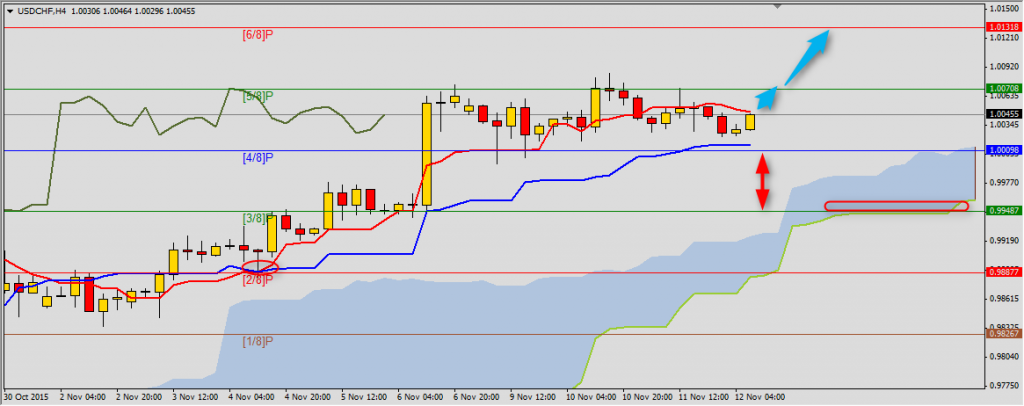

USDCHF

Bullish trend on USDCHF stopped on (5/8)P 1.0071 line and despite few tries bulls couldn’t break it. Today price is below Tenkan-sen 1.0048 and breaking above this line will generate another buy signal. Maybe this time price will reach to (6/8)P 1.0132. Decrease below Kijun-sen and (4/8)P 1.009 will be a sign of correction to Senkou Span B 0.9958.

You can read Ichimoku strategy description here.

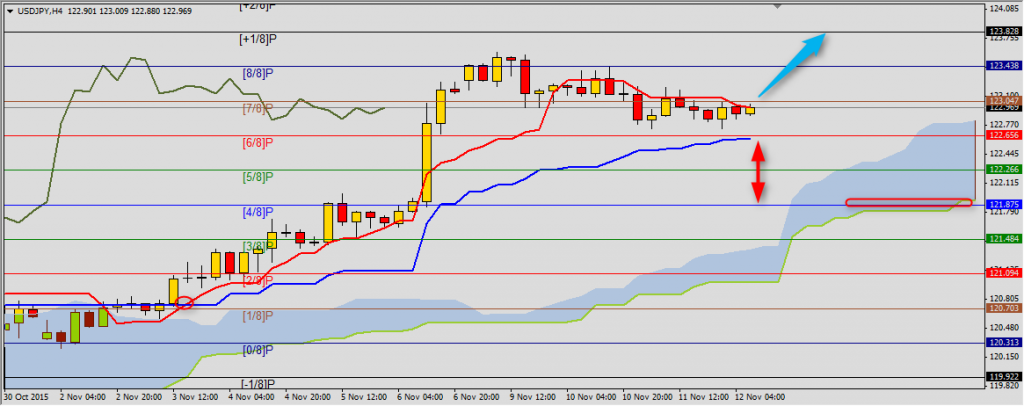

USDJPY

Similar situation on USDJPY. Here buy signal will be close of H4 candle above 123.05-122.97 area which is set by (7/8)P and Tenkan-sen. First range will be 123.83 and then 125.00. Decrease of USDJPY below Kijun-sen 122.61 will be a sign of side trend with support at Senkou Span B 121.91.

YOU CAN TRADE USING ICHIMOKU STRATEGY WITH FREE FXGROW ACCOUNT.

GBPUSD

This pair is getting close to important resistance. It is Tenkan-sen, Kijun-sen and (5/8)P 1.5259 line. If it will not be broken there will be rebound to (4/8)P 1.5137. Break above Kijun-sen 1.5261 will be a sign of further increases to at least Senkou Span B 1.5342. Ichimoku lines setup still prefers continuation of bearish trend.