Online trading broker, GMO Click Securities, acting as a subsidiary of GMO Internet Inc., published its monthly trading volumes in connection with the February OTC FX and exchange activity.

Online trading broker, GMO Click Securities, acting as a subsidiary of GMO Internet Inc., published its monthly trading volumes in connection with the February OTC FX and exchange activity.

Within a month, the OTX FX volumes totaled $717.3 billion – failing by 10.3% compared to January’s results. Click365 exchange volumes fell also – by 17.4% to $3.75 billion. Overall, the total trading volumes in February stopped at $721 billion level.

A spokesman for the company, explained during a press conference that decrease in February’s trading volumes were lower than in January due to low Yen volatility and the impact of fewer trading days in the month.

Low Yen Volatility Main Reason For Volumes Decline

The Japanese Yen is underlying currency for many GMO customer, which is for them a reference point and also to trade related currency pairs valued in yen. Due to that, GMO is one of the largest retail brokers in the FX market in terms of volumes. When liquidity decreases, then the GMO clients share in the market also decreases which pull the company performance down.

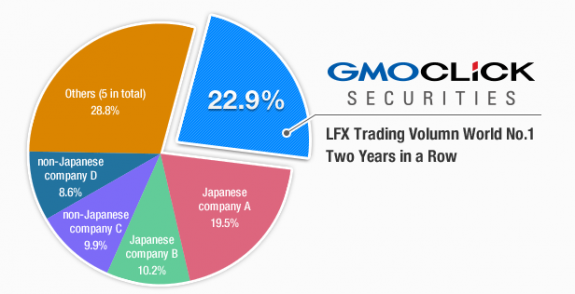

Brand recently emphasized its leading position in terms of market share in retail volumes. Despite the month-over-month (MoM) declines, this thesis is still difficult to be overthrown. The following chart prepared by the GMO Click Securities presents it in the clearest way: