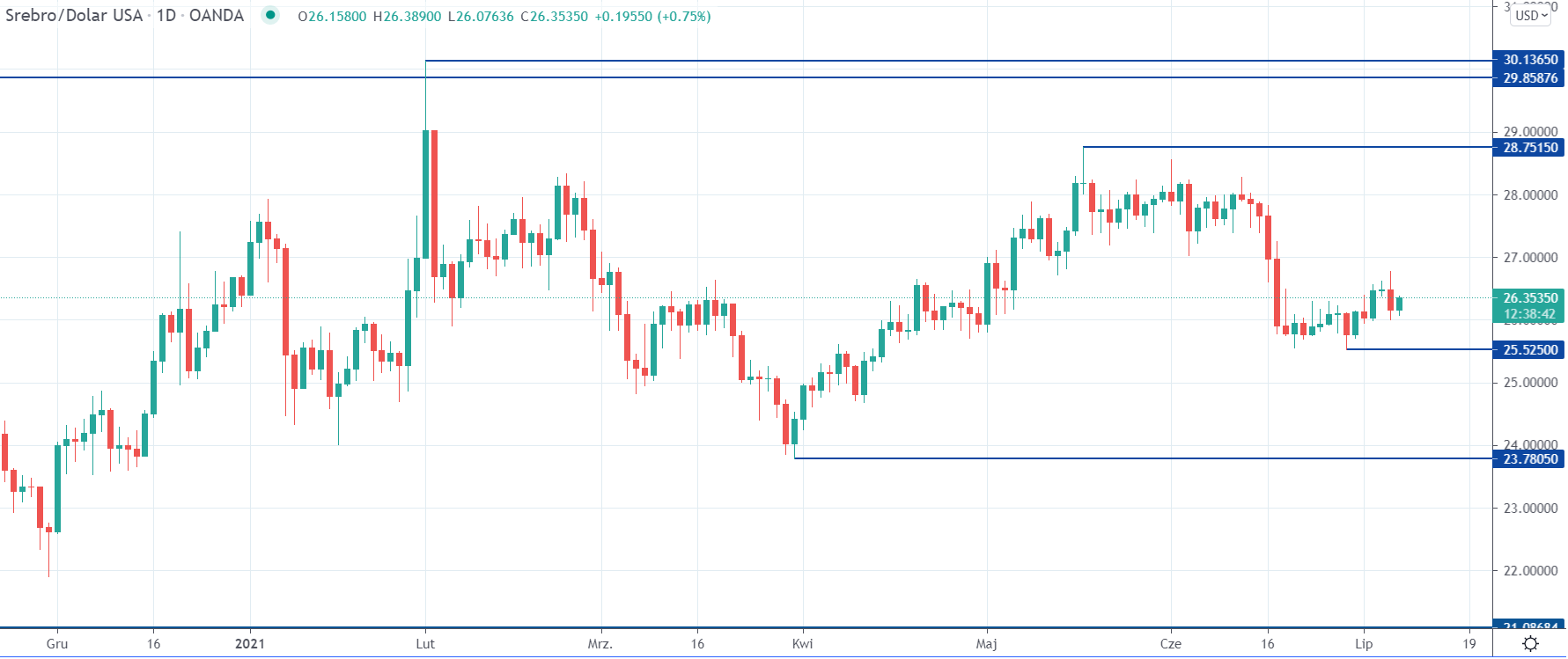

June’s hawkish FOMC changed the dynamics of US yields and drove silver to a local low of $25.53. Since then, relative price stability has allowed the white metal to recover some of the June decline. Meanwhile, inflation and a weaker dollar are supporting central bank gold purchases. Moreover, a weaker USD should continue to be a key support for investor demand, ANZ Bank economists say.

- Silver regains ground, but there are limits given low price momentum

- Rising inflation and a weaker dollar support central bank gold purchases

- Central bank purchases of gold set to rise to 520 tonnes this year

Currently, there are important resistance levels to overcome in the silver market. The $28.03 level is located on the boundary line of the triangle pattern on the weekly chart. Below this is the Fibonacci level at $27.16, as Benjamin Wong, strategist at DBS Bank, notes.

– On the weekly charts, silver’s decline has been halted at 25.53 by a trendline that extends to 19.25, where the late July 2020 minimums were located. With support established at the 55-day moving average at 25.28 and $25.02, silver has room for a mild rebound after reaching recent lows, the report said.

Silver is likely to regain ground, but there are some limits given the low price momentum.

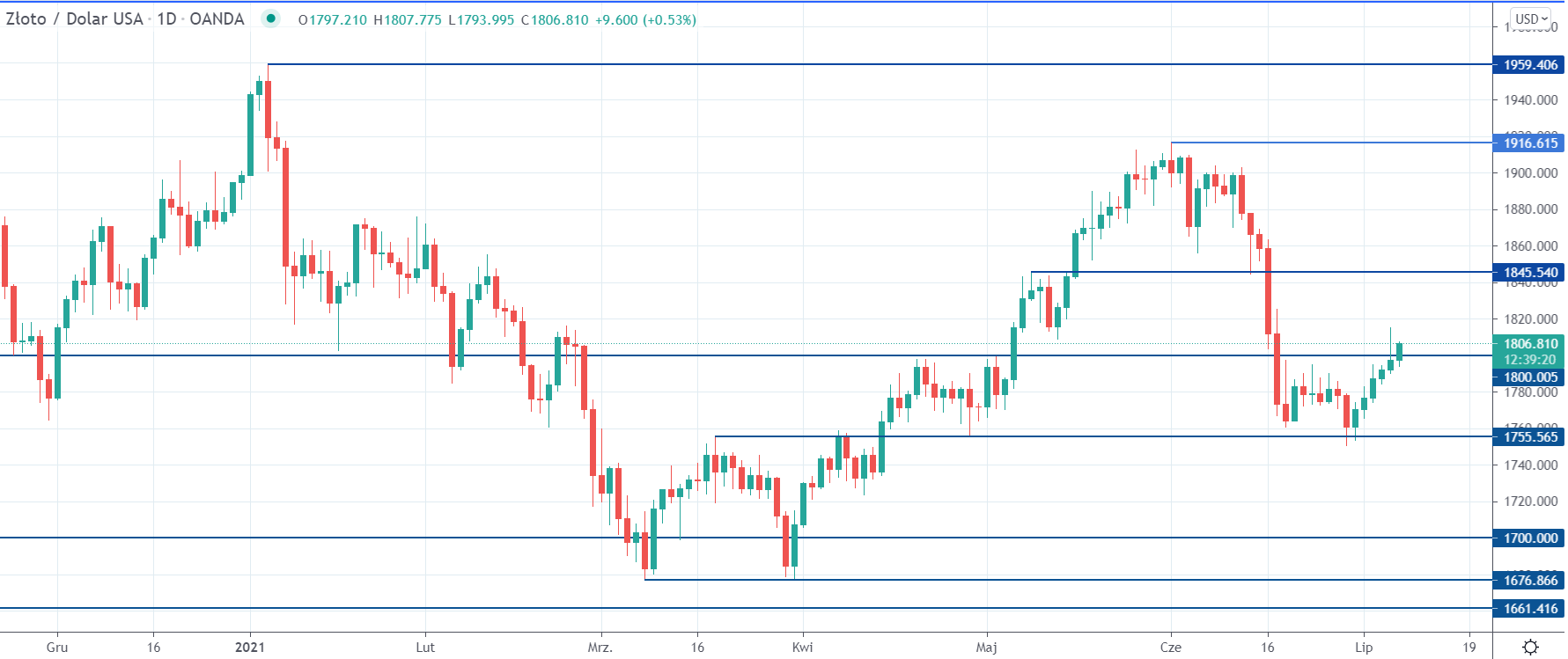

Gold price outlook: investors will turn to XAU/USD as a hedge – ANZ

Inflation and a weaker USD support central bank gold purchases. Moreover, USD weakness should continue to be a key support for investor demand, according to economists at ANZ Bank.

– Growing uncertainty around monetary policy, inflation and rising risks of equity market volatility should support safe-haven gold demand. US bond yields and the outlook for a weaker dollar further reinforce our belief that the gold price will move higher, the report indicated.

Central banks have increased their gold purchases in recent months, offsetting some of the loss in physical demand in Q2 2021.

– We forecast central bank gold purchases to rise to 520 tonnes this year, it concluded.

I recommend a description of the strategy used for this analysis:

GOLD – at an important level, will payrolls show the direction? -30.06.21

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo