The British pound/US dollar (GBPUSD) pair set an all-time low at 1.0365 at the end of September last year. Since then, the pair has been moving in an uptrend. Today, during the London session, we saw quite sharp declines. One of the reasons for these declines was today’s data from the UK identifying trends in orders. The survey is conducted in the form of a survey by the CBI, which shows a significant drop in orders from manufacturing companies.

The Industrial Trends Survey – conducted by the Confederation of British Industry in the UK – tracks changes in factory order volumes from around 500 companies across 38 manufacturing sectors. The survey takes into account domestic and export orders, inventories, prices, investment plans and production forecasts. Manufacturers were asked whether the current situation is above normal, normal or below normal for each variable. The results are presented as a weighted percentage balance, which is the difference between the percentage of respondents who answered more or higher on each question and the percentage who answered less or lower on each question.

A higher than expected number should be seen as positive (bullish) for the GBP, while a lower than expected number should be seen as negative (bearish) for the GBP. Today’s data (-8 was expected and is -17) indicates a significant deterioration in this area.

GBPUSD – bearish engulfing

Yesterday’s trading reached 1.2444 where the December 2022 maximum and an important resistance level is located. Towards the end of the day trading the pair declined and the day closed forming a bearish engulfing. Today we are observing an attempt to break out of this formation at the bottom. If by the end of the day the trend continues and the day closes below yesterday’s minimum it could be a signal for a correction. The MACD has currently entered a downward phase and is forming a bearish divergence with the price chart, which may support a downward scenario.

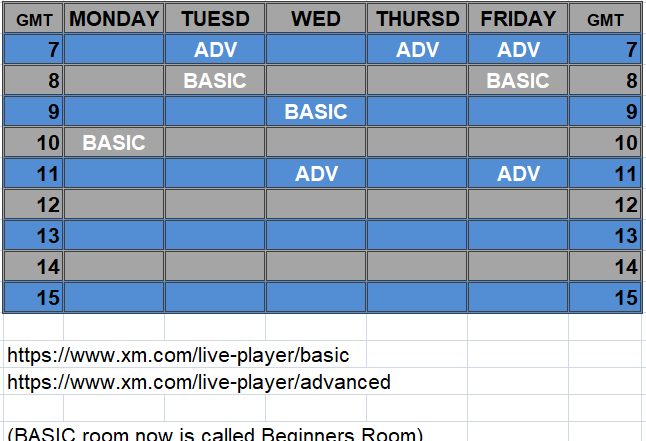

I will talk more about this pair and several others in my live sessions:

LIVE EDUCATION SESSIONS

This January WEEK 4 (23-27) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

Translated with www.DeepL.com/Translator (free version)