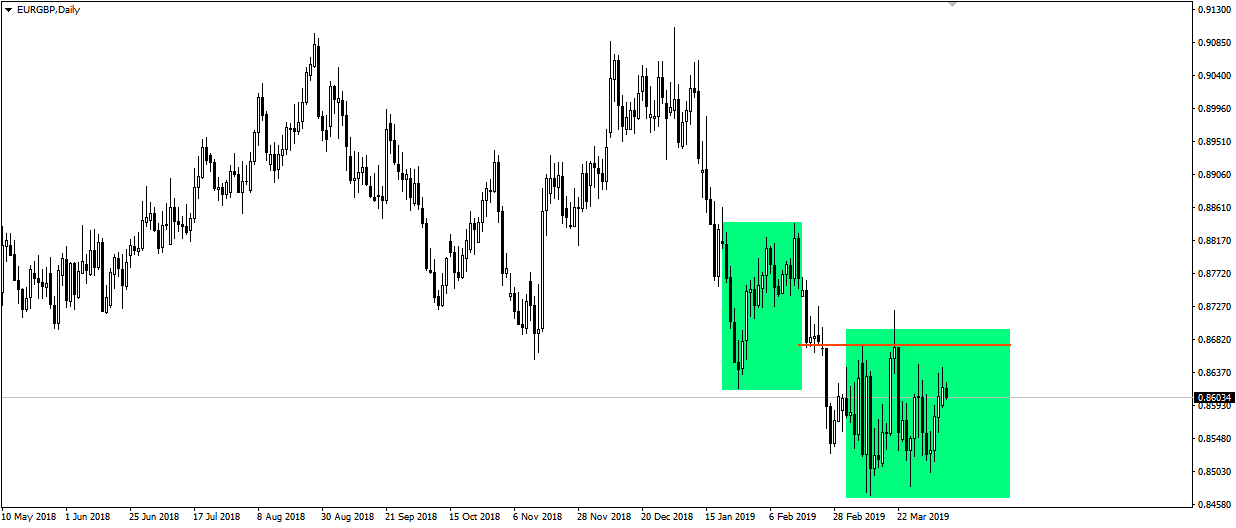

The EUR/GBP daily chart shows the consolidation process since the beginning of March. Interestingly, the consolidation is almost identical in scope to the previous correction in the downward trend since the beginning of the year. It seems interesting for speculators to see extreme levels of consolidation, such as the resistance around 0.8680. At the moment, it seems that this is where the exchange rate is heading.

The euro is strengthening despite the often weak economic data, especially from Germany. It seems that perhaps a lot of this is already being valued at the moment, hence the recent strengthening of the European currency. If we look at the calendar, the increase in the direction of resistance could have its final on Wednesday. Then we have the EU summit on Brexit, at which there will probably be new reports, for example on whether to accept or reject the proposal to extend the Brexit to 30 June. Prime Minister May recently assured the United Kingdom that it would leave the EU with an agreement or would not leave at all. It seems, therefore, that there may be some positive reports for the Pound. If the price is then close to resistance and the upper range of consolidation, it is possible that there will be an interesting transaction opportunity.