including EUR, CND, AUD, and RMB, and dollar-yen also recovered to 112-113s. Yellen’s expectations are virtually in line with our own, and we maintain our view that if they prove accurate, dollar-yen should head to above 115.

However, in the near term we think the market will continue to be ruled by risk and uncertainty. Some US economic indicators set to be announced in the coming weeks, including nonfarm payrolls, can weaken due to hurricane damage. The Trump administration indicates that it will finalize its choice for the next Fed chair by mid-October. The proposed tax cuts will likely face numerous obstacles to adoption. We also believe that East Asian geopolitical risk will continue to act as a cap on USD/JPY.

Get similar commentaries daily with FxWatcher service>>>

In Japan, the focus is on the 22 October Lower House election. The election will be a contest between the incumbent LDP and Komeito alliance and the Party of Hope, an assemblage of the major opposition parties. The market now feels that it cannot entirely discount even the risk of Abe stepping down. The Party of Hope has yet to officially announce either specific economic policies or candidates, and it is therefore too early to attempt a detailed comparison with the LDP. Moreover, the two parties harbor the potential not just for a battle between incumbent and opposition; a conservative grand alliance is not out of the question. Uncertainty is growing in the Japanese political landscape.

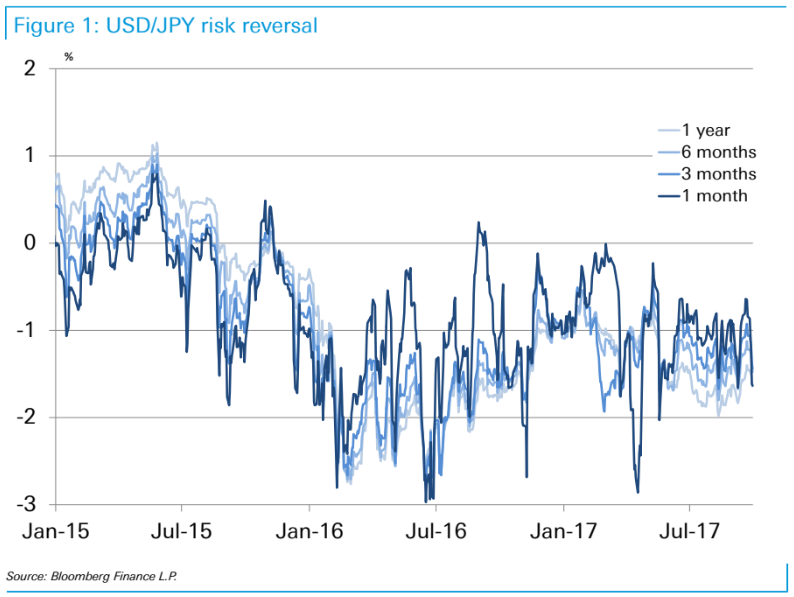

However, dollar-yen has not shown any significant negative reaction to the above political risks. Bearish reactions to geopolitical risk have become more limited, perhaps because the market has become acclimated to North Korea’s military provocations. Accordingly, we think USD/JPY is likely to remain jittery (with the options market somewhat cautious about yen appreciation) in a range centering on the low 110s in October. We maintain our outlook for a rise in USD/JPY over the medium term. If news flow confirms attempts by the US and North Korea to reach a diplomatic solution, USD/JPY would likely head toward the high 110s, backed by strong US fundamentals.

However, dollar-yen has not shown any significant negative reaction to the above political risks. Bearish reactions to geopolitical risk have become more limited, perhaps because the market has become acclimated to North Korea’s military provocations. Accordingly, we think USD/JPY is likely to remain jittery (with the options market somewhat cautious about yen appreciation) in a range centering on the low 110s in October. We maintain our outlook for a rise in USD/JPY over the medium term. If news flow confirms attempts by the US and North Korea to reach a diplomatic solution, USD/JPY would likely head toward the high 110s, backed by strong US fundamentals.