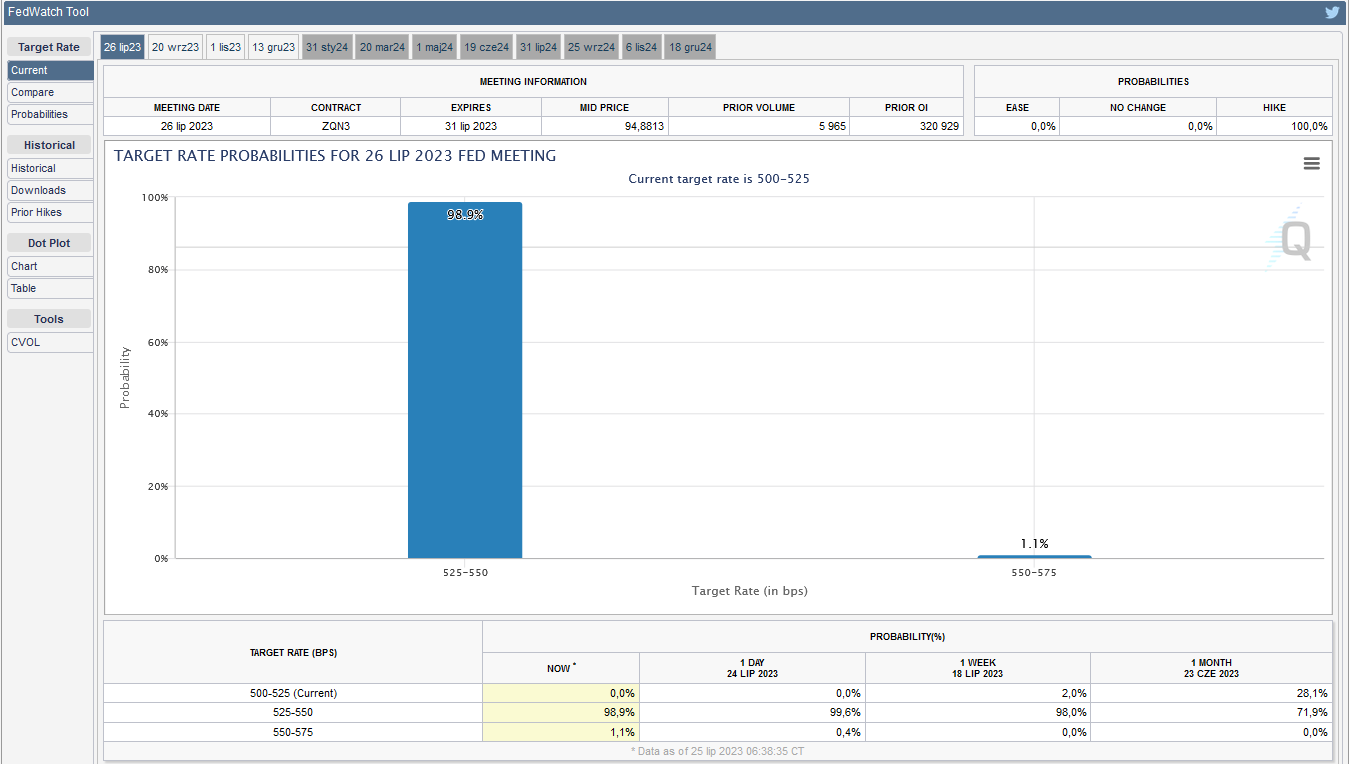

This week we are facing three important macroeconomic events. The Federal Reserve will decide on interest rates in the US, and on Thursday we will learn about the European Central Bank’s decision on the same topic.

Fed – what will be the decision ?

On Wednesday at 19:00 GMT+1 we will know the level of interest rates in the US. I don’t need to remind you of how important this information can be for the forex market, just look at how the charts looked at the time of previous decisions, they usually provided a lot of excitement and considerable volatility. The futures market is pricing the possibility of a 25bp hike at close to 100%. Whether this will be the case will become clear tomorrow evening. Any deviation from 25bp could cause sharp movements in the dollar pairs . If the Fed decides to leave rates unchanged- a weakening of the dollar would be inevitable.

ECB – quo vadis EUR ?

Asked if the ECB was considering a pause in rate hikes, following a similar statement by the US Federal Reserve on Wednesday, Ms. Lagarde said “we are not thinking about a pause.” Speaking after the announcement of the rate hike, ECB President Christine Lagarde said inflation is falling, but is “expected to remain too high for too long,” adding that they are “ready” to adjust all their instruments to ensure inflation returns to the medium-term target. This was the kind of statement we heard in June when the Fed refrained from hikes and the ECB raised rates by 25bp to 4%. We can probably expect another 25bp rate hike at Thursday’s ECB meeting (13:15 GMT+1) as well.

BoJ – no change ?

Since Mr. Uoda took over as chairman after Kuroda, there have been unofficial reports that in order to save the weakening yen, the new chairman would decide to change something in the so far very loose monetary policy. However, to date nothing has changed, we continue to hear only verbal attempts to influence the forex market, and the USD/JPY exchange rate continues to move in correlation with US10Y bond yields – making the yen weaker and weaker. Will Friday’s BoJ meeting change anything? I doubt it…

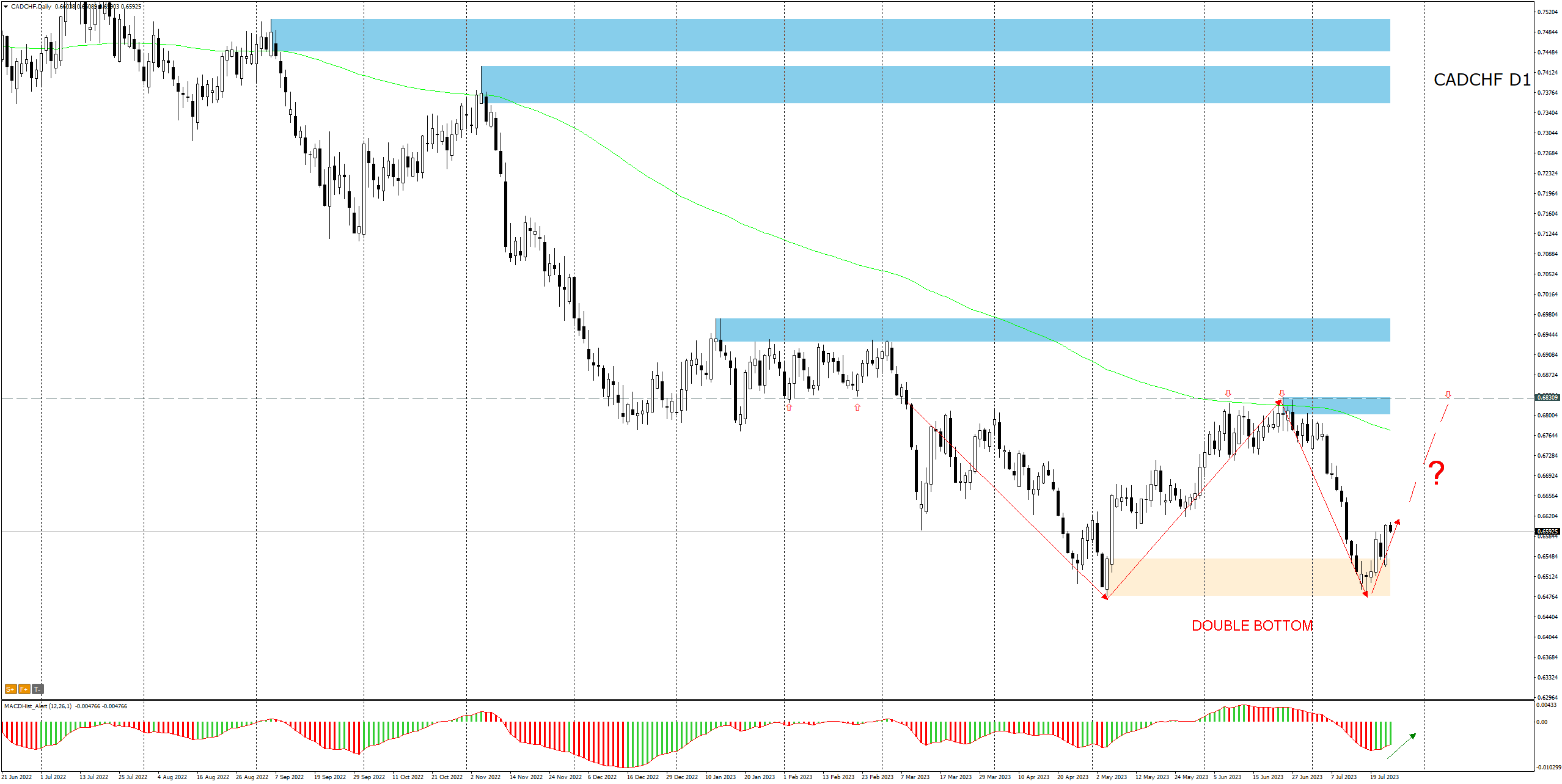

So what to trade with such important events on the calendar? My choice are crosses – that is, pairs without USD. Today such an interesting instrument seems to be CAD/CHF.

CAD/CHF – double bottom ?

A double bottom formation has appeared on the chart of the Canadian-Swiss pair CAD/CHF. Such formations often signal upward corrections, and if the neckline was overcome, it could start a new uptrend. The nearest demand target could be the mentioned neckline, i.e. the 0.6830 level.

LIVE EDUCATION SESSIONS

This WEEK (25-29 July 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo