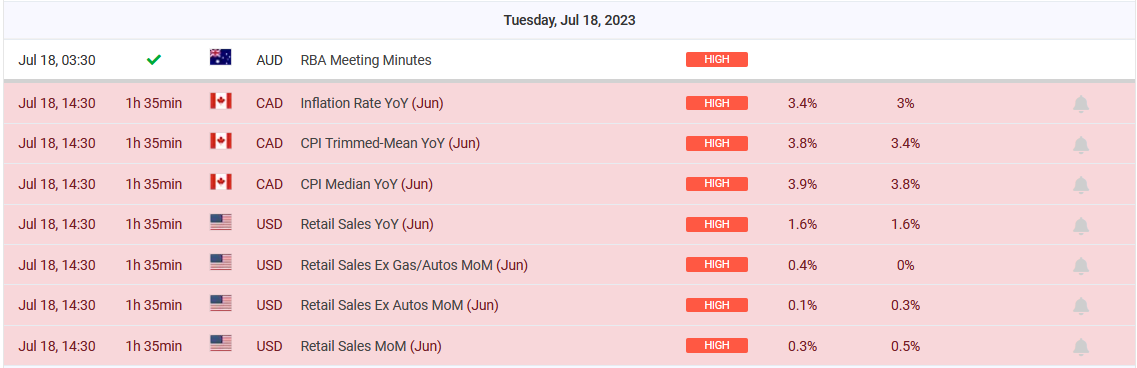

Today during the US session we will learn data from the retail sales market ( 14:30). An increase from 0.3 to 0.5% m/m is expected. At the same hour we will learn the level of inflation in Canada and at 3:15 pm the volume of industrial production in the US.

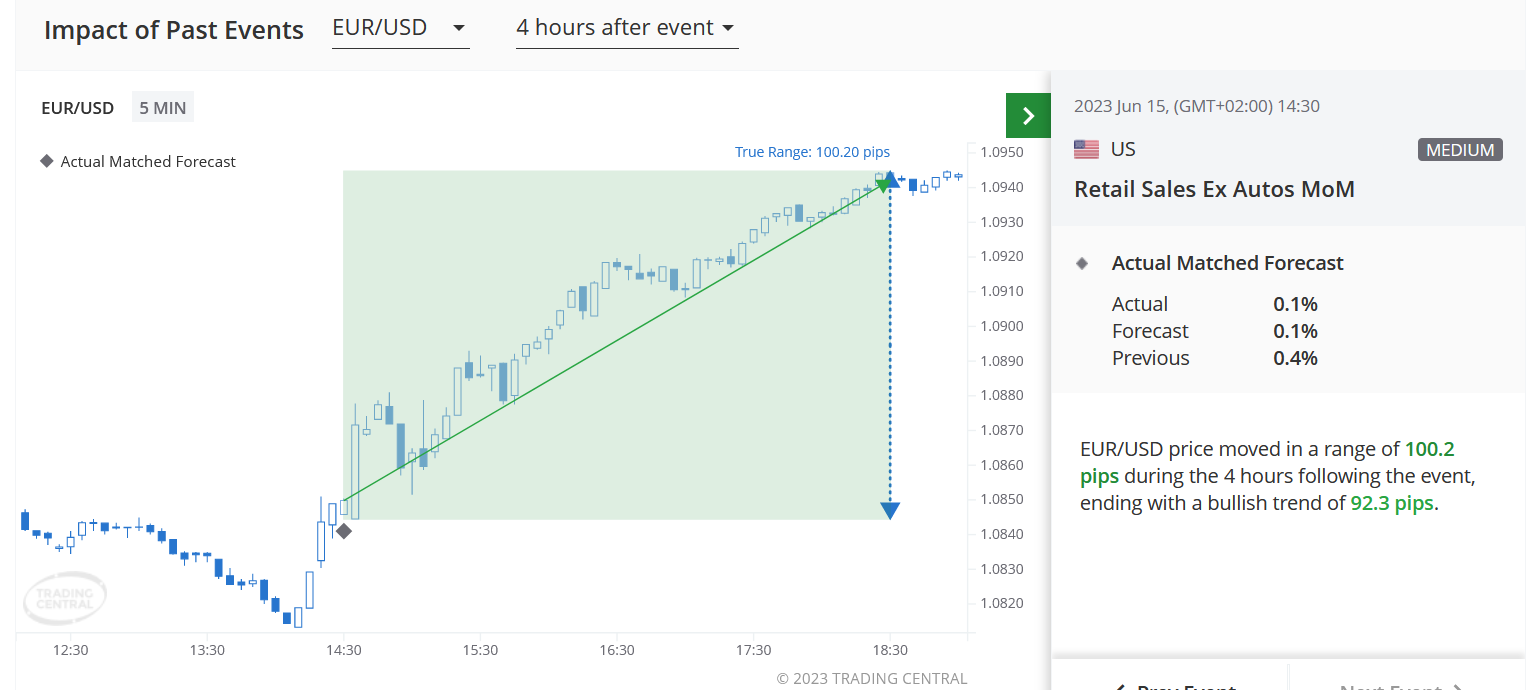

The data can have a big impact on the major currency pairs related to the dollar. For example ( chart below), the EURUSD pair gained nearly 100p after the data turned out to be in line with expectations a month ago.

The USD has been weakening against most world currencies following US inflation data released a week ago, which showed another drop to 3%. The EURUSD pair has gained significantly, and within a few days the rate rose by 260p reaching 1.1275 today.

However, a slight uncertainty of buyers can be noted, as after reaching the mentioned level, a rather sharp sell-off occurred and a bearish engulfing formation appeared on the H4 chart. Therefore, it is worth watching further movements on this pair and, in the event of a bottom breakout, join the very likely correction of recent increases. The target of the correction may be the resistance of the channel (currently located at the level of 1.1170) from which the price broke out last week.

LIVE EDUCATION SESSIONS

This WEEK (17-21 July 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo