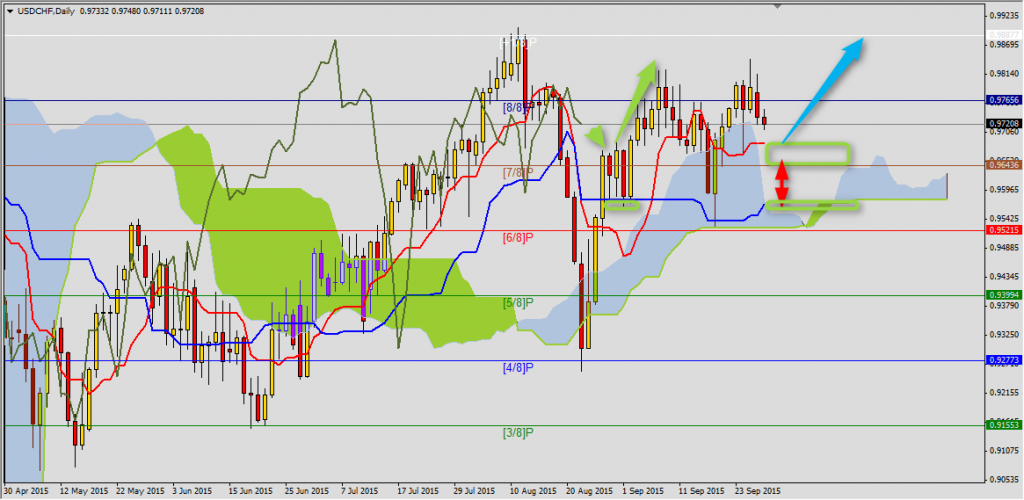

USDCHF

Pair stays for few sessions in consolidation and another try of breaking (8/8)P 0.9766 failed. Today price is getting closer to support area 0.9685-0.9644 set by Tenkan-sen and (7/8)P line. Breaking this level will mean going back to Senkou Span B 0.9579 and Kijun-sen 0.9571. However Ichimoku averages still inform us about growth potential on this pair and re-testing 0.9886 level, where high from Auhust 11th is placed and (+1/8)P line.

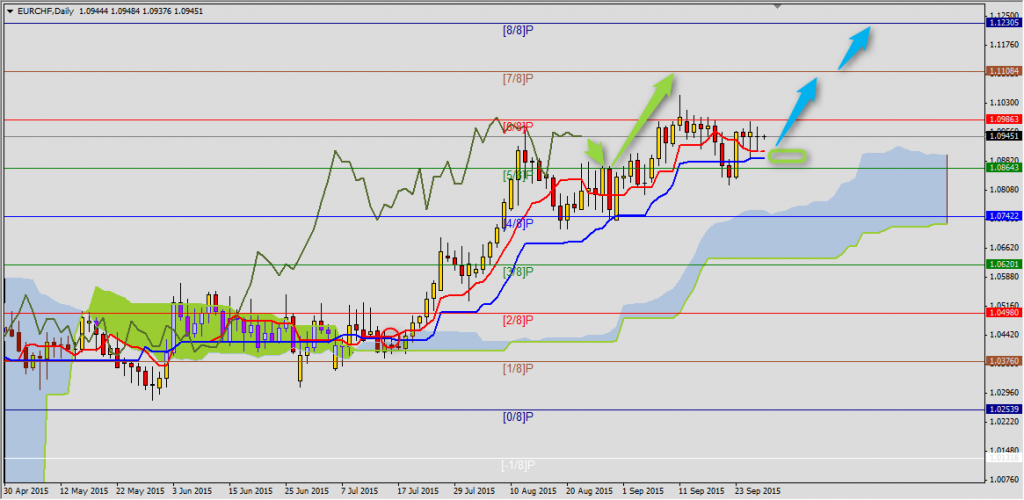

EURCHF

EURCHF is in bullish trend since the end of July and there is still active buy signal from crossing Kijun-sen and Tenkan-sen. These lines set now support area for correction (1.0907-1.0890) and resistance is at (6/8)P 1.0986. If EURCHF stay above (5/8)P 1.0864, the range for the pair are Murrey levels 1.1108 and 1.1230.

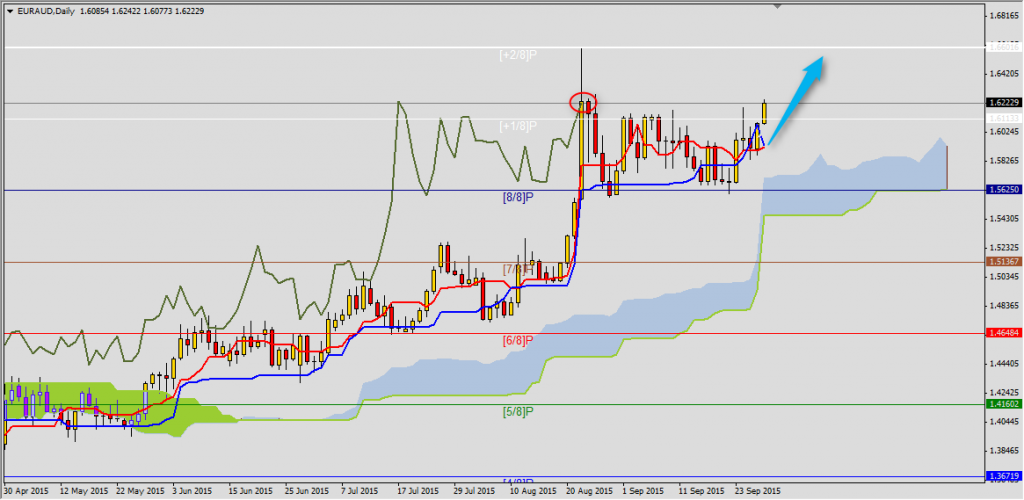

EURUAD

Price is again above Kijun-sen and Tenkan-sen and to generate buy signal we only need these two lines crossing. Chikou Span tries to reach above chart and if EURAUD does not drop below 1.5921 level bullish trend should last at least to (+2/8)P 1.6602.