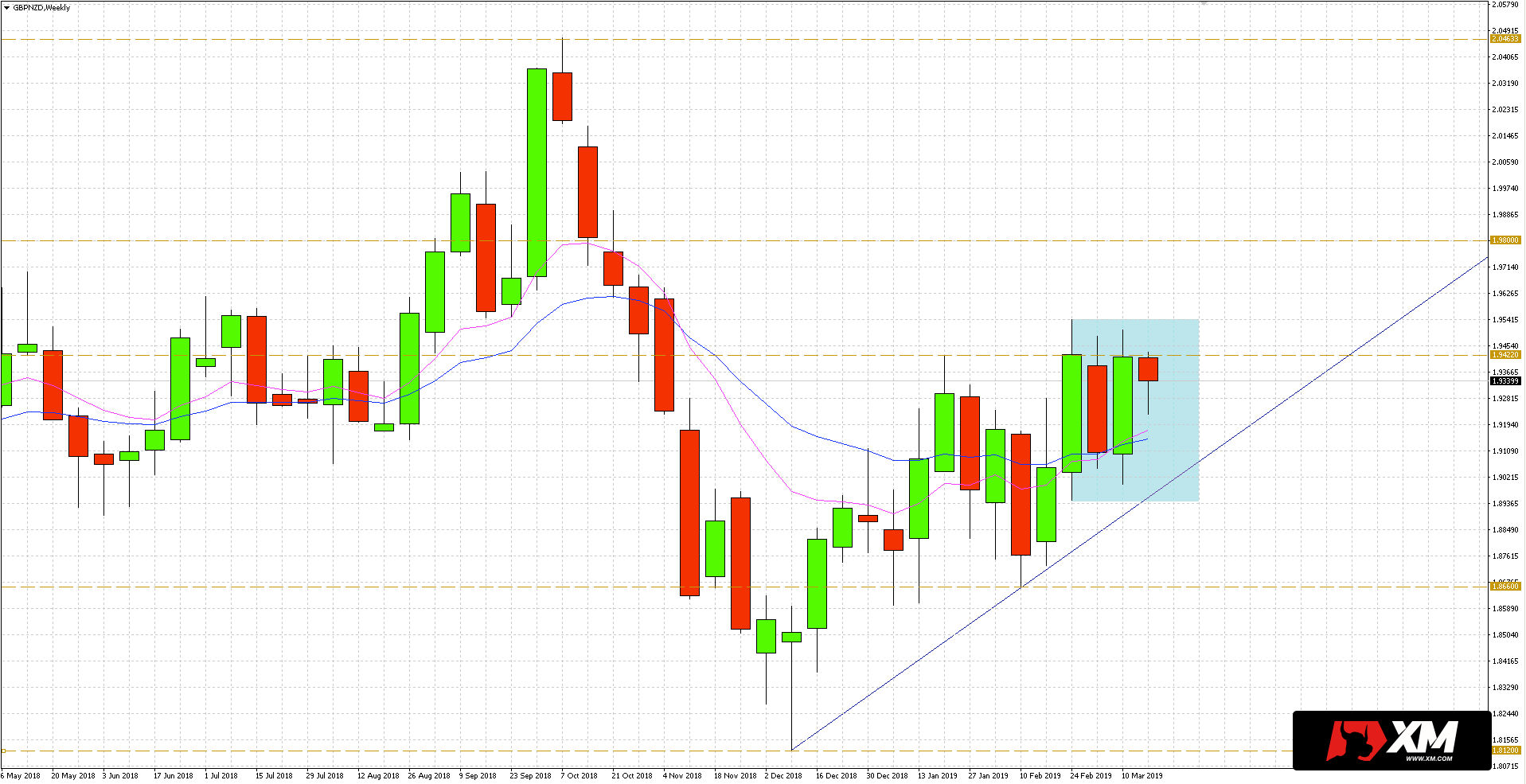

Looking at the GBP/NZD chart from a broader perspective, we can see that the quotations correct the strong decline lasting until October to December 2018. Since the low was settled, buyers have managed to make up for more than half of the previous losses.

Resistance close to the level of 1.9422, where the maximum of January this year falls, has recently proved to be crucial. During the last 4 weeks the quotations have been testing this level, however, the buyers have not succeeded in overcoming it effectively.

In addition, the price is moving in the mother’s candle range of the inside bar formation from the last week of February. In the long term, therefore, the direction in which the price breaks out from the pattern may be important.

If buyers manage to successfully complete the zone at 1.9422 – 1.9540, the next goal may be 1.98. Alternatively, closing the week under the trend line since last year’s minimum and the 1.8945 low of the mother candle would open the way for a 1.8660 downward trend.