The beginning of the second week of June did not provide much excitement, volatility was low. Perhaps, at least to some extent, this was influenced by the Whitsun celebrations in the Scandinavian countries and Switzerland. The economic calendar was also poor in events – none deserved more than one “bull”.

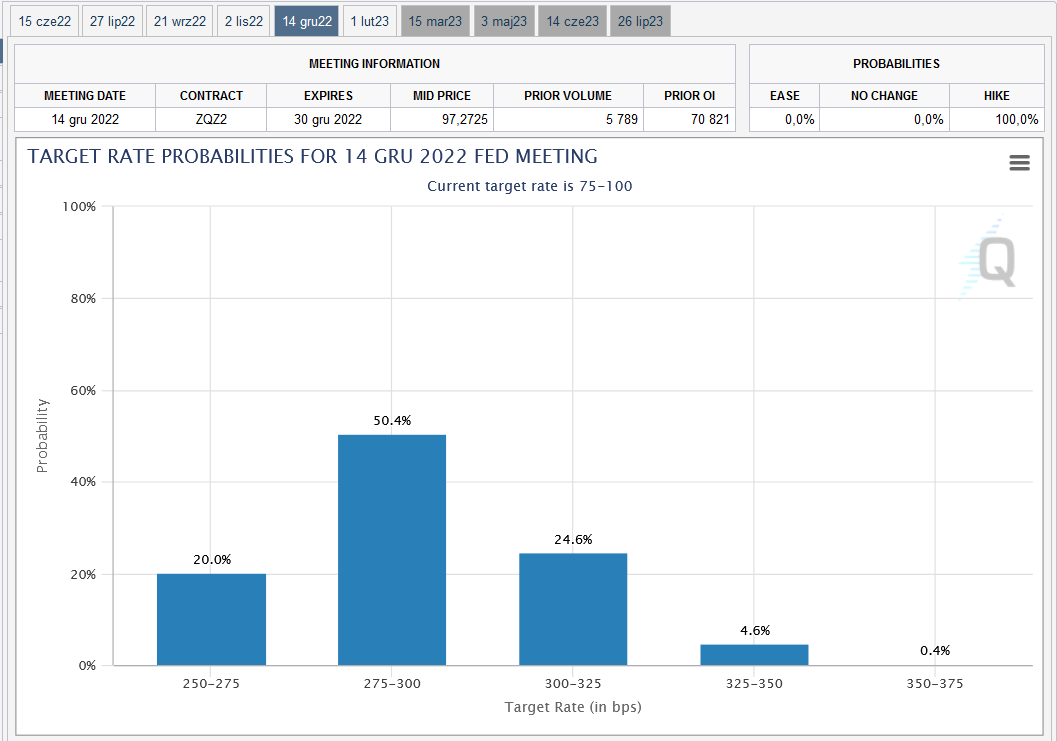

In mid-June, on the 15th to be precise, we will know the level of interest rates in the USA. Expectations are at +1.50 bps and there is little evidence to suggest otherwise. By the end of 2022, the Fed is targeting interest rates of 2.75-3.0%%. For the past few days, we have noticed that 10-year US bonds are getting cheaper and their yields are approaching 3% which entails a weakening of the yen strongly correlated with the US10Y.

The USD/JPY exchange rate is again approaching this year’s maximum. If this trend continues in the long term, the dollar may soon cost around 135 yen.

Overall, it promises that pairs with the yen in the near term will continue to move in the directions set in May.

Today, looking for instruments that would provide an opportunity to open a position with a high probability of winning, I paid attention to the pair of European currencies EUR/GBP.

The pair has been moving in a broad consolidation for quite some time. Today’s daily candle covers with its range the Friday’s one creating the bullish engulfment. The MACD is currently pointing south.

On the H4 chart the price is approaching the local uptrend line. If the price overcomes this support and at the same time breaks out of the bearish embrace formation it could be a signal for declines towards the nearest supply zones 0.85 and the next 0.8450. Here also the MACD is downward and a downward divergence appeared.

LIVE TRADING SESSIONS- FREE ENTRY

I invite you to my – Tuesday’s, 7th of JUne at 08:00-09:00 GMT +1 (London time) live trading session here: https://www.xm.com/live-player/basic

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo