The eagerly awaited FOMC meeting is behind us. We learned yesterday the Fed’s stance and its plans for monetary policy in the US.

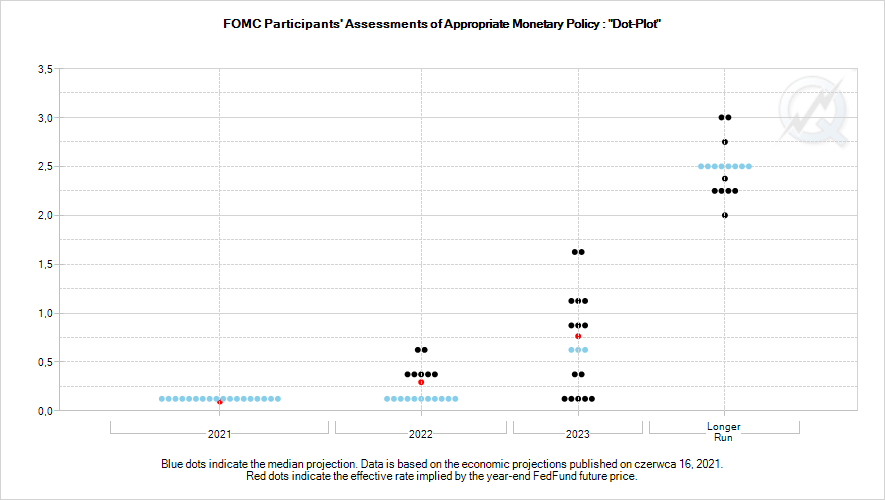

Higher inflation forecasts and greater confidence in restoring the economy led most FOMC members to move up the time horizon for rate hikes.

- FOMC members accelerate the possibility of interest rate hikes

dollar gains - USDCAD has begun a correction of its more than one-year downtrend

The voting shows two hikes in 2023 compared to no hike after March meeting. There has been a lot of talk about a shift towards a single hike, but two is the real surprising figure. Moreover, 7 out of 18 members see a hike next year and that is now something that moves the market.

Powell will probably try to dampen these expectations and will remind at every opportunity that forecasts are volatile, but the FX market does not want to wait. In short. buy the dollar as soon as there is any correction of yesterday’s increases …

Long term I would bet on longs on USDCAD.

In the May 2021 analysis I wrote as follows:

Quote: “Since the beginning of May 2015, the pair USDCAD – the US dollar with the Canadian dollar after a short correction was heading north to set an all-time maximum at 1.4690 6 months later.

A year and a half passed and the price was again at the level from May 2015 – 1.2060. Another 2.5 years passed and the pair’s quotations grew and the price on March 15 last year reached the value of 1.4670… It was only 20p short of the previous maximum.

The next year is a strong downtrend price is again at the level of 2015 and 2017, forming a double top formation.”

Yesterday’s FOMC meeting outcomes resulted in a significant strengthening of the USD, also against the CAD. It is very likely that the USDCAD price, being in an upward correction, will move towards the downward channel resistance (chart above – USDCAD Daily).

Breaking the local S/R level of 1.2350 will be a significant buy signal.

On the H4 chart you can see in more detail which levels can play a significant role when planning to open positions.

If the price has problems with overcoming 1.2350, it is worth using any price reversal to the south to open a Buy position. The most favourable would be the level of 1.2200-10. In the long term the possible increase to 1.2580.

I recommend a description of the strategy used for this analysis:

USDCAD- after 6 years the double top formation completed! 13.05.2021

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo