Yields on 10-year US Treasury bonds fell below 4.2% on Tuesday, again approaching three-month lows. Investors are awaiting key US inflation data, which should provide further clues about Fed plans. Headline inflation is likely to have slowed again, but the core index is expected to continue to show steady levels.

On Wednesday 13.12, the Fed is expected to keep interest rates unchanged and would cool expectations of a rate cut as the labour market shows more resilience to high interest rates than initially expected. The US economy created 200,000 jobs in November, above market expectations of 180,000, and the unemployment rate unexpectedly fell to 3.7%.

Tuesday 14:30 – US inflation data

The expected rise in monthly core CPI inflation would suggest that the disinflation process is fragile. However, according to Nomura analysts, the underlying disinflationary trend remains intact as new vehicle prices are likely to have continued to fall, reflecting an oversupply of new vehicles in the face of tighter credit conditions. Rental inflation also remained low…. After November, we believe that tighter credit conditions in the car loan markets and imbalances in the rental housing markets are likely to weigh on core inflation in the coming months, continuing the disinflationary trend.”

The European Central Bank’s decision on interest rates in the Eurozone is expected on Thursday. Analysts predict no hike and the decision itself will not necessarily cause increased volatility on currency pairs with the euro. More important will be President Lagarde’s press conference, when we will know what the ECB’s further plans are for the next quarters – if and when we can expect cuts or perhaps interest rate hikes.

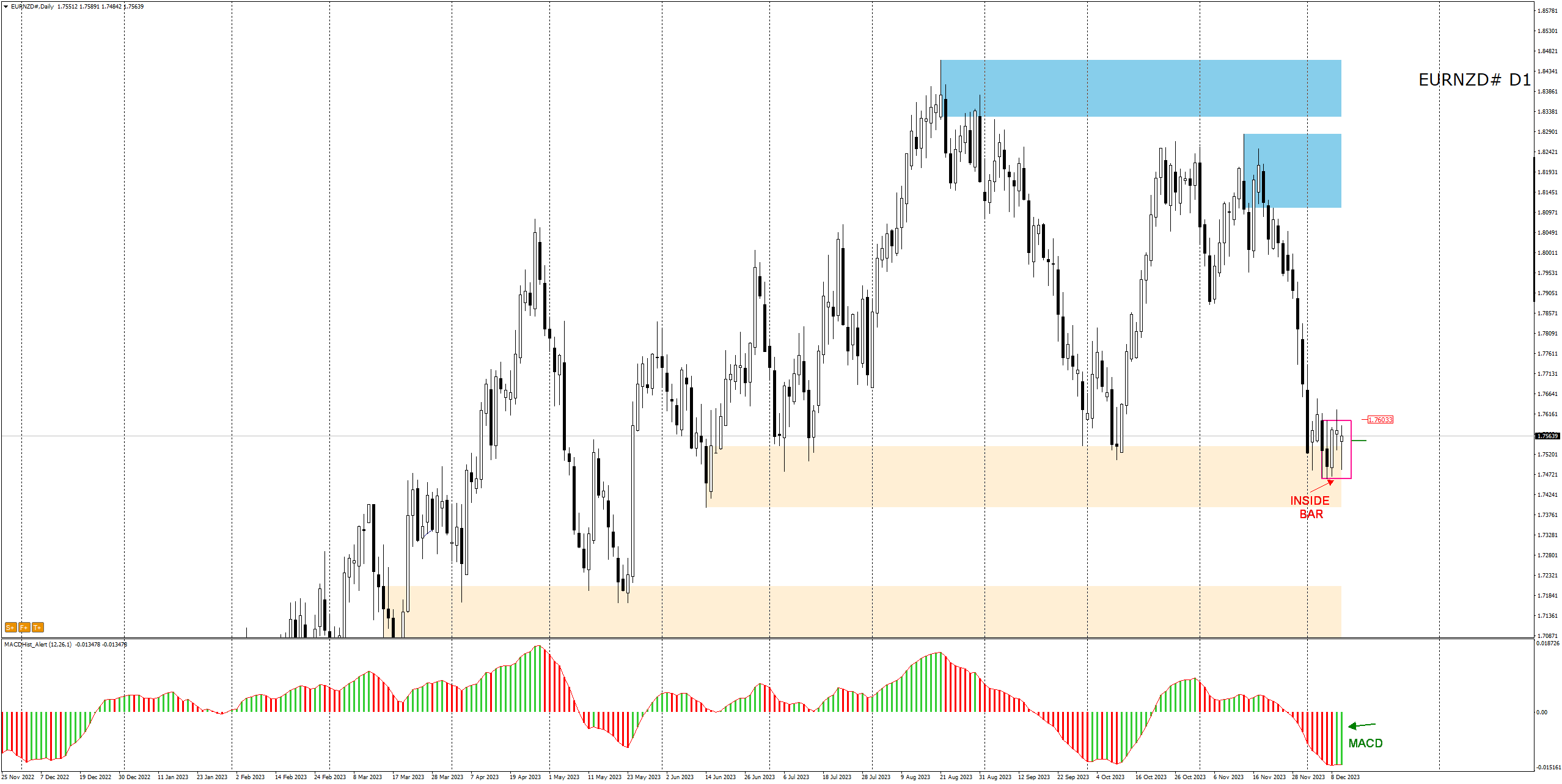

EURNZD technical analysis

The EURNZD pair moved in a downward swing in November. The price has reached the demand zone and is currently in the inside bar formation area. The MACD indicates the possibility of an upward breakout, but in view of Thursday’s ECB meeting – it may be worth not taking a position until then, or at least waiting for the daily candle to close outside the formation.

LIVE EDUCATION SESSIONS

This WEEK (11 – 15 December 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo