The rally in gold continues and even accelerated during Monday’s Asian session and seems unstoppable. Gold is correlated with the US10Y bond yield, and this has been falling lately due to weaker US data, which has led to a drop in inflation expectations and hence Treasury bond yields.

Trading Economics writes: “Yields on 10-year US Treasury bonds fell to 4.2%, almost reaching their lowest level in three months, as investors continue to believe the Fed has completed its monetary tightening cycle. In his recent comments, Fed Chair Powell did not reaffirm the market’s expectation of interest rate cuts, but stressed that monetary policy was ‘sufficiently’ tight, leading markets to believe that the Fed may have completed the rate hike cycle.

In addition, recent data showed that the overall economy is slowing down. The ISM Manufacturing PMI for November came in lower than expected, indicating a 13th consecutive decline in factory activity. In addition, all PCE inflation readings slowed and the number of unemployment claims reached its highest level in two years.”

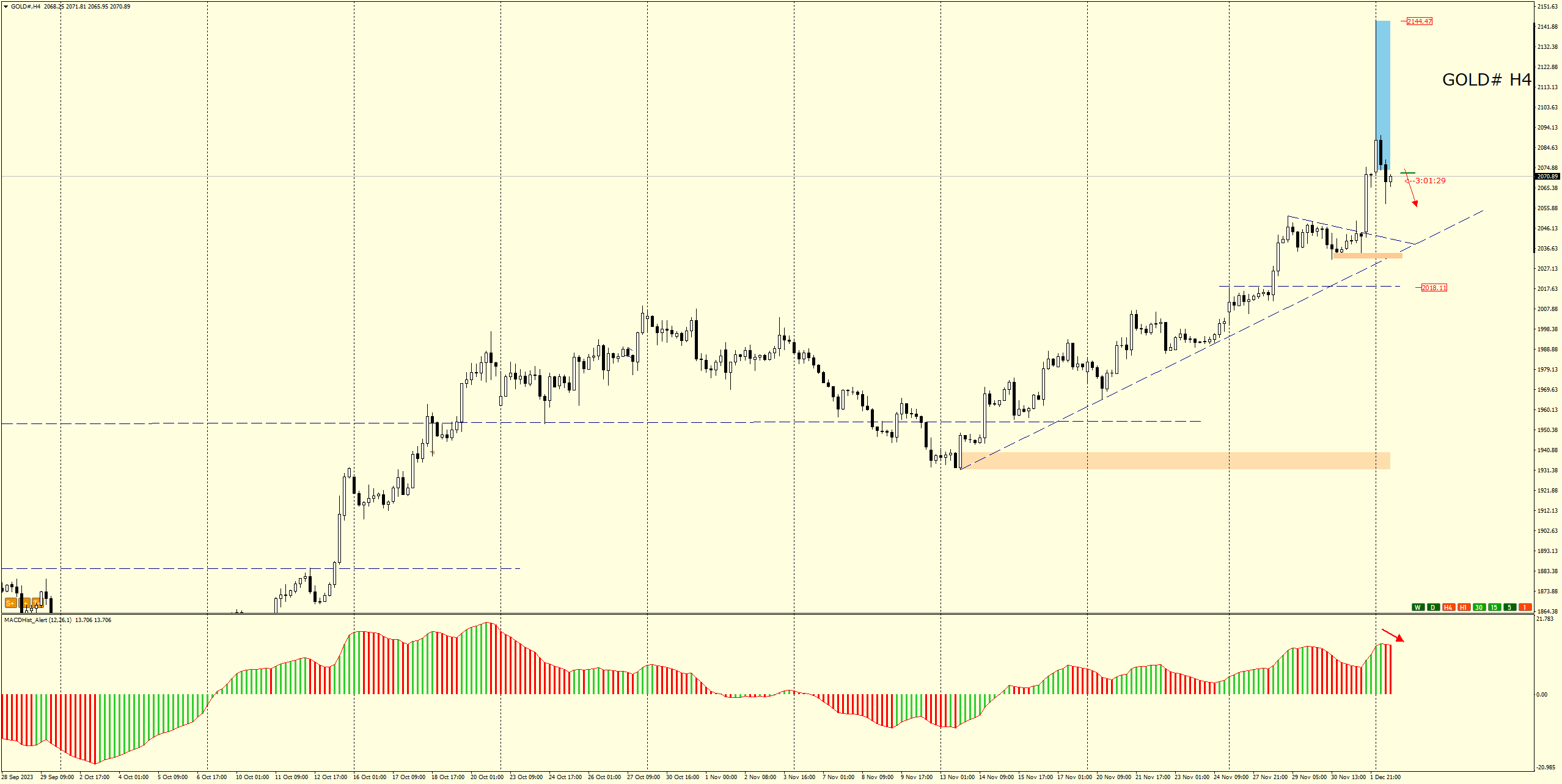

However, when we look at the rate of decline in US10Y yields and what has happened in Gold-we can see some disproportion in the rate of change. It appears that Gold will give back some of the morning’s gains in the coming hours. It is still an instrument in an uptrend, but I would look for buying opportunities around the $2035/oz demand zone.

GOLD H4

A correction of this morning’s gains may reach the local trendline and demand zone which are located around the $2030-2040/oz level. The MACD has entered a downward phase, supporting the correction. However, it is still an instrument in an uptrend, so any correction may be shallow.

LIVE EDUCATION SESSIONS

This WEEK (4 – 8 December 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo