Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

AUDNZD

Yesterday I wrote that probably I will have to close this position, because bearish cross of Tenkan and Kijun is coming. Fortunately I decided to wait with that and price appreciated again. Currently the profit is about 90 pips, price have to break local resistance next to 1.1140 where last time there was a bearish response.

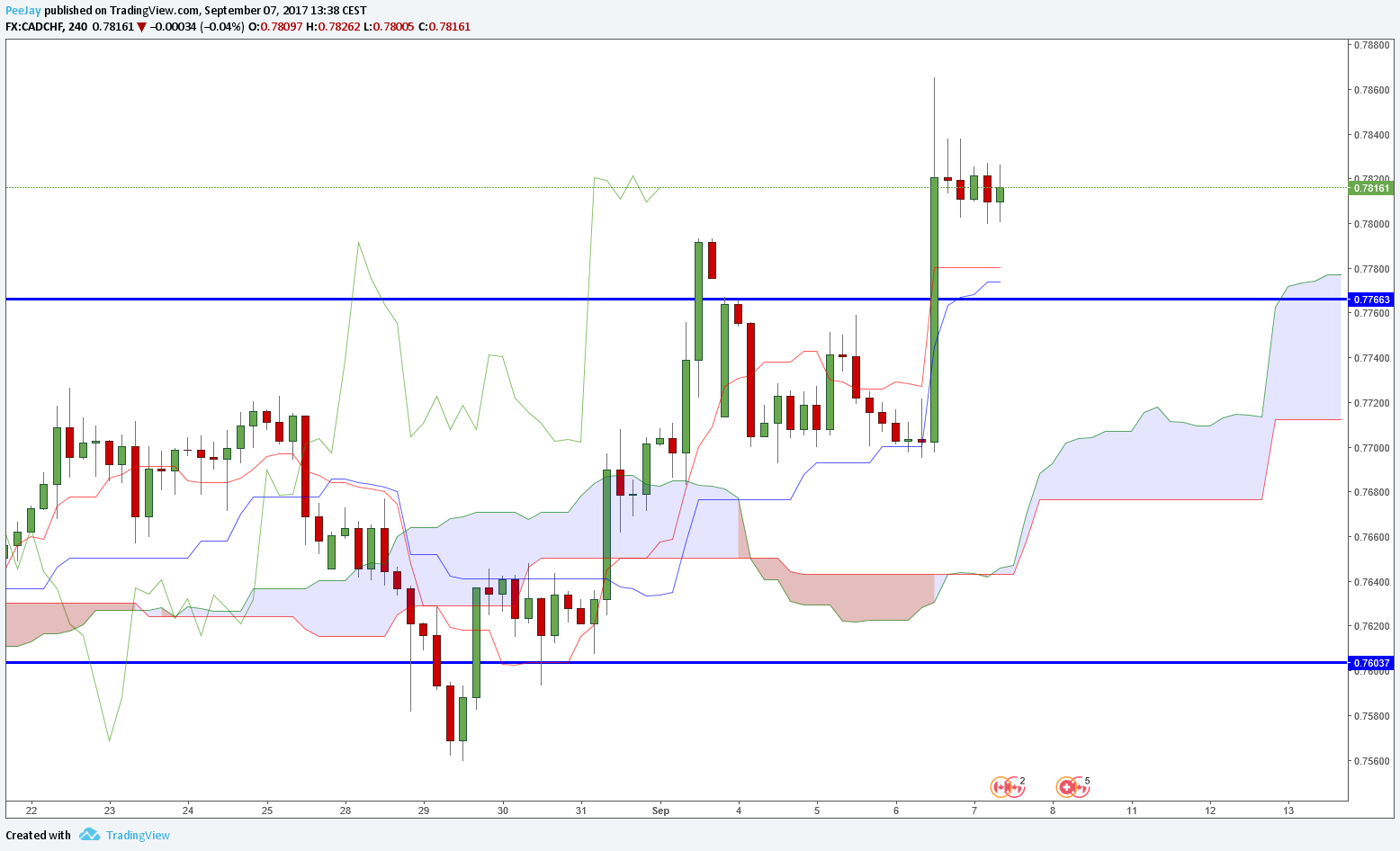

CADCHF

After yesterday’s decision of BoC CAD gained strongly and now is above daily resistance. I opened buy limit order with entry level at 0.78, SL 50 pips lower and TP 150 pips higher. If there will be small bearish correction, position with RR 3:1 will be opened.

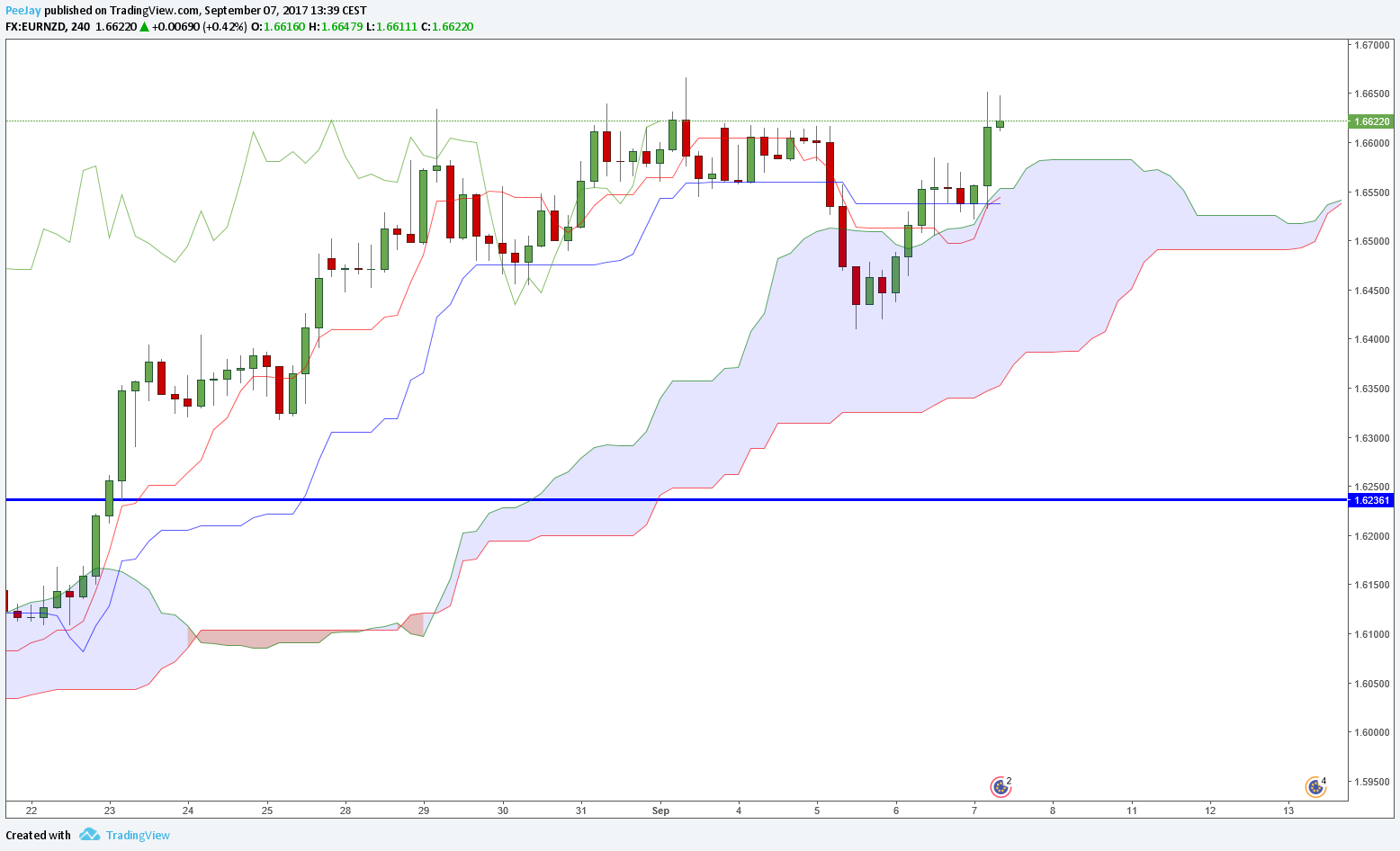

EURNZD

Interesting place to open long position. Bullish cloud is really wide, recently there was a cross of Tenkan and Kijun, break out of cloud and close above Kijun line. If I wouldn’t have opened position on New Zealand dollar yet, I would buy this pair.