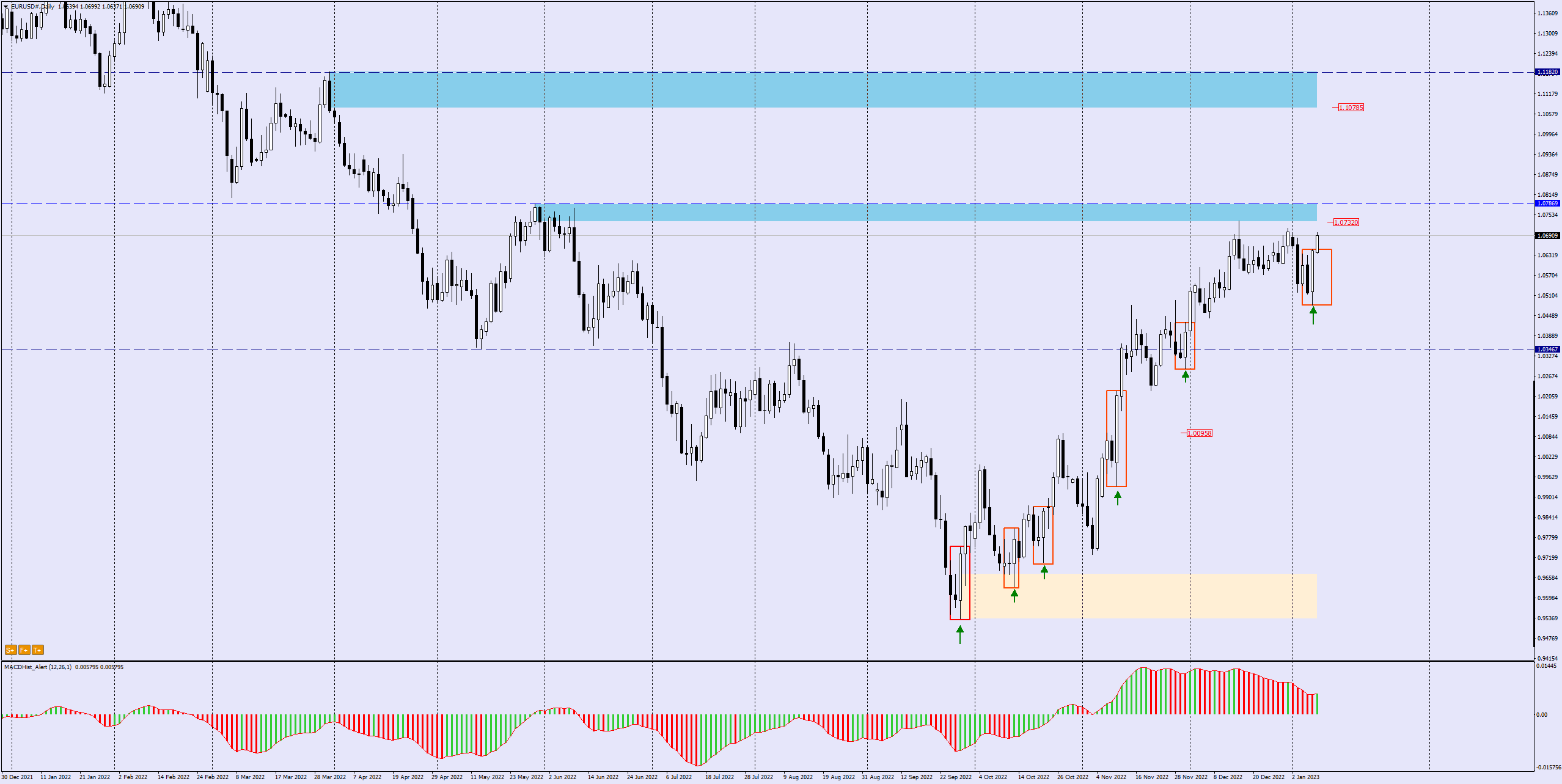

The EURUSD pair from the beginning of 2021 was moving in a downtrend. After a decline of more than 2,800 pips, the pair reached 0.9530, setting a 2022 low on 28 September. From that day onwards, the EURUSD started to grow.

EURUSD – continuation of the increases

On the daily chart we notice a series of bullish engulfings marked by red rectangles, which appeared in corrections and signalled the continuation of the increases. Last Friday, after the publication of good data from the US labour market – NFP (non-farm payrolls), the pair again gained in value, and the daily candle once again formed a bullish engulfing formation.

Today there was a breakout from the formation and the price continues to rise. MACD is entering an upward phase. The likely target may be the supply zone starting at 1.0730, and its upper limit is the support and resistance level at 1.0785. When planning a long position, we must take into account a possible correction of today’s growth and a return to the maximum of the bullish engulfing formation, where our stoploss should be located.

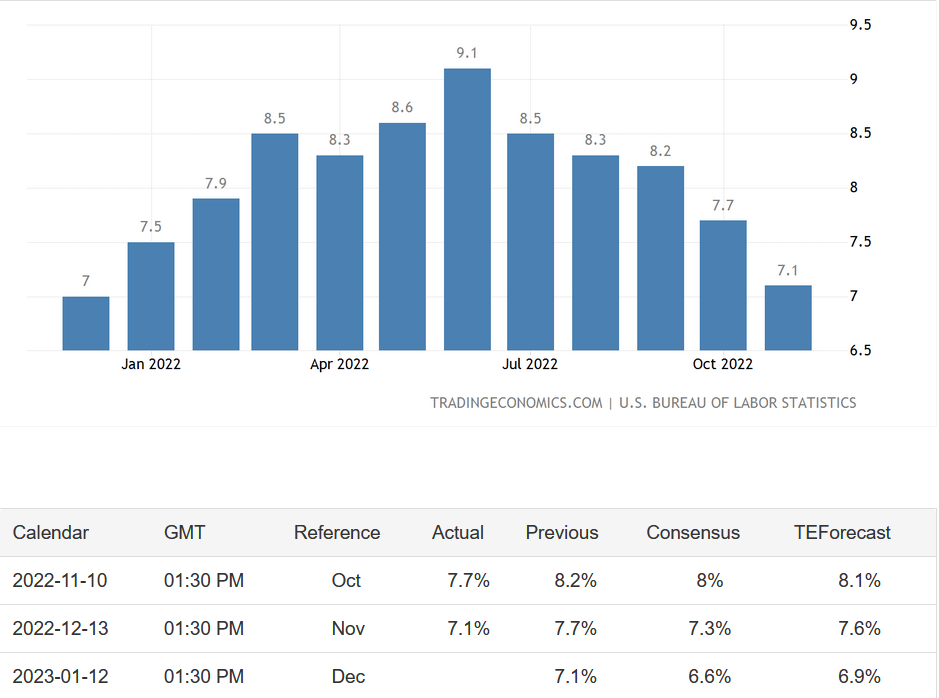

US inflation – 12 January, 14:30

Thursday sees an important event on the economic calendar – we will know the level of inflation in December (US). Inflation has been falling steadily since June 2022, giving hope for a more dovish stance from the Fed. If it turns out that this time too the readings will be better than expected – this could be another upward impulse for EURUSD.